Chapter 1. What Is Blockchain?

What is blockchain?

Ask 50 technology leaders this question, and you’ll probably get 50 different answers. Most business leaders know that blockchain is an important technology that’s changing the world, but they struggle to simply explain it. They grasp the main concepts, but when they try to put them into plain language, everyone ends up more confused.

Most blockchain experts, on the other hand, struggle to explain it simply. It’s as if you asked them to explain a car, and they launched into a 10-minute monologue about the physics of internal combustion engines. Meanwhile, you’re thinking, I really just wanted to know what makes a car go vroom.

Simplifying is difficult, so we’ll work hard to make things simple.

In this chapter, we’ll explain what blockchain is, with easy-to-understand examples and diagrams. Through our writing, speaking, and consulting work, we’ve tested these examples with thousands of people worldwide, so we know they’re useful, understandable, and (most important) memorable.

So even if you’re an expert, this section is worth reading. You’ll benefit from having a common language with which to talk about blockchain, using words that will resonate, making your voice echo in distant lands.

If you’re a beginner, you’re in for a treat. These are the stories of the great blockchain pioneers, the visionary geniuses who built this technology that we love so much.

But first, we need to answer that simple question: what is blockchain?

Blockchain: The Simple Definition

Blockchain is the Internet of Value.

Think about something that holds value for you. You might say your relationships, your pets, or your treasured diary from fourth grade. But for this discussion, let’s focus on things that are a store of value, meaning things we generally trust and agree will hold their value.

Money is an obvious store of value: if someone gives you a dollar, it will generally be worth a dollar in the future. Lots of agreement, plenty of trust. But many other types of value exist: stocks and bonds, gold and silver, frequent-flier miles and Starbucks rewards points.

Blockchain is like a new kind of internet that lets us send and receive this value to each other. Just as today’s internet lets us share information, blockchain lets us share value.

Think back to the olden days of yore, before the internet. If you had a question, you went to the library. There you located an encyclopedia, looked up the appropriate fact, and then discovered the encyclopedia was 10 years old and offered no help.

Today, of course, information is available in real time on the internet. Wikipedia contains the sum total of human knowledge, accessible from a device that fits in your pocket. When a new movie or product is announced, fan pages and blog posts instantly appear. Social media is like a real-time feed into human brains.

Before the internet, information had to be hand-pumped out of schools and libraries. Today we have a firehose of facts. Any information is available at any time, any place in the world. We live in the Information Age, an explosion of knowledge that will out-Renaissance the Renaissance.

But the internet was only act 1. Blockchain is act 2, allowing value to be shared as easily as information.

For example, today it’s still kind of hard to send money. Sure, we have Venmo, Alipay, Google Pay, Apple Pay, and PayPal, but that’s five competing standards (and there are many more). There’s no all-in-one global payment app, except cash. But cash has plenty of other problems: every country has its own, it’s easy to lose, and (since it’s anonymous) criminals love it.

When it comes to sharing value, it’s like we’re still looking up facts in library encyclopedias.

As an analogy, imagine you could send money as easily as sending email: just type in the recipient address, the amount, and hit Send. That’s the kind of easy, trusted, friction-free experience made possible by blockchain.

