Chapter 1. Introduction to DeFi

DeFi is shorthand for decentralized finance. That’s generally what you hear when you ask about DeFi, as if that clears up all the confusion. But for most people, that definition doesn’t do a thing to clarify what DeFi is, what it does, and why anyone would want to use or build a DeFi application. So let’s fix that. After all, the most important characteristic about any decision is that it’s an informed one. And you can’t make an informed decision in DeFi unless you know what you’re working with.

DeFi runs on blockchain platforms or decentralized applications (called DApps). Understanding the basics of blockchain is the core of understanding how DeFi works and why, so we’re going to cover that first, so you can follow along with the specifics of DeFi. After all, it would be pretty hard to explain the benefits of a Bryant pivot versus an Iverson step back if you have no working knowledge of the rules of basketball. You need to understand the boundaries of the game before you take on the advanced plays, so we have to help you understand what blockchain is and how it works before we get into one type of blockchain application. In this chapter, you’ll learn what blockchain is and how it evolved, what decentralization is, what traditional finance and decentralized finance are, and the differences between them.

General Warning to Readers

For those reading this and thinking they don’t need a lawyer, or a CPA, or any other paid advisors:

-

This book is to give you a strong general grounding in DeFi and the issues surrounding the field.

-

This book isn’t your lawyer. Your lawyer is your lawyer.

-

This isn’t a book designed to detail these regulations for specific situations, so your particular issue is likely not covered in depth.

-

I strongly encourage everyone developing, investing in, contributing to, or using applications in DeFi to find an attorney who specializes in this area to determine whether they are subject to Know Your Customer (KYC)/anti–money laundering (AML) or other regulations.

-

Read 1–4 again.

What Is Blockchain, Anyway?

Has anyone ever lied to you before? Has someone ever promised you they would do something and then not done it? Most of us have had some experience being on the receiving end of a lie, from the Tooth Fairy to a ghosted Tinder date. People promise to pay for drinks “as soon as I get my check” and then disappear off the face of the earth—or pretend there was no obligation to pay, or they didn’t even get the drinks in the first place. Checks get bounced, accounts get overdrawn, families invest in companies and stop speaking when they fail. People lie. But, unfortunately, they aren’t kind enough to tell you when they’re lying. Decisions stall in various efforts to check facts and complete due diligence, and people get screwed.

But people still need to work together. We need to buy and sell stuff. We need to collaborate and join resources to innovate. So what do you do when you need to work with people but can’t trust them? You need a trustless system. You need something that doesn’t require trust—something that assumes that people are lying—and still operates effectively, transferring rights without conflict. You need blockchain.

Blockchain can be an intimidating topic. It’s a field full of people throwing around obscure words and technical theories, designed more to keep earlier adopters feeling like members of a special club than educating people on the technology.

But even with the best of intentions, it’s a pretty complex topic. It combines philosophy, theories of economic and monetary policy, microeconomic modeling, and a sizable chunk of behavioral psychology. With the “crypto bro” culture and meme-heavy jargon, it’s hard to find a solid foothold to build your knowledge on. Discussions of blockchain and DeFi can make anyone feel like they’re back in middle school, afraid to ask questions or even comment.

But it’s important to remember that blockchain is just a technology. When we think about technology, what is the first thing we think about? Usually some form of hardware (computers, smartphones, weird old switchboards with dozens of wires and women bound to relentless patriarchy). But what is technology really? The best definition is probably one like this: it solves problems people have, using scientific knowledge. That’s it. It has no real ulterior motive. When you pair a scientific understanding of the world (how things work by principle, not observation) with a specific context (calculate this faster, use fewer people, do work humans can’t, extend the ability of humans, etc.), you get technology. Cars, sneakers, airplanes, hair dryers, toothbrushes—all types of technology. It feels threatening only when you are in the generation above the generation of mass adoption.

At its heart, blockchain is a technological implementation of Yuri Ijiri’s seminal accounting innovation, momentum accounting (also known as triple-entry bookkeeping).1

A Brief History of Accounting

I hear you thinking: “Wait, what? I thought we were talking about blockchain. I would never buy a book on accounting. Ever.” Before you start hunting for the receipt (and stop doing that!), I know. I agree. Accounting can be incredibly boring—except that it inspired the greatest of all innovations: writing.

Ancient Sumerian tablets, containing some of the oldest writing, are actually simple receipts: “I gave you this for that.” Merchants tallied their accounts at the end of the day, to derive a view of cash flow. And when you think about it, it makes sense. I mean, what’s the thing you want to keep track of the most (aside from any kids or pets)? Your money.

Turns out we’ve been trying to track value—money we have, debts we’re owed, debts we owe—since humans started to understand what “my stuff” meant. Let’s look at what we’ve come up with over the millennia, starting with single-entry bookkeeping.

Single-Entry Bookkeeping

IOUs are the oldest form of accounting, known as single-entry bookkeeping. This allowed people to begin to trade without having to carry items with them. An IOU in some form is an incredible innovation. Farmers, for example, had few options before this: either wait at the farm and hope buyers stop by (limited market opportunity) or cart around giant bales of harvested grain to a marketplace to access more and higher-volume buyers (high cost of opportunity). Being able to access marketplaces without dragging around bales of grain provided much greater opportunity for sale. In addition, marketplaces could be attended off-season, so farmers could buy things all year, not just for the short period in the fall when grain was harvested and ready for sale. This opened up the world of off-season purchasing with an early form of credit.

All this resulted in extra income, which could be used to improve farm efficiency, hire more labor, and improve the ability to support more children. More children meant more money, either by providing free labor to the farm or becoming employees to outside entities, bringing in salaries. In addition, the more frequent market exposure allowed more opportunity for culture and knowledge exchange, which is the basis for human innovation.

Payment in advance, whether by seasons or days, allowed people to buy things before they actually had the money. In effect, the IOUs were the first credit cards—physical proof that the debt existed and could be collected. This is the core of provable transfer of resources, and how humans were able to expand to nearly every inch of habitable land on Earth. The ability to keep records and learn vicariously is the foundation for all technology—and all human knowledge.

However, as transactions spread beyond the people in one’s town or village, the limitations of single-entry bookkeeping began to reveal themselves. A simple receipt didn’t show that anything was received in exchange, nor did it protect against fraud or theft.

In addition, businesses had become large ventures. People started to realize that when expenses are investments, they should look different from expenses that are simply repeat spends of consumable goods. (For example, $10,000 spent on pencils should look different to a company’s financial picture than $10,000 spent on equipment to manufacture the product sold, and both are different from $10,000 as a one-time payment to set up an overseas subsidiary.) We needed a better system to keep up. Enter double-entry bookkeeping.

Double-Entry Bookkeeping

In the 11th century, bankers of the medieval Middle East created double-entry bookkeeping, likely culled from a version of the Indian Jama-Nama system. This was revolutionary because it required both parties to enter both sides of a transaction, assuring greater accuracy and reliability, as well as account for expenses and revenue as they actually impacted the total company, rather than simple cash flow. This is the move from recording “I owe you one bale of grain” to “You gave me three goats, so I owe you one bale of grain.”

