Adding Payroll Transactions from an Outside Service

Lots of companies use outsourced payroll services, like ADP or Paychex, to avoid the brain strain of figuring out tax deductions and complying with payroll regulations. When you use one of these services, you send them your payroll data and receive reports about the transactions that they processed. The service takes care of remitting payroll taxes and other deductions to the appropriate agencies.

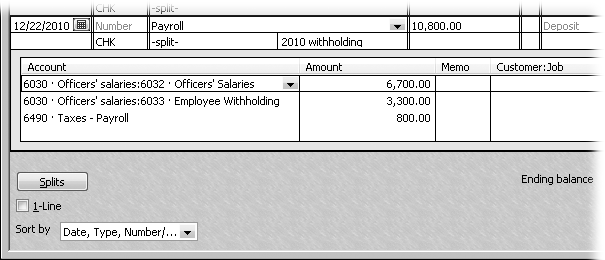

The problem with this setup is that none of these payroll transactions appear in your QuickBooks company file unless you add them. Fortunately, you don’t have to enter every last detail. You can simply create a journal entry debiting the payroll expense accounts and crediting your bank account (Recording Purchases Made with Petty Cash). Or you can create a vendor in QuickBooks for payroll and then memorize a split transaction that distributes the money from your checking account into the appropriate expense accounts, as shown in Figure 14-4; here’s how:

Create a vendor for your payroll transactions.

On the QuickBooks Home page, click the Vendors button. In the Vendor Center toolbar, click New Vendor. You don’t have to fill in all the fields in the New Vendor window; simply type a name like Payroll in the Vendor Name box and then click OK.

Figure 14-4. In most cases, your payroll falls into three categories: Salaries and wages represent the ...

Get QuickBooks 2011: The Missing Manual now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.