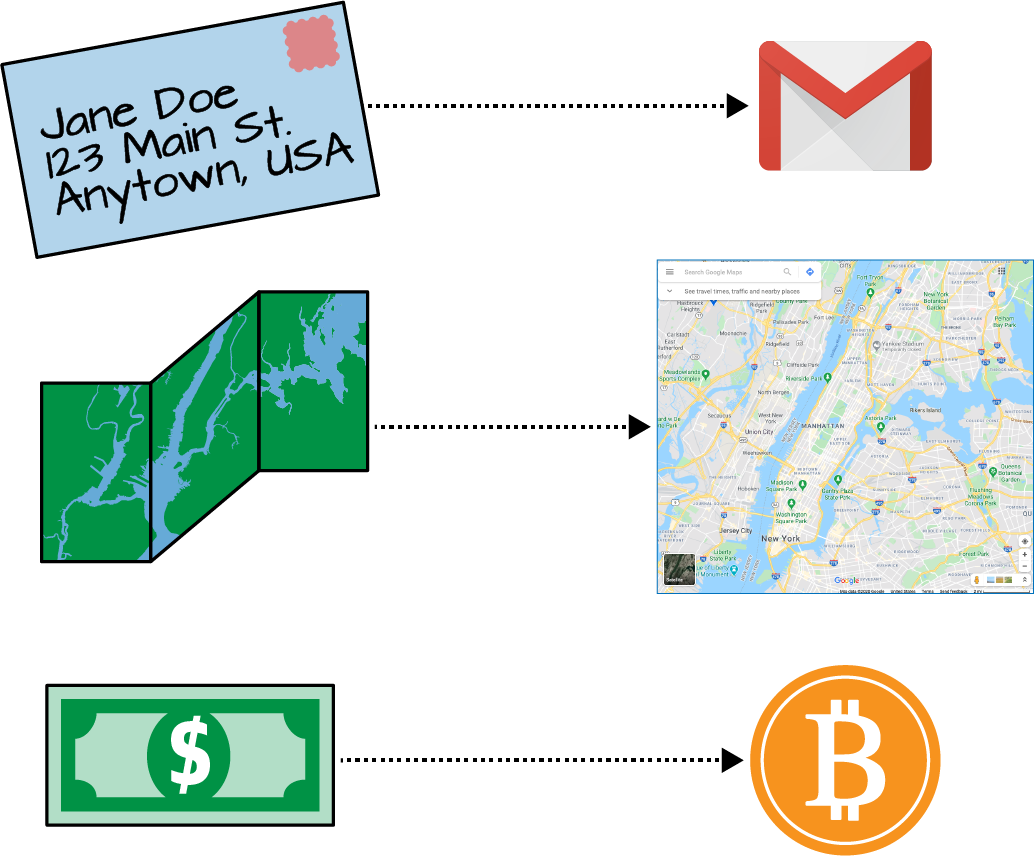

Just as Wikipedia made encyclopedias obsolete, and email made paper mail obsolete, blockchain is making the cash in your wallet obsolete, replacing it with something that’s way faster and way more convenient (Figure 1-1).

Figure 1-1. The evolution of paper to digital

Digital delivery is faster and cheaper than pushing paper. It’s trackable and auditable. It also generates data, which can be fed back into computers for analysis and improvements, making transactions faster and cheaper still.

That’s why most of the enterprise technology projects of the past 50 years have been focused on moving business systems from paper to digital: email, websites, cloud computing, big data, and analytics. Indeed, the trend is called digital transformation—and the trend is not only accelerating but also reshaping the global economy.1

Blockchain technology plays an important role in this digital transformation—this shift from paper to digital—by making it easier to send and receive value.

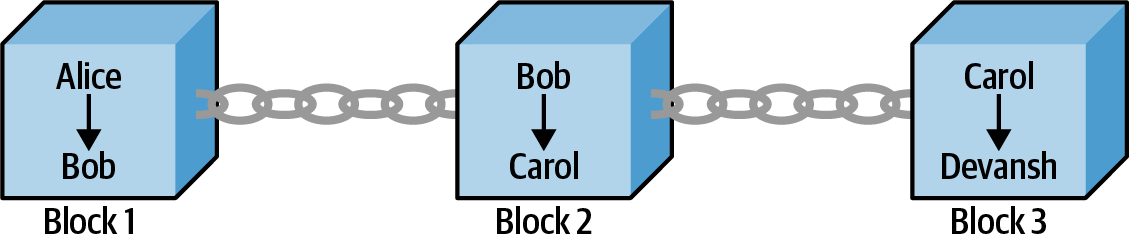

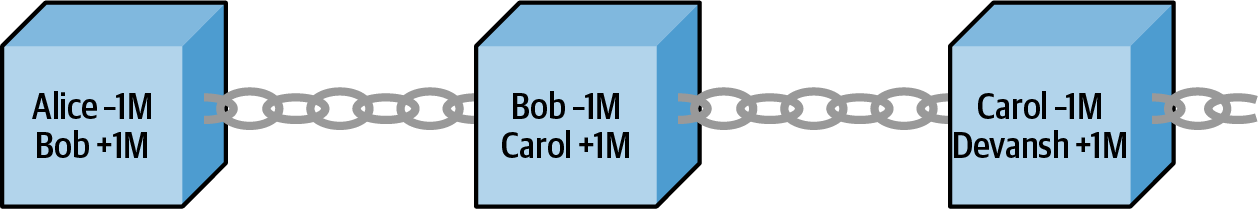

Let’s say, for example, that we’re tracking the flow of a dollar. Each time a dollar changes hands—going from Alice to Bob, then Bob to Carol, then Carol to Devansh—we write that transaction to a block of data, and then we add that block to a chain of other blocks, as illustrated in Figure 1-2.