Now parties could trade not just existing goods, but future goods, with a way to account for goods and services owed and paid. Transactions could be carried forward and still remain in each day’s records, so that revenue and debt accrued but not paid could still be kept current. This took off in the 1300s with the Genoese empire, and by the 1600s it had become the common method of recordkeeping among the major trading empires. Massive movements of goods, services, and capital across borders resulted, in large part because the method of accounting for these flows between strangers did not require trust—only proper records and proper receipt. This was the true beginning of globalization.

Then...we kind of got stuck. Remember, there were tens of thousands of years between the first humans hanging out by the magic fire and the creation of single-entry bookkeeping, and a few more millennia to the leap to double-entry bookkeeping. Accounting isn’t exactly a field that drives innovation. When something works, we tend to keep to the status quo until that status quo simply doesn’t work any longer.

Massive Fraud, or the Status Quo Officially Doesn’t Work Any Longer

But then, in 1997, the Asian banking crisis happened. What were previously considered stalwart banks making conservative investment and capital management decisions turned out to be an intertwined mess of favoritism and personal enrichment at the expense of shareholders and deposit holders. This was later termed “crony capitalism”: expensive short-term capital and development funds went to inside parties and/or inefficient, poorly managed companies, rather than to those offering the best or most profitable business propositions.

Quickly on its heels came the accounting scandals of the 2000s. Enron, WorldCom, HealthSouth, Tyco, AIG—the early 2000s are a ghostly graveyard of blue-chip companies that were cheating shareholders with “creative” accounting techniques, often backed by the most widely respected independent accounting companies in the world. Respected “Big 6” accounting firms like Arthur Andersen and KPMG were suddenly connected to shady inside business practices.

As the world stared into a gaping hole where millions in revenue should have been, a flaw of the double-entry system was brutally exposed. With the double-entry system, everything is accounted for in arrear, and anything can change or be changed from the moment of entry up until the accounts are audited by an impartial third party. Unaudited accounts were subject to any sort of editing with any sort of rationale, by accident or intention, which did nothing to help people making current and future decisions based on those entries. People started to realize that the mere act of keeping books wasn’t sufficient. Third-party auditing was mandatory to maintain any sense of reliability or trust.

Triple-Entry Bookkeeping

In 1988, Dr. Yuji Ijiri, professor at Carnegie Mellon University and president of the American Accounting Association, wrote a monograph discussing a new accounting revolution: momentum accounting, or triple-entry bookkeeping.2 This was less of a sea change in the accounting and business communities than you might expect. More like a puddle change. This was likely because almost no one read it.

Momentum accounting is a method of accounting that helps forecasting; it tells you how fast or slow a company is growing. But it required something double-entry bookkeeping doesn’t have: facts. As you saw earlier, double-entry bookkeeping provides a reason for a debit (money you owe) or credit (money someone else owes you).

As Dr. Ijiri describes:

[Accounting moved from] single entry [bookkeeping], which just records what happened, to double entry, where what happened has to be explained by reasoning by another account—if you don’t have [an] explanation, you can’t have an entry.

But it still leaves open the risk of mistake or fraud. If you want to be able to use bookkeeping for prediction, you need something solid to base your prediction on, not guesses or something that may be misremembered or, worse, something both parties colluded on. Something that can’t be altered or edited or “revised creatively.” And from this, we get the idea of a permanent ledger that records in real time—a system in which both parties keep a record of the transaction, but so does the system itself.

Do you see the sea change here? Triple-entry bookkeeping moves to the logical third dimension of accounting, which is not just a record and a reason, but also an auditable trail. Many have discounted the impact of this methodology, or the relationship of triple-entry bookkeeping to blockchain. However, this revolution is the heart of the functionality of blockchain.

But one person did read the monograph, eventually. And it turns out that one person recognized the genius of this innovation. On June 26, 2005, Ian Grigg, a financial cryptographer and later member of the Satoshi Nakamoto Institute, posted this:

It was widely recognised since David Chaum’s designs first appeared that the new “digital certificate” model of money was not aligned or symmetrical with accounting techniques such as double entry bookkeeping. Many people expected the two to compete, and indeed many money systems avoided combining them; this is I believe one of the few efforts to integrate the two and show them as better in combination than apart.

Arrear Versus Arrears

In arrear means after the fact—e.g., payment after the service has been rendered. This is like hiring a cleaning service to clean for the month of August, and the company bills you on August 31. You are paying in arrear.

In arrears means behind—e.g., payment that is late. If you hired that cleaning service for August, and payment is due August 31, but you don’t pay until October 1, your payment was made in arrears.

Triple-Entry Accounting

The digitally signed receipt, an innovation from financial cryptography, presents a challenge to classical double-entry bookkeeping. Rather than compete, the two melded together form a stronger system. Expanding the usage of accounting into the wider domain of digital cash gives three local entries for each of three roles, the result of which we call triple-entry accounting:

This system creates bulletproof accounting systems for aggressive uses and users. It not only lowers costs by delivering reliable and supported accounting; it makes much stronger governance possible in a way that positively impacts on the future needs of corporate and public accounting.3

This is the core thesis of what later became blockchain technology. As digital cash was maturing (through online banking, ATM machines, etc.), Grigg noticed the failure of double-entry bookkeeping to account for potential fraud and mistakes in the system. More importantly, however, he created a solution. By pairing the digital certificate of digital cash with a triple accounting system, capital movement could be more reliable and secure, and less subject to fraud. Eventually, this method of recordkeeping wasn’t just about recording financial transactions. The recordkeeping became the financial transactions.

Confused? Let’s clarify by seeing it in action. Welcome to the emergence of Bitcoin.

The Bitcoin Revolution: The First Blockchain Use Case

In October 2008, an unknown individual or entity going by the name of Satoshi Nakamoto published a paper titled “"Bitcoin: A Peer-to-Peer Electronic Cash System” to the Cryptography and Cryptography Policy mailing list.4 Nakamoto described creating tokens, called bitcoin, which represented individual digital certificates moving through a chain of transactions. Nakamoto advocated creation of encrypted blocks to track these transactions through time, as they were happening.

While many count this as the genesis of blockchain, it is really the origin of a single practical application method of an auditable trail transfer system. This application is what we generally term blockchain (named for the chain of encrypted block transactions). It is this application, the Bitcoin blockchain, that is the model for all currently developed blockchain technology, but it is important to remember that this is just one part of the true innovation—an auditable trail transfer system.

The Bitcoin blockchain was based on a compilation of the token-based interbank transfer accounting system of the 1960s and 1970s (still in use), a digital cash innovation from the 1980s known as Hashcash (the encryption method is actually called hashing), and this basic concept of using tokens as the substitute digital certificate.

