THE CONCEPT OF DEFERRED INCOME TAXES

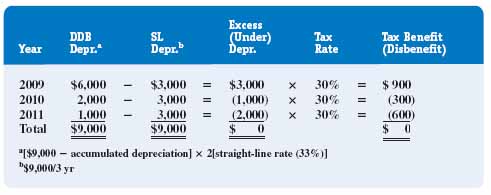

Suppose that Midland Plastics purchased a piece of equipment on January 1, 2009, for $9,000. The equipment is expected to have a three-year useful life and no salvage value. Midland computes depreciation using the double-declining-balance (DDB) method for income tax purposes and straight-line for reporting purposes. In 2009, Midland's choice to use two different depreciation methods creates an income tax expense on the income statement, which is based on straight-line depreciation, that is greater than its income tax liability, which is based on double-declining-balance depreciation. In 2010 and 2011, the difference reverses itself, and the income tax expense is less than the income tax liability. Figure 10B-1 provides a schedule of these differences and, assuming an income tax rate of 30 percent, computes the tax effects associated with using DDB instead of straight-line for tax purposes.

FIGURE 10B-1 Income tax effects due to DDB depreciation

Note that use of the DDB method, instead of straight-line, creates a tax savings of $900 in 2009, the first year of the equipment's useful life. In 2010 and 2011, however, this benefit reverses itself, giving rise to additional tax payments of $300 in 2010 and $600 in 2011. As of the end of 2009, Midland can view these additional tax payments as liabilities, because many consider them to be future obligations. ...

Get Financial Accounting: In an Economic Context now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.