Figure 1-2. How to diagram a blockchain: blocks represent transactions and chains show the sequence of transactions

To understand how these blocks and chains work in real life, let’s look at the first successful use case of blockchain: the digital currency called bitcoin.

Note

Bitcoin: The first successful (and most successful) blockchain project, launched in 2008 by the mysterious Satoshi Nakamoto.

Bitcoin: The Blockchain Origin Story

It’s one of the great mysteries of history: who invented bitcoin?

On Halloween 2008, a costumed character going by the name of Satoshi Nakamoto released a world-changing document called “Bitcoin: A Peer-to-Peer Electronic Cash System.”2 Published to an early message board for cryptography enthusiasts, it was part technical whitepaper, part political manifesto.

In the paper, the anonymous author painted a vision for a new kind of “e-cash” that could be sent worldwide as easily as sending an email: in short, moving from paper money to digital money. In the process, bitcoin would rewrite the rules of the global financial system, which was still in the throes of the 2008 financial crisis.

For blockchain enthusiasts, the bitcoin whitepaper has since taken on the quality of holy scripture, with each section meticulously numbered and laboriously discussed. In just a few elegant pages, Satoshi springs a new financial universe into being, governed not by the laws of humans but the laws of mathematics.

The Satoshi whitepaper was the Big Bang of blockchain.

Like the main characters in all the success stories you’ll read in this book, Satoshi was not satisfied with the theory; the challenge was in building it. Over the following years, Satoshi drew a small band of developers and enthusiasts who were attracted to both the technical challenge and the political ramifications of a money developed “by the people, for the people.”

This early community—a motley assortment of cryptography geeks, cypherpunks, devout libertarians, and digital currency programmers—helped develop and test the bitcoin software, set up the first bitcoin network, and create (or mine) the first bitcoin.

Note

Mine: To earn bitcoin by contributing computing power to the network.

At this point, bitcoin had no real value. For most of the early enthusiasts, it was a hobby, an interesting experiment. But as the size of the community and the codebase grew larger, those early pioneers began to excitedly whisper: what if this bitcoin actually became valuable? What if this was not just a geeky techno-libertarian project, but, like, real money?