To summarize, blockchain technology is an application pairing triple-entry bookkeeping with digital certificates. Its primary use case is to prevent fraud or mistakes in double-spending digital money or assets. It isn’t the so-called peer-to-peer transfer (without a bank) that is revolutionary, though excluding banks from transactions is always a positive development, according to me. It’s the new instant auditability that is revolutionary. The ability to have real-time transfers of value between parties that is based on verifiable facts that we can audit, or track, at any given time is incredible. We aren’t relying on someone’s word or opinion that a transaction happened between parties and someone was or wasn’t paid. We aren’t hoping someone didn’t end up with bookkeeping “extra parts” they’re trying to shove somewhere illegally.

With blockchain, we know that each party (1) agreed to enter into a transaction with the other (both used private keys or passwords to sign off on the transaction), (2) agreed to exchange a specific amount of value with each other (an amount of the underlying token, coin, or asset represented by a token), and then (3) actually exchanged that value. How do we know this? Because the transaction closed. It is listed as a transaction between the parties on the blockchain. If those three conditions didn’t exist, the transaction wouldn’t exist on the blockchain. So no more guessing, missing numbers, or extra parts.

This is particularly important because, in United States law, legal contracts require meeting of the minds (agreement to enter into a transaction that is mutually understood by both parties) and consideration (an exchange of value) reflecting both quantity and price. As you can see, all these elements may be met by having a closed blockchain transaction between parties.

People call blockchain a “trustless system.” It is an entirely trustworthy system.

Ethereum and the Smart Contract Revelation

The Bitcoin blockchain is the primary use case and application of auditable trail accounting for digital cash or currency. Bitcoin is nothing more than a coin representing a value, and each bitcoin can be broken into 100 million subcoins called satoshis, or sats.5 Bitcoin (or sats) is the coin that gets transferred from wallet to wallet, and it represents a cash value. You can see what the value of bitcoin is on any of the marketplaces on which it trades, converted into various fiat currencies or other cryptocurrencies. People buy it from other people or from crypto exchanges (trading for fiat currency) or in exchange for goods or services.

But then people started stretching this concept of auditability of transactions. What else could you transfer between wallets? Does it have to be bitcoin? Could it be something else or represent something else? Absolutely. Here are some things you could transfer:

-

Coins representing value on other chains

-

Tokens representing a promise, ownership, or interest in something digital or physical

-

Tokens representing a patent or other intellectual property

-

Tokens representing digital or physical art

-

Tokens representing anything digital, such as music, AI code, or a novel

-

Tokens representing a “skin” for your avatar in a game

-

Tokens representing an equity interest in a project or company

-

Tokens representing the right to sublet your apartment or house

But could you do it on the Bitcoin blockchain? The first step was to figure out if the Bitcoin blockchain could handle smart contracts.

Smart Contracts

Smart contracts were originally created by Nick Szabo, an American cryptographer and computer scientist, in 1994. These didn’t start off as what we currently think of as smart contracts: self-executing programmable logic that initiates whenever an agreed state exists, can stop on set conditions, and can automatically start over countless times.

Szabo was initially focused on the idea of a transaction protocol that automatically executes or documents a set of actions based on the terms of a previously agreed set of terms. Several attempts to create functional smart contracts and a smart contract platform on the Bitcoin blockchain failed. An early NFT (nonfungible token, see “Nonfungible tokens”) platform was even created, called Counterparty. However, none of these made any inroads in adoption or gained significant traction.

Ethereum’s Innovation: Self-Executing Programming → Smart Contracts

Finally, in December 2013, a 21-year-old developer named Vitalik Buterin released a whitepaper on his blog proposing a new vision of audited trail technology, moving beyond the financial use case evinced by Bitcoin and the Bitcoin blockchain.6 He considered the Bitcoin blockchain to be a weakly executed form of smart contract, and it was not able to support Turing complete applications. He proposed an alternative platform, named Ethereum, that would be a stronger and more malleable, Turing complete system, using a token-based approach to execute transactions involving any digital asset.

These self-executing transactions are based on starting principles agreed to by the parties, then recorded by digital certificate tokens known as Ether that function on the Ethereum platform. He made these self-executing, or smart, contracts initiated and halted by use of Ether tokens and clear logic systems. This was an incredible step forward—no more waiting for payments or approvals.

For example, say a company makes instrument sensors to ensure that highly sensitive instrumentation is being maintained within a small, specific range. This company wants to sell access to its instrument sensors to large clients, and it has a business model requiring monthly installment payments of $750. This could present a problem for the company—it no longer has physical possession of the sensor, so it either requires constant oversight of the payment schedules of every individual client, or it runs the risk of the sensors being used without payment. It also presents a risk to the customer: if the amount is paid but an error occurs in recording payment, payment is not recorded, or the instrument company fails, then the sensors will not operate, and the sensitive instrumentation and equipment could be severely damaged. Now the sensor company can protect both itself and the client by attaching the sensing trigger application to Ethereum’s blockchain.

Since this is an auditing network, first and foremost, everything is initiated when the contract terms are placed on the system. Here, those terms would be something like (in very simplified form) “if $750 is deposited into the company account on the first of each month, turn the instrumentation sensor on, and leave it on until the last day of the month,” and set as a loop until the termination day or event of contract. On the first day of each month, the smart contract triggers an oracle to check the company’s account.7 Provided that the conditions are met (“$750 was deposited today into the company account by the client”), the instrumentation sensor will start or continue running until triggered to stop. No human intervention is required, nor permitted. To confirm that the terms of the contract are met, the contract and each execution is clearly tracked and traceable on the platform.

Think about that. It’s pretty incredible. You don’t need a department of people to confirm payment, verify transactions, chase down clients for collection. You also don’t need to be a huge company that can afford that much overhead and cost. If the sensor (or whatever you make) is working, you were paid. If you don’t get paid, it doesn’t work. This is how we start making the transition from the records tracking the transaction to becoming the transaction itself. So the tokens that reflect the transactions now start having independent, not assigned, value. They represent the value of real transactions. And you don’t need to be the size of IBM to afford using this system; anyone can do it.

So now we have the ability to transfer assets anonymously (Bitcoin blockchain), and the ability to do more complex actions like programming asset transfers and automating transfers based on prior programmed conditions (Ethereum). Blockchain is officially a Thing now, so we need to discuss the basic tenets of blockchain that define the ethos most projects require. This is an extrapolated list made by empirical observation (i.e., I created the list after talking to a lot of people and looking at more projects than any human should).

Tenets of Blockchain (According to Me)

Here’s the list of what I believe to be the basic tenets of blockchain:

-

Open

-

Shared

-

Distributed

-

Consensus

-

Permanence

-

Anonymity

-

Trustless

Open

Open here refers to two different concepts: open ledger and open source.

Open ledger refers to the type of transparency that exists in most of blockchain. Go to any industry event, and you’ll hear about 70%–75% of the speakers mention “transparency” as a core value of blockchain. But that isn’t really what exists—or what people want. Blockchain has an odd sort of half-transparency that we’ll call public-private. The transactions are all public, which means you can literally track an asset as it passes from one person to another, and you can see that someone paid x amount for y. But the identities of the parties are all private. We transact through wallets (discussed more in the section “A Word on Wallets”), which are our means of accessing the blockchain—just as your ATM card lets you access your bank account. Your bank account exists and chugs along without requiring your interaction or attention, but when you want to see what it’s doing or withdraw or deposit assets or funds, you need that ATM.

