Handling Refunds and Credits

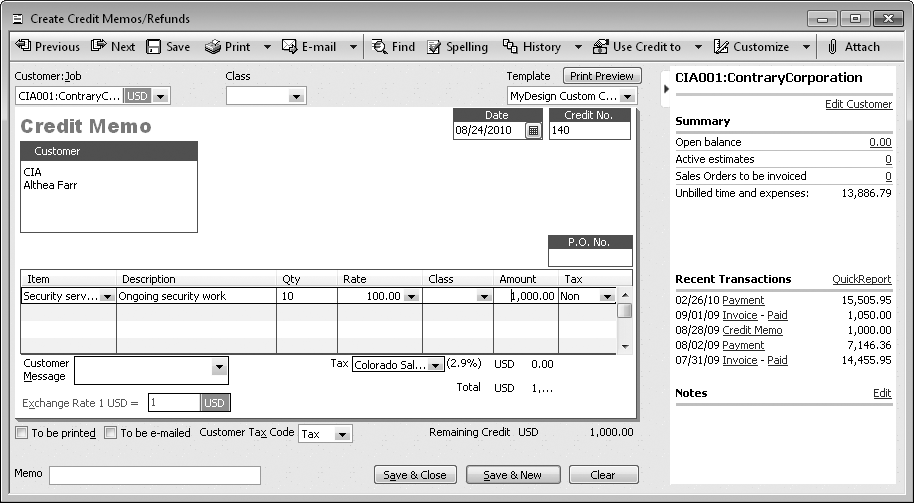

If a customer returns a product or finds an overcharge on their last invoice, you have two choices: issue a credit against the customer’s balance, or issue a refund by writing a check. In the bookkeeping world, the documents that explain the details of a credit are called credit memos. On the other hand, when a customer doesn’t want to wait to get the money she’s due or she isn’t planning to purchase anything else from you, a refund check is the logical solution. In either case, refunds and credits both begin with a credit memo, as shown in Figure 10-25.

Figure 10-25. A credit memo is like an invoice except that the items you add represent money flowing from you to the customer instead of the other way around. Don’t enter negative numbers—QuickBooks takes care of calculating the money due based on the value of the items. In QuickBooks 2011, the right side of the Create Credit Memos/Refunds window shows a summary of the customer or job and recent transactions.

Creating Credit Memos

Here’s how to create a credit memo:

On the Home page, click Refunds & Credits or choose Customers→Create Credit Memos/Refunds.

QuickBooks opens the Create Credit Memos/Refunds window. If you stay on top of your invoice numbers, you’ll notice that the program automatically uses the next invoice number as the credit memo number.

As you would for an invoice, choose the Customer:Job.

Get QuickBooks 2011: The Missing Manual now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.