The First Bitcoin Purchase

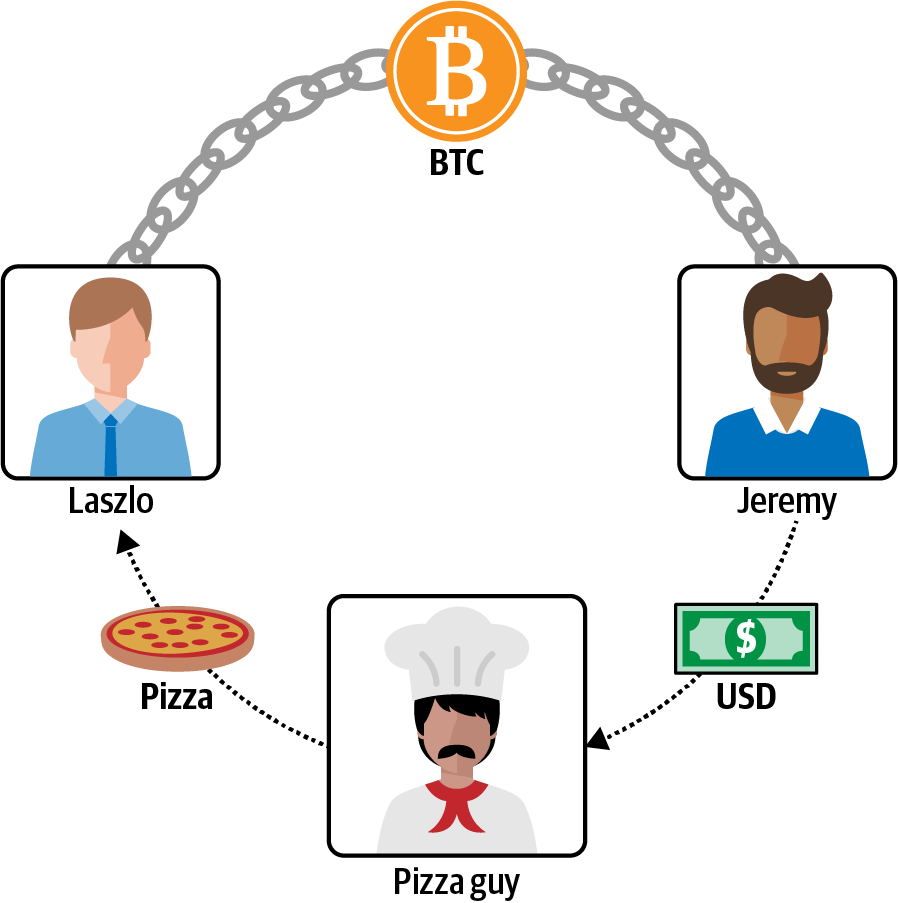

In 2010, one of these early community members, a programmer named Laszlo Hanyecz, conducted a landmark experiment. To prove bitcoin had real-world value, he suggested using bitcoin to make a real-world purchase: a couple of pizzas.

Hanyecz found another early bitcoin enthusiast, Jeremy Sturdivant, who was willing to help. To pay for the pizzas, Hanyecz sent bitcoin to Sturdivant, who then called up a local pizza shop and arranged to have two pizzas delivered to Hanyecz (Figure 1-3). In exchange for Sturdivant’s service as a “pizza broker,” the two settled on the somewhat arbitrary number of 10,000 bitcoin.

Seven years later, those pizzas would be worth $100 million.

Figure 1-3. The $100 million experiment: Laszlo sends bitcoin to Jeremy. Jeremy sends dollars to the pizza guy. Pizza guy sends pizza to Laszlo’s house.

The experiment proved that bitcoin had real-world value: that is, people would accept bitcoin as payment and assign a value to this payment in United States dollars. Bitcoin was being used as money. The post-pizza price of bitcoin began to take off: within 10 days, users were willing to buy and sell a single bitcoin for 8 cents each.3

Satoshi’s dream of digital money was coming true! The reclusive programmer continued to work tirelessly behind the scenes, suggesting changes, making improvements, and managing the scrappy team of volunteer developers. Mysteriously, Satoshi communicated only via email or message boards; no one ever met the creator of bitcoin face to face.

Then something weird happened. Satoshi began handing over all the source code for bitcoin to the top developers…then vanished.

Satoshi left behind accounts worth some 1 million bitcoin (BTC), which seven years later would be worth nearly $20 billion. To this day, no one knows the identity of Satoshi, or even whether Satoshi really exists. Some think Satoshi is a woman. Some think Satoshi is a group or even a government. Some think Satoshi is an alien.

It’s a remarkable origin story because it’s absolutely true. And it teaches us one of our first lessons about successful blockchain projects: have a good origin story.

The story of your blockchain project is the way you get people interested in joining your blockchain. And getting people to join your blockchain, as you shall shortly see, is the primary challenge facing blockchain leaders.

Blockchain begins with bitcoin. If blockchain is the Internet of Value, bitcoin was the first unit of value to start flowing on it.

Within your enterprise, you also have units of value. Perhaps they’re customer reward points. Or data shared between vendors in your supply chain. Or maybe the unit of value is just plain old money, flowing between international offices or through a global network of customers. Wherever value is flowing, there is a potential opportunity for blockchain.

Blockchain begins with bitcoin, not just because it’s still the most successful blockchain project, but because it provides excellent lessons on how to build your own successful blockchain project.

One lesson is you can’t always predict where a blockchain project will go. Satoshi, for example, could not have envisioned the long, strange trip that the bitcoin project would take. To understand this unusual journey, let’s review what bitcoin was designed to do.

How Bitcoin Works

It’s easiest to think of bitcoin as peer-to-peer money.

Note

Peer-to-peer (P2P) money: Money that can be sent between users, without having to go through a central bank.

If you’ve never used bitcoin, the best way to understand it is to buy a little bit. (It’s a business expense.) Even if you invest only $100, you’ll learn a great deal just from the process of buying it. You can purchase any amount of bitcoin through a service like Coinbase, which will convert your plain old money into bitcoin, depositing the bitcoin in a digital wallet (like an online banking account).

From there, you can send bitcoin anywhere around the globe, as easily as sending email. Your digital wallet comes with a public key (like an email address) and a private key (like a password). To send bitcoin to someone else, you enter their public key, confirm the transaction with your private key, and the money is transferred.

No banks. Peer-to-peer money.