That wallet is a mix of letters and numbers, and although your wallet is your unique set of letters and numbers, it’s very hard to tell who specifically owns any particular wallet, unless you own a unique item. (Your wallet can be identified as yours in a number of ways. For example, by seeing some of the assets held in it, like a one-of-one NFT or token someone knows you’ve bought, NFT you bought, or, if you are the biggest holder of a particular token, locating the wallet that holds the biggest chunk of that particular token. Note that there are ways to fix these issues quite easily.) Otherwise, anyone could be the owner of any wallet. This open ledger really means public transactions with private parties.

Open source code is very different from traditional web or app development. Most traditional development uses a closed source code, which is more or less proprietary to the founding team and company and is kept confidential, as intellectual property is considered a valuable asset.

Blockchain is often (though not always) driven by community first, and that leads to viewing development as a communal project, which means using base code that is free and available to anyone who wants to use it. It is usually hosted on GitHub or another decentralized site, and anyone can view the code and borrow it. Many open source projects also allow open commenting and even editing—anyone can develop on these projects, and they become very community-focused. While a few projects are based on closed source code (particularly if a private chain or an identity-based application), this is generally not considered “acceptable” within this space.

Distributed

Being concept of distributed isn’t well understood in this context. We’re talking about the fact that no one controls the ledger. It’s related to the preceding shared concept: the ledger is the same across all the nodes. But distributed goes a bit further. This means that everyone has the same copy—but also that no one controls it.

There’s a lot of confusion between the terms “distributed” and “decentralized,” and people learning about DeFi aren’t sure which one applies to blockchain. (People who have been in DeFi for years aren’t always sure, either.) So let’s talk about the difference, and the problems with saying that anything in blockchain is fully decentralized.

Distribution versus decentralization

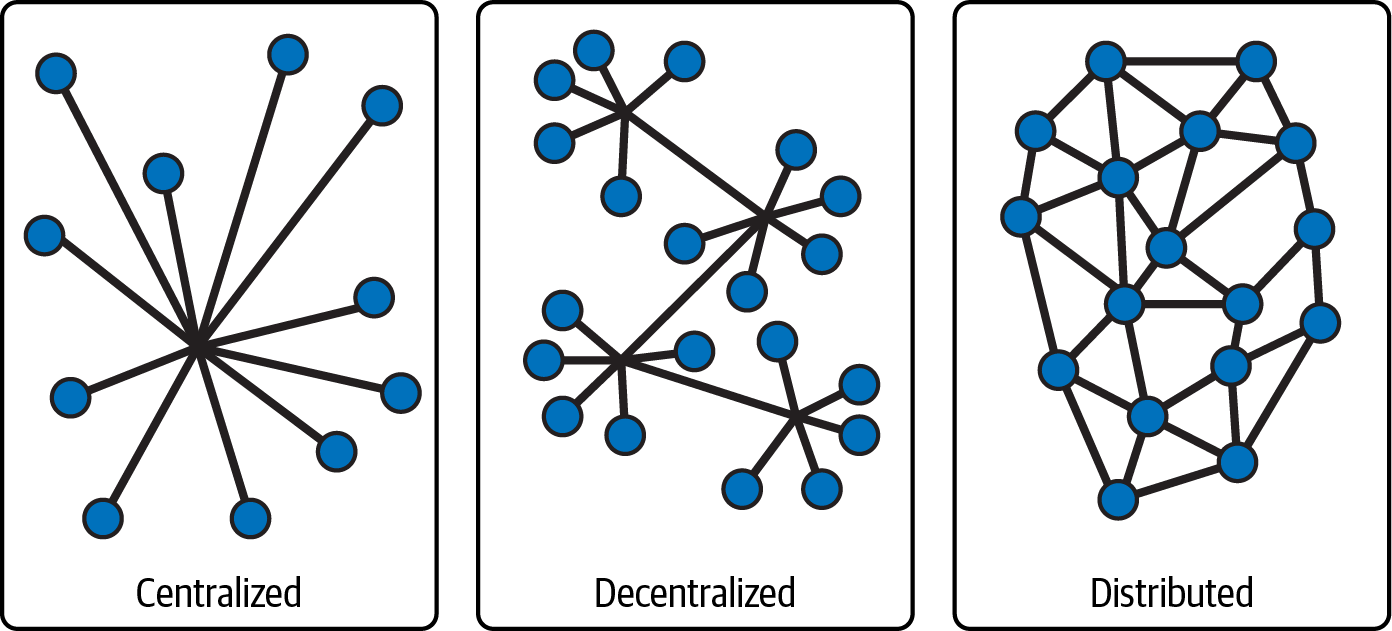

Blockchain technology is, in its ideal state, both distributed and decentralized. Let’s clarify what this terminology really means, starting with Figure 1-1.

Figure 1-1. Different ways to build networks: centralized, decentralized and distributed (Image credit: nakamo.to)

Decentralized in this context is talking specifically about control. Decentralized systems have control shared among a certain number of independent parties—the more independent people, the more decentralized. For example, open source software, like Linux, is decentralized—the code is created and modified by independent developers who jointly develop the base software and any derived applications. There is no overarching master parent entity controlling all. Everything is entirely independently created and deployed.

The internet as it currently stands is (sort of) decentralized. No one entity controls the internet. However, a few key players, like internet service providers (“portals” to the internet, like Facebook/Meta and Google), telecom companies (like Spectrum and Verizon), some governments, and even internal employer home pages, serve as bottlenecks that either redistribute users to the various sites or stop them from being able to move freely around the internet. We call this “federated,” because the parties are all independent—but there aren’t many of them and they can (and often do) collude.

“Distributed” and “co-located” describe where the parts of the system are physically located. In a distributed system, all parts of the system are located in different places, like on the different nodes of the platform. For example, people-distributed companies have executives and staff who do not share a main office. Personnel may not even share the same city or country. They rely on technology to convey information such that all parties remain current on the goings-on of the business.

Co-located systems, on the other hand, have all parts of the system in one place. Companies with all primary personnel coming to the same office are co-located, as is a software company with all servers and personnel located in one place. Everyone is nearly instantaneously aware of whatever they need to know, because it happens on-site.

Blockchain systems are certainly distributed, in that all parts are not just located in different locations, but every access point, or node, running that blockchain has access to all the information on the system. So, in essence, all system information is located on every system access point. Each node has all the information you would expect to find on a central database; no central headquarters or tacky badges on lanyards required.

Decentralization of blockchain, however, is a bit trickier. Most of the current systems are controlled at some point (or many points) by a relatively small group of people. These could be miners (if tokens are mined), governance token holders (the people who get to vote on stuff the platform or application does or doesn’t do), or both. So, one of the biggest problems of blockchain is that it can be manipulated by just a few people agreeing and forming a choke point. Most of the time, it isn’t intentional. It just takes time for a small founding team to build something that’s distributed broadly enough at all points to be called fully decentralized. It’s not really a coincidence that one of oldest platforms, Bitcoin, is our most decentralized. But even Bitcoin still has bottlenecks of control. To really understand decentralization issues in blockchain, we have to explore it a bit deeper.

