SHOULD YOU SCALE INTO POSITIONS?

Ted is a novice position trader who wants to know, “How much should I buy?” A buy-and-hold investor would take his cash and divide it into equal dollar amounts (buckets), spending each bucket on a stock. A $100,000 portfolio might contain 10 positions of about $10,000 each or 20 positions of $5,000 each.

Ted has his core portfolio setup the same way, but wants to concentrate his trading portfolio in just a few, large positions. His portfolio is valued at $200,000 with the first half dedicated to core positions, and the other $100,000 split into four positions of $25,000 each.

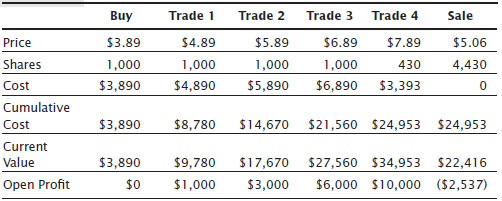

He plans to buy when price closes above the 40-week (200-day) simple moving average and sell when it closes below it. He decides to throw $25,000 into this trade, but does not want to spend it all until he knows the stock is performing. Therefore, he buys fixed share amounts (constant position size) as price rises by $1, until he spends the entire $25,000. Table 2.6 shows the trades and Figure 2.1 shows the position trade (A, B, C, D are the approximate buy points for trades 1 through 4).

Table 2.6 Money Management for Ted's Trade: Constant Position Size

As price rises, he accumulates more shares, 1,000 at a time, boosting the current value of the holding from $3,890 to $27,560 after Trade 3. Then there is a problem. He wants to buy more, but the cost, at $21,560 (Cumulative ...

Get Trading Basics: Evolution of a Trader now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.