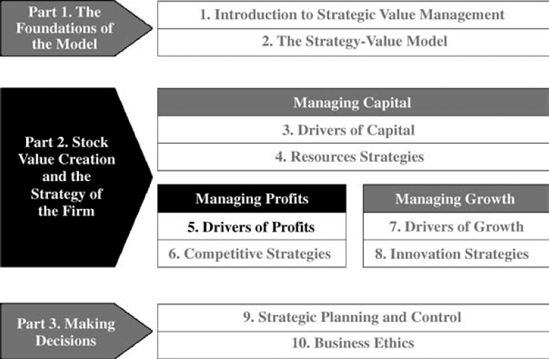

Chapter 5. Drivers of Profits

Chapters 5 and 6 deal with profits driven by market power. Chapter 5 focuses on competitive environmental analysis, and Chapter 6 on competitive strategies. They introduce a new understanding of competitive scenario analysis and strategies that simplifies strategic management, establishes metrics, and builds critical thinking, together with new tools to develop knowledge.

As you might know, the first step that most strategic management textbooks recommend, previous to defining a strategy, is to analyze the environment. They normally recommend two analyses:

External analysis typically involves the strengths, weaknesses, opportunities, and threats (SWOT) analysis, a competitive analysis using Porter's five forces framework, industry life cycle, and a macro environment analysis (economy, technology, politics, regulations, etc.). It is confusing why strengths and weaknesses or the competitive analysis are called external analysis when you are comparing your firm with others, so in fact it is both external and internal analysis.

Internal analysis involves analyzing your competitive advantages based on Porter's value chain analysis, your core competencies, cost analysis, the resources analysis, and others. You may feel confused why it is called internal analysis when the core of the analysis is the comparison with other firms and consequently it is again internal ...

Get Strategic Value Management: Stock Value Creation and the Management of the Firm now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.