Three types of decentralization

The problem of decentralization is really that it’s difficult not only to express in various situations, but also to understand. Fortunately, Vitalik Buterin, one of the key founders of both Bitcoin and Ethereum, already thought through a bunch of this for us and conveniently wrote it down.8 He’s brilliant, and great at explanations, so I encourage everyone to read his Ethereum whitepaper (you should also read his blog and other papers—and if he gets into graphic novels or screenplays, we should all probably start reading those, too). But we’re going to distill a bunch of that down here so we can apply it toward blockchain and DeFi specifically. I’m kind of extrapolating at will here, so apologies in advance to any purists who look at it as dogma.9

Also, that’s weird, because none of this is dogma. Stop doing that.

So, as we mentioned before, when we talk about “centralized” and “decentralized” here, we are talking about states of control, or governance. A centralized system has one individual or group of individuals controlling the entire system, while a decentralized system has its governance spread out among all the members.

An example of a centralized system would be the Chinese yuan exchange rate with other currencies. (I’m simplifying a lot here, so bear with me.) Until 2015, China’s yuan exchange rate remained fixed relative to a basket of currencies. China kept the yuan’s value pegged to within 2% of that basket’s value. It wasn’t based on the market rate for the yuan. It wasn’t based on any opinion of the yuan. It was based on a rate that was fixed by the Chinese government and, possibly, an underground coven in the mountains of Tibet. I’m speculating on that last one, but really, it’s as likely as any other valuation method, because we just have no idea how this thing was set. The yuan was entirely centralized, with all control resting with the Chinese government.

Decentralization can happen in many ways, or all these ways together (italicized text taken directly from Vitalik’s post). These are as follows:

- Architectural

-

How many physical computers is a system made up of? How many of those computers can it tolerate breaking down at any single time?

- Political

-

How many individuals or organizations ultimately control the computers that the system is made up of?

- Logical

-

[Do] the interface and data structures that the system presents and maintains look more like a single monolithic object or an amorphous swarm? One simple heuristic is: if you cut the system in half, including both providers and users, will both halves continue to fully operate as independent units?

Vitalik lists a bunch of examples of variations in political, architectural, and logical centralization or decentralization, but the point is that you can have one or more levels of decentralization. You can adjust your level of decentralization. With this in mind, asking, “Is it decentralized?” isn’t going to give you the information you want. You have to ask, “How decentralized is it?” In blockchain, you probably want to focus mostly on architectural and political decentralization—which are, unfortunately, the most likely to be centralized in some manner.

Architectural decentralization

Architectural decentralization is important because this reduces the likelihood of the system crashing because of a node computer breakdown, system hack or other attack, or forced shutdown due to political pressure. (Each of these has happened to the Bitcoin blockchain.) Distributing the system among a wide number of nodes has two benefits: it reduces the likelihood of crashing, and as a bonus it also reduces the ability of private or government actors to control or shut down a particular blockchain.

Political decentralization

Political decentralization is what most people are referring to when they talk about the need for “decentralization in blockchain.” It’s really about two types of political control: governance and consensus.

Governance is the process that figures out which rules control a system, how to execute those rules, and what the system (or members of the system) do to enforce the rules and deter rule-breakers. For example, holders of the Rally (RLY) governance coin are able to do things like these:

-

Approve proposed updates to the application

-

Define rights for internal pre-minted “creator” coins

-

Determine the rate of return for a staked correctly validated vote

-

Determine whether a staked coin should be confiscated because of a falsely validated or fraudulent vote

Consensus, on the other hand, is the voting method that determines whether a measure passes or a block of transactions should be closed and the next block opened. This happens via an agreed-on method of voting that includes the percentage of vote required to pass various actions. “Reaching consensus” means using the existing governance methods to find a common agreement that a particular block of transactions or proposal should be added to the chain (transactions) or adopted (proposal).

Tolerance and decentralization

Why does decentralization even matter? The theory is that systems that are decentralized are less likely to fail because they have three types of resistance to failure, or tolerance:

- Fault tolerance

-

The decreased likelihood that a complex system with lots of parts and redundancy will fail accidentally because too many parts would be required to fail simultaneously.10

- Attack tolerance

-

The decreased likelihood that a complex system will fail intentionally because it’s too expensive to attack and destroy it because there aren’t central access points; you have to attack the entire system at once.

- Collusion tolerance

-

The decreased likelihood of multiple parties acting maliciously in tandem.

These reasons have flaws, unfortunately.

Fault tolerance is drastically lowered when, for example, all the parts are manufactured in the same location. For example, most mining equipment required to process proof-of-work transactions come from four major manufacturers, two of which dominate market share.11 Similarly, most blockchains have nodes that run identical software. A bug or virus that affects one node would impact all of them.

Attack tolerance is generally lowered as efficiency improves. This is a natural condition of the current iterations of blockchain: typically, scalability is attained by reducing pathways to processing, which reduces the cost of attacking the remaining nodes. Systems like delegated proof of stake or large mining pods reduce the attack cost as well by making it more likely for attackers to attack the nodes actually processing. Hardware is much easier to spot than tokens, so proof-of-work nodes present much greater risk of attack than any other kind of consensus/processing method.

Collusion tolerance is generally lowered the more concentrated blockchain control is, either by mining power or token holding. Having large mines or nodes all co-located, especially in a country that promotes restrictions on blockchain, encourages collusion, even if only to evade local prosecution or expulsion. If your large token holders or miners all know each other and can get together for tea to discuss what’s happening on-chain, or they all show up at the same conference and wave hello to one another, you may have a significant collusion problem.

Fortunately, there are ways to address this in platforms and DApps. The following options will add a degree of security in your chain or DApp:

-

Add in true randomization (such as quantum randomization), or at least some form of pure proof of stake, which allows any token holder to be a voting node and reduce predictability.

-

Distribute nodes geographically.

-

Use varied and competitive software and hardware developers.

-

Identify core developers or nodes publicly (this one is less popular, as “doxxing” removes anonymity and is often avoided by those interested in working in blockchain).

-

Use a complex consensus method like proof of work combined with proof of stake, or other combination system.

-

Keep software and protocol developers separate and unknown to one another to the greatest extent possible to avoid commonality and easy collusion.

-

Limit concentrations of mining power and/or token holding, and establish severe penalties for surpassing limits.

Consensus

We’ve covered a bit of consensus already, but a consensus method is a validation method for all nodes.12 There are around 14 consensus methods as of the time of this writing, the earliest of which is the proof-of-work method described in the Nakamoto Bitcoin whitepaper.13

This really just means you need a method that determines how you will process transactions (hashing or encrypting them in the process), who gets to be part of the voting or closing process (mining, staking, etc.), what percentage of votes constitutes agreement, the actual voting method, and how the votes are counted. Most chains want this as automated as possible, and they use a combination of algorithms and smart contracts to make this easy to execute but difficult to fake for an outside attack.