Peer-to-peer money has the potential to radically disrupt the world economy. Think back to how P2P file-sharing services like Napster changed the game for music and software companies: no longer was Sony or Disney the single point of distribution. Now anyone could (illegally) download their latest album or video game by simply connecting to the Napster network, which was run by millions of users running the Napster software. Anyone running Napster became a node in the global file-sharing network.

Note

Node: Broadly speaking, a single computer within a blockchain network.

If you wanted to download from Napster, in other words, you also became a Napster node. (Read that sentence again.) This meant that when you started up the software, you weren’t just a “taker,” you were also a “giver.” Suppose that you downloaded the latest Metallica album. As long as you kept Napster running, other people could start downloading from you.

Napster solved the user adoption problem by making every user a contributor: as you were downloading an album, you were also sharing that album with anyone else who wanted it. By making every user a node, the Napster network exploded like a wildly contagious virus.

Similarly, Satoshi’s whitepaper outlined a plan for P2P money: anyone running the bitcoin software would become a node in the network, effectively decentralizing the network and protecting it from interference by centralized governments or banks. No one would “own” the network, so no one could shut it down. Figure 1-4 shows the difference.

Figure 1-4. Centralized money versus decentralized money

Note

Decentralized: Shared among nodes, with no central authority. Think peer-to-peer software, rumors, potluck dinners, memes, or a catchy song.

This was not just a political statement. Earlier experiments with digital money had failed, either through lack of user adoption (DigiCash in 1998)4 or through legal battles with the US government (e-gold in 2006).5 What made Satoshi’s vision different was this idea of peer-to-peer money. It would spread naturally across the planet, and no government would be able to shut it down. Bitcoin would be decentralized.

The Decentralized Ledger

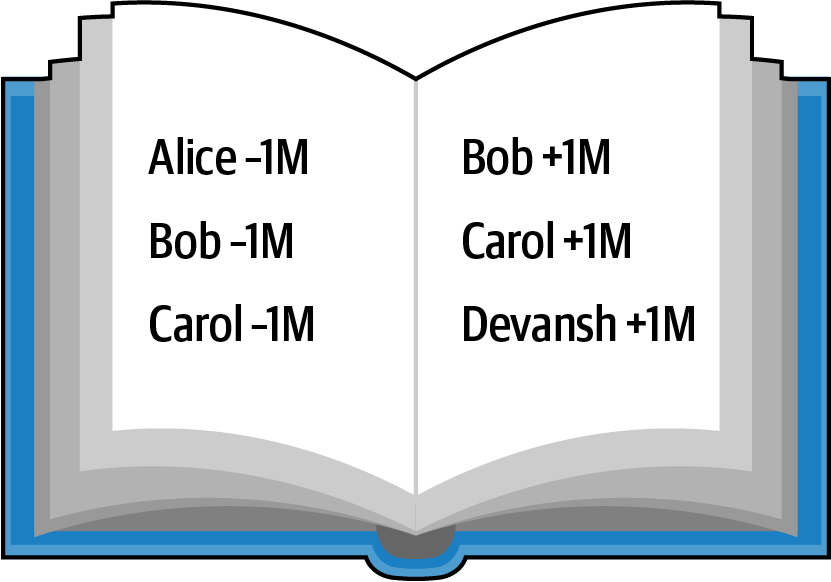

But here we run into a problem: money has value, and that value needs to be recorded somewhere. We want to know where the money is and where it’s been. If I pay you a million dollars, I want a receipt. And you want to know that the money landed in your bank account.

Broadly speaking, this is the practice of accounting—and traditionally, we keep track of money in accounting ledgers. Anywhere we keep track of money—Microsoft Excel files, Intuit QuickBooks, even an old-school checkbook—is an accounting ledger.

Note

Accounting ledger: A central repository for all accounting data (the inflows and outflows of money). Blockchain uses decentralized accounting ledgers, which have both advantages (more trustworthy) and disadvantages (lots of coordination).

Traditionally, these accounting ledgers have been centralized, meaning they’re held by one central party: you, your accountant, or your bank. They all work on the basic accounting principle of credits and debits, or inflows and outflows of money.

For example, let’s imagine that Alice transfers $1 million to Bob, who transfers it to Carol, who transfers it to Devansh (Figure 1-5).

