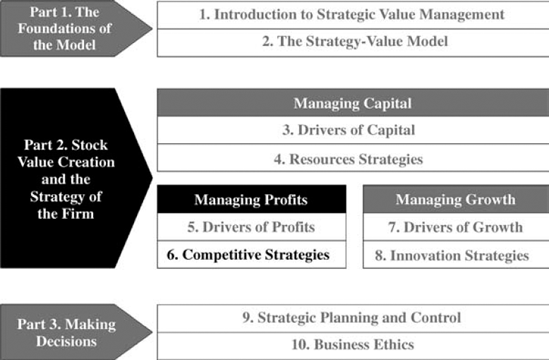

Chapter 6. Competitive Strategies

As we discussed before, profits are like the lifeblood of the company; this chapter focuses on how to produce such blood.

Classic strategic management relies entirely on Michael Porter's dual approach of low-cost and differentiation strategies. However, as we saw in previous chapters, research and literature show that low-cost strategies lead to perfect competition (when they are based on actions) and destroy stock value, because they generate negative EVAs, normally below −2 percent. Differentiation strategies have a very limited ability to create stock value; their EVAs are on average close to zero, some years above and some years below (also when they are based on actions) because they require capital investments. They also have a short life because they can be imitated by the competition.

Some textbooks are starting to introduce the resource view of the firm (RVF); however, their views are still not integrated and consolidated.

This chapter introduces a new approach to develop competitive strategies by following the goal of stock value creation. It is based on industrial economics (also called industrial organization: IO), game theory, and the resource view of the firm (RVF). This has four critical benefits:

Help in visualizing the economic and financial impact of competitive decisions. This has an extraordinary value. For decades strategic management ...

Get Strategic Value Management: Stock Value Creation and the Management of the Firm now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.