Permanence (or Immutability)

Immutability is the inability to erase, undo, or insert transactions after a block is closed. is a This is a really important part of the technology. Erasing and undoing transactions in financial recordkeeping is the heart of most fraud. These are transactions that are kept “off book,” ignored, deleted, isolated, and otherwise separated from the bulk of the financial transactions, giving an often drastically different financial picture.

Remember, at its heart, blockchain is an accounting ledger. The ability to avoid manipulating past entries or creating false ones is at the core of blockchain. We’ll look at the example of Enron shortly.

However, like all features, the inability to undo transactions can have bug-like problems. This is why, when assets are stolen—e.g., someone steals bitcoin from an exchange or wallet, other assets are illegally obtained by con (a “rug pull” or “honeypot”) or straight hack—it is impossible to stop or undo the transaction. The transaction must be voluntarily reversed by the thief initiating a transaction back to the person robbed. As you can imagine, this doesn’t happen often. There are some “white hat” hackers who do this to test for security holes, then return assets after they report the breach, and collect a bounty. Unfortunately, you’re more likely to find your assets on a black market site than back in your account with a note saying, “Ha ha. Just kidding.”

The inability to insert transactions is another major feature of blockchain. Blocking and hashing, a process that is described in the Nakamoto Bitcoin paper, links every transaction in the past to all future transactions. Early blockchains, including the Bitcoin blockchain and Ethereum, used a consensus method called proof of work, in which a block of transactions are hashed, or encrypted with a randomized code, then combined with all other concurrent and past transactions, and reencrypted. This makes it nearly impossible to extract a single transaction from the past and alter or add in a transaction that doesn’t have the proper links to all past transactions, including the randomized encryption codes. Because current transactions are inextricably linked to past transactions, it is nearly impossible to insert or alter a transaction outside the chain of all previous transactions accidentally. Fraud is immediately noticeable, because it cannot have all prior transactions, correctly hashed, with the correct tagging (the header) to insert with new transactions. This means that you can’t alter past transactions or insert new ones to justify past decisions, and no delete button or discussion with accounting will allow past transactions to be viewed in a different light or amended so they look better to shareholders. Any attempt to fraudulently insert a transaction is blatantly obvious.

Of course, as with all things, this has a “bug” side as well. Processing the entire chain whenever a block of transactions closes requires more and more energy as the blockchain grows. This is the cause of the environmental risk often discussed, and one of the primary reasons most of blockchain technology has moved beyond the original proof-of-work consensus method to other, far more energy conservative approaches, like proof of stake.

We should also note that the permanence that prevents fraud also prevents easy pivots when building. It’s taken over five years for Ethereum to move from proof of work to Ethereum 2.0’s proof-of-stake system. It is that hard to pivot. You have to plan very far ahead to deal well with roadblocks and potential barriers and failures. This is the opposite of the common traditional web and application approach of building a minimum viable product, testing it out continuously, and altering as the market determines. None of that is possible, and certainly not in a beta version. In blockchain, you build and succeed or fail in public. These prior offerings have great lessons for us in understanding how other people have approached problems and how their decisions turned out. Since we can’t pivot, we have to study these past offerings in detail, and work in as much flexibility as possible, to allow for the ability to recover and add a bit of agility to a very structured system.

Now, that is not to say tampering with a blockchain is impossible. Any system has multiple weak points, and blockchain is no different. Other weak points follow and will be discussed in much more detail later in this book:

- Wallets

-

Wallets are accounts that stay electronically linked to the internet, either because they are controlled by another site or exchange (hot wallets) or simply remain on the internet (warm wallets). Each of these can be attacked by viruses or theft, including theft from the platform itself if it’s a hot wallet.

- False consensus

-

False consensus, or virtual control, of the blockchain is really a risk of too few holders of tokens or too few nodes—it recentralizes control. False consensus occurs when the tokens or nodes are held by one or a few entities that own or control over 50% of the blockchain’s tokens (the 51% attack). As blockchains progress, more nodes are added, distributing control to more people and reducing this risk. Bitcoin, unfortunately, is particularly subject to this risk, as the HODL (buy and hold) philosophy has resulted in mining and hoarding, rather than distribution of assets.

As a result, 10% of miners control 90% of mining capacity, and only 50 miners (0.1%) control close to 50% mining capacity.15 While balances by intermediaries have been increasing since 2014, the top 1,000 investors control around 3 million BTC (approximately 20% of the bitcoin in circulation), while the top 10,000 investors control approximately 5 million BTC (approximately 33% of the bitcoin in circulation).16 All that means lots of bitcoin in few hands, which is a point of centralization. The more these holders act together, the more we can see that this small group can exercise an enormous amount of power over the chain when acting together.

- Phishing and bad invitations

-

This remains one of the biggest reasons fraud persists, especially among wallets. People click links they shouldn’t, give away seed phrases (which you should never do), and/or invest in projects based on false premises or fraud. This is still a huge problem in the industry.

- Failed security protocols

-

Attacks also attacks result from failed security protocols or protocols that have a deliberate “back door” left in the code to allow later attack when more assets are on the chain. An example is one entity holding two of the three authentication keys required for a multisignature (multisig) wallet, allowing internal theft and fraud (see, e.g., the $66 million theft from Bitfinex).

Currently, these are being addressed by new voting protocols and adjusting loss across users. These are temporary resolutions, at best, and are addressed in a later section of this text. I’ll discuss details on how these smart contracts are actually triggered in “A Word on Wallets”.

Anonymity

Anonymity here refers to that concept I mentioned earlier: public transactions, private parties. The platform or application has to protect the identity of the parties, and it does this by providing randomized wallet identifiers (letters and numbers) and using protocols that do not directly identify parties whenever possible.

Legal requirements regarding money laundering and securities issues, among other things, prevent this from being as anonymous as most in the system would like. Most try to keep these identity requirements to a minimum, and stress the importance of keeping identifiers to as small an amount as possible.

Trustless

As noted previously, one unique aspect of blockchain is that it expects bad actors. It expects a certain amount of fraud to be part of the system and deals quite well with it. If you want anonymous parties and public transactions, you need to be able to have agreements and actions execute by themselves, or the delay in getting every party to agree to a contract or offer will be so long and work intensive that the blockchain would be unusable.

What Does Any of This Have to Do with Finance?

That’s a great question. We have a bunch of information on blockchain, but what does this have to do with finance—and what is finance, anyway?

I already went through accounting; I’m not going to make it worse and start adding in a bunch of math and statistics to discuss finance and financial tools. Let’s talk about what traditional finance (or TradFi) is and how money flows in economies—and why this sucks for most people, leading to the rise of DeFi. It’s exciting stuff that leads to you making more money with the money you have, so let’s get started!

What Is Finance?

Finance, in general, can best be described as money making money. When you hear people say you need to “put your money to work,” they are often speaking of putting your money into some sort of financial tool so you can generate more money with it. How does that work? Through the magic of interest and time—especially compound interest, which we’ll discuss in this section.

When you put your money into a standard bank account, you get access to three powerful tools: the ability to store your funds in a safe location, the ability to convert someone’s debt to you into cash that is available for use, and the ability to convert your money in whatever form it exists to digital cash, which is now the primary form of payment. It’s difficult to buy most goods and services in the US without some form of digital payment—either a credit or debit card. This is the fundamental problem of the unbanked: it’s not that they have zero access to funds; it’s that they have no cheap or convenient way to store it, which is why predatory lenders like check-cashing companies and pawnshops are able to prey on them so easily. This was one of the first problems blockchain intended to solve—the ability of banks to preclude people from accessing their basic services, forcing them to use services with extremely high interest payments that create debt that is functionally impossible to pay off.

If you are lucky enough to have a bank account and access to those tools mentioned, you also get the ability to earn interest on the money you deposit. This is like earning rent from the bank because it gets to use your deposited money, and the bank earns interest on the investments it makes—with your money. But interest rates have not been particularly high since the 1990s, and most people earn little to no interest on their deposits—even though the bank is still using their money, and making a lot of money on it. We’re going to discuss how that happens next.

How Money Flows in Banks and Economies

Now, let’s talk about how money flows between retail customers (people like us, not institutions or funds). When you deposit money in your account, you might think this cash sits in a vault, ready for people to take it out. It does not.

Most economies flourish only with economic activity—that is, when money changes hands. This is what happens when you buy or sell goods or services. Economies like lots of activity; it makes people who make goods or offer services richer, which, in theory, makes them hire more people, who earn money that they can, in turn, spend on more goods and services. All this spending and making and hiring means the government doesn’t have to support people through entitlements like welfare.

Entitlement programs cost money, which has to be generated through taxes. Raising taxes does not endear any elected official to their constituency (especially in the US), so most view entitlements, and the increases in taxes they require, as a last resort only. Everyone spending money means the money is getting redistributed without the need for increased taxes—which, of course, makes lawmakers extremely happy. The fact that redistribution always seems to go from the same people and to the same people is not something they like to focus on.

Most governments view the role of government as primarily to monitor redistribution, not to enforce a more equal flow of money to and from parties. As a result of this redistribution and money flow goal, they do not particularly want money to sit idle in vaults or under beds. When money sits, it doesn’t get redistributed, and that leads quickly to requirements for broad government support—and tax increases. Even China, with its economy that is actively managed by the government, as opposed to the US system of economic management through free markets, experienced trouble with the tendency of many Chinese families to save up to 30% of their income. They had to encourage spending to release those funds, which was a big trigger for the growth of the middle and upper classes we’ve seen in the past few decades.

So, we imagine banks full of stacks and stacks of cash—but now we know that it is against government interest to have it just sitting there. So what did they do? They required banks to hold only a small amount of cash, which is called the reserve ratio. This reserve ratio varies depending on the total amount of eligible deposits each day, but ranges from 0% to 10%. That’s it. Ten percent of deposits are kept on hand. Some banks choose to keep more on hand to make sure they can pay out more depositors on demand, which is called excess reserves and is another range that banks set themselves according to their perceived needs (the liquidity ratio). Note that the liquidity ratio can be reduced or removed whenever the bank wants.

Also, banks can borrow money from the central bank (the Federal Reserve in the US, or Fed) simply by asking—and are not turned down. This overnight loan to cover the reserve ratio means that all banks can effectively leave nothing in their vaults and assume the Fed will help them if they need to pay out depositors because they want to take money out of their accounts.

Banks Are Using Your Cash—and Not Paying for It

So, what do they do with the millions of dollars we depositors so generously leave with them? Banks put this money to work. They enter into a variety of financial instruments, lending out your money in mortgages, small business loans, personal loans, and many other types of interest-bearing offerings. And there’s that word again, interest. Let’s take a little detour to understand what interest really is.

When you loan out money, think of it like renting out a truck. The person you loan it to either takes the keys and goes (if you know them), or leaves maybe a copy of their license and a credit card authorization (if you don’t know them—to make you feel comfortable loaning out your truck to a stranger). When the truck is due to be returned, they return the truck. The truck has to be in the condition you loaned it—no extra scratches, dents, or missing parts. You get everything back exactly as you loaned it out. But what else do you get? You get a rental payment—the amount you charge for loaning out your truck. That is your incentive to loan out your truck. You are getting paid for it, which is the cost of rental, and the price of you being without your truck because someone else is using it.

Now, instead of a truck, imagine you are loaning out money. You loan it out, with collateral if you don’t know or trust the person, or without if you feel certain they will repay the money. You get your money back in full; they don’t get to keep part of it. But on top of that, you get a payment for renting out your money. That’s interest.

Interest is the rental fee for loaning out your money. The rate is high if you think the person you are loaning the money out to will probably pay but aren’t sure they will pay back everything or pay on time. You want to get more money because there is more of a chance you could lose it, and you might have to borrow money to cover your own expenses. If you can borrow it at a certain rate, like 3%, you want to make sure that you loan it out at a higher rate, something like 5% or 6%, so that even if you have to borrow money to cover your own mortgage payments and bills, or even go to court to collect the money you are owed, you still charged enough to make a profit. That’s why the rate you can borrow money at is so important to know. If you thought you could borrow at 3%, but it turns out that when you need money you can get it only at 7%, loaning your money out at 6% would make you lose money if anything goes wrong. Remember, you can’t use your money while you are loaning it out. If it isn’t repaid, you have to find money somewhere. You have your own lenders to worry about. Many people don’t bother to understand this basic concept, which is why they end up losing money in financial instruments.

So, now we know that the government doesn’t want big chunks of money sitting and doing nothing, and banks have to leave only a small amount (if anything) in their vault for depositors. What are they doing with all those deposits? They are lending them out—and earning interest! They have millions of dollars of your money (and mine, and everyone else who has an account there), and they turn that money around and loan it out, charging a range of interest rates for it. It would be nice if they guaranteed that the money would be available as loans for the same community that deposited money in accounts with that bank. That would be circulating money from the community to the community, in larger amounts than any individual could do on their own.

But, unfortunately, they do not do that. They loan to the people who can pay them the most money, who they believe will repay their funds with certainty. And generally, that is not the small businesses of the local community or individuals. It’s the large companies and high-net-worth individuals.

So, you aren’t getting that money loaned back out to you. But, at least you get a piece of that interest your money is generating, right? No. The bank keeps all of it. That is what is forming the base amount of its revenue—all those dollars it earns. The bank does that by loaning out your money and then putting it back in the bank only long enough to give people their money when they request it (this is just your typical bank withdrawal from your account). But all those interest payment profits the bank made on the money you generously, if unknowingly, let it borrow free of charge? The bank keeps that. And if you’ve ever paid a bank fee, or an ATM fee, or a low balance fee, or a wire fee, then you just paid them to use your money.

On top of that, let’s talk about access. You see the banks making all this delicious cash for far less risk than investing in a stock or coin, or starting a company. So you decide you’d like in on this great deal. So you ask the bank if you can put some cash in those investment tools also. Just a little bit to add to its pool and give you a nice return in a few months. Easy peasy, right? Nope.

Your bank offers you crappy option one: an interest-bearing account. This account has a minimum balance and often a limit on transactions per month, along with a fee for many services. And for all this, you get an interest rate of 1%. If you’re lucky.

No? Welcome to crappy option two: a certificate of deposit (or CD), generally requiring you to lock up your minimum investment for a period of six months. The minimum amount is, on average, $5,000—meaning you need $5,000 extra dollars you can’t touch during the lockup period (six months!), for the incredible interest rate of...1.36%.17

My goodness, these are both shockingly crappy options with a huge amount of expense and very little upside, you say? You’re correct. Banks do not care about providing access to investment tools to anyone who does not have $5,000 as spare cash. But between zero investable cash and $5,000 in investable cash lives around 95% of the population. That banks don’t care about. At all.

And that’s the problem with traditional finance: most people don’t want you to be able to do it. Especially banks.

What Is Decentralized Finance, and Why Is It Important?

Decentralized finance (DeFi) is money making money, like centralized finance, but without using banks. Does it sound more interesting already? I think so too.

Instead of banks controlling access to financial tools, anyone can get access to the magical tools of interest and time to generate and maintain generational wealth. No one will limit your access based on your income, your last name, your ethnicity, your address, your education, your alma mater, your parentage, or even your legal status within a country. If you want access, you get it.

That, of course, presents its own problems. With no financial educational requirements in most school systems around the world, those with knowledgeable people in their house or immediate environment have a clear advantage over those who do not. And the people with that kind of knowledge floating in their environment more often than not are already wealthy. Those who are not wealthy don’t have Uncle Joe, who runs the Derivatives desk at Citi, pop on over to run through cash flow, risk management, and the time value of money. The rest of us are more likely to get a list of people (relatives and predatory lenders) and food banks to turn to when the money runs out before the end of the month. It’s hard to worry about investment strategy and cost-benefit analysis when you are trying to make sure your kids are fed every day, especially when you aren’t.

So the openness of DeFi is a bit illusory. Anyone can participate, but the advantage clearly lies with those who have the background to understand what is happening in real time. And those people are the already wealthy investors, who have access to both traditional finance (TradFi) via banks, and nontraditional finance, through DeFi.

Access and risk comprehension aside, DeFi applications work similarly to TradFi in principle. You loan someone money for a set interest rate, and you get back your money plus interest rate returns. That’s pretty much where the resemblance ends.

Although the terms used will be described in much greater detail as we move into the mechanisms of DeFi, some of the key differences between DeFi and TradFi are summarized in Table 1-1.

| TradFi | DeFi | |

|---|---|---|

| Length of investment | One month to five years for most interest-bearing offerings, and indefinite for interest-bearing savings accounts. | Some loans (flash loans) are the length of the transactions, others for minutes or hours. Some are for days or even a month. |

| Investment currency | Fiat | Stablecoins and/or asset-backed tokens, primarily incentivized governance tokens |

| Interest rates, on average | Banks are giving, on average, 0.06% for interest-bearing savings accounts, 0.07% for money market accounts, 0.14%–0.27% for certificate of deposit accounts (longer term = higher interest). Compare that with the average rates banks are getting, which range from 3% to 36% (longer term = lower rate). This difference between rates banks give and rates banks get is the net interest margin, which is the biggest source of profit for banks. | 1%–5% for simple staking on a chain, 1%–6% for liquidity providers, 2%–10% for lending platforms, 60%–80% or more for yield farming and aggregators. |

| Compounded/simple | Annual percentage rate, which does not factor in compounded interest | Annual percentage yield, which does factor in timing and amount of compounded interest |

| Custodial | Yes—your investment is locked up for a predetermined period. | Rarely. Most are noncustodial, and you can exit the transaction once concluded (flash loan) or at will (staking, liquidity provider, etc.). |

| Identities | Parties are aware of one another, including detailed identifying information such as Social Security number. | Parties identified by wallets; not otherwise known to each other. |

| Qualifying | Minimum amounts and credit score may apply | No qualifications other than sufficient collateral |

| Collateral | Collateral is required for loans as borrower, and minimum balances function as collateral base. | Collateral determines amount of loan. |

Conclusion

In this chapter, we’ve learned about the basic structure of blockchain, the key aspects of blockchain, characteristics that describe blockchain, and its applications, some of which also cause difficulty in blockchain use or development.

We also discussed the key principles of both traditional and decentralized finance, and the reasons that decentralized finance, or DeFi, is so incredibly important. Next we’re going to talk about current development in DeFi applications and platforms, and understanding the main tools of the DeFi system.

1 Yuji Ijiri, “Momentum Accounting and Managerial Goals on Impulses,” Management Science 34, no. 2 (February 1988): 160–66.

2 Ibid.

3 See Ian Grigg’s June 26, 2005, post and correlating paper, posted to FinancialCryptography.com.

4 Ian Grigg is widely considered to be either the identity behind the mysterious Satoshi Nakamoto persona, or one of a small group who collectively named themselves or were affiliated with Nakamoto.

5 A satoshi is one 100-millionth of a bitcoin, just as a penny is one 100th of a US dollar.

6 Vitalik Buterin, “Ethereum White Paper: A Next-Generation Smart Contract and Decentralized Application Platform,” Ethereum, 2014, https://ethereum.org/whitepaper. Updated and revised by the Ethereum Foundation.

7 An oracle is a piece of data-sensing software that leaves the blockchain platform to retrieve external data.

8 Derived in part from Vitalik Buterin, “The Meaning of Decentralization,” Medium, February 6, 2017, https://oreil.ly/sjTEN.

9 Hopefully, my good intentions will stave off hate.

10 Simple systems may be more secure, technically, because they have fewer overall points of access or potential breach, but the statistical likelihood of failure is higher because fewer things are required to fail to have the simple system not work. Each component of a simple system is simply more important. (Ha.)

11 Jamie Redman, “Bitcoin ASIC Miner Manufacturing Domination: Bitmain and Microbt Battle for Top Positions,” Bitcoin.com, June 22, 2020, https://oreil.ly/EuNe7.

12 Nodes are computers supporting a blockchain platform or application by lending theirs processing power or voting validation to the platform or DApp for stability and governance.

13 See “The Bitcoin Revolution: The First Blockchain Use Case” for a description of the paper. This paper is referred to as the “Nakamoto whitepaper.”

14 This is an “open secret” in the securities community. Though no official statements have been made regarding the failed Veba merger, numerous investigative reports indicate the link between Enron’s books and the failure of the merger. The most cited appears to be “Enron’s Many Strands: Early Warning: ’99 Deal Failed After Scrutiny of Enron Books” by Edmund L. Andrews et al. in the New York Times, Jan. 27, 2002.

15 Study done by National Bureau of Economic Research, released October 2021.

16 Ibid.

17 National average interest rate as of October 2023. Note that minimum amounts and yields vary tremendously by bank and personal credit and banking history of applicants.

Get Understanding DeFi now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.