Figure 1-5. Alice, Bob, Carol, and Devansh as we’d represent them in an accounting ledger

With blockchain, we are dealing with a decentralized ledger; it’s not kept on a single computer or bank account. So where do we record that transfer? There is no QuickBooks file to record the transaction, just a massive shared database spread across hundreds of nodes. How does the blockchain system “know” who now owns the bitcoin?

Here’s where we make the mental shift to blockchain, to go from paper to digital. Blockchain is a different method of accounting: we write each transaction to a block of data and then chain those blocks together, as shown in Figure 1-6.

Figure 1-6. Alice, Bob, Carol, and Devansh as we’d represent them on a blockchain

Imagine a long line of wooden blocks connected sequentially by chains. Each time a bitcoin is transferred, we engrave this transaction in a new block and then chain this block to the end of the line. This digital system has benefits over paper:

-

Unlike in an old-fashioned paper checkbook, we can’t go back and erase an entry.

-

Unlike in QuickBooks, we can’t overwrite the file.

-

Unlike an accounting firm, we can’t convince anyone to “cook the books.”

With blockchain technology, we have a permanent—or immutable—record of Alice’s transfer to Bob.

Note

Immutable: Permanent.

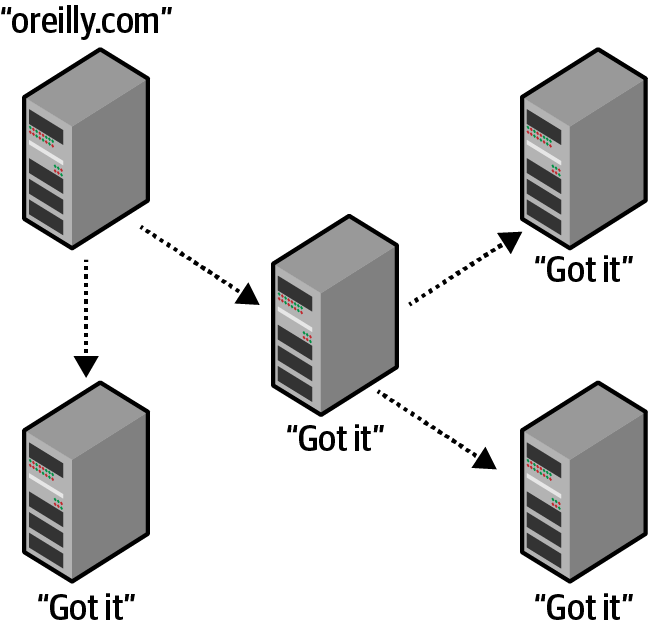

But how does this information make it back to the nodes? Through a process called consensus. Think of the way a domain name is gradually replicated to domain name servers around the world. Within 24 hours, a website can be up and running at a new address, thanks to the cooperation among thousands of independent domain name servers, functioning like internet nodes that check and agree with one another, as demonstrated in Figure 1-7.

Figure 1-7. A new website domain replicating to domain name servers around the world

Note

Consensus: The way nodes come to “agree” on who paid what to whom (more on this later).

Consensus is why, far from being sketchy or dangerous, blockchain-based money is more trustworthy than traditional money. As we all know from spy movies, paper money can be stuffed into duffel bags and exchanged in the lower levels of parking garages. With blockchain, we can trust the transaction (there’s a permanent record of it), and we even know who made it (their digital address).

There’s one more piece of the puzzle: good money should also have scarcity: we shouldn’t be able to produce it out of thin air. When we download a PDF file from the internet, we are essentially creating another copy of the document; that won’t work for money. People should work hard for their money, which keeps the wheels of society turning.

Note

Scarcity: A fixed or limited supply (as opposed to digital assets that can be infinitely copied).

Satoshi’s masterstroke was to combine P2P file sharing (which allowed the network to spread rapidly) with decentralized ledger technology (which allowed money transfers to stay safe, secure, and scarce—more on this in Chapter 2). By mashing up these two technologies, Satoshi provided an incentive for users to build the network, by rewarding them with small amounts of bitcoin (which they now trusted) for hosting a node in the network (which was now exploding).

And as the size of the network grew, so did the price of a single bitcoin: from $0.08 in 2010, to $800 in 2014, to $8,000 in 2017. This created a virtuous circle: as bitcoin soared in price, the bitcoin network soared in size and power.

Satoshi’s blockchain experiment was working. More important, it was about to give birth to the next big innovation in blockchain: an explosion of baby bitcoins.

Blockchain Is a Platform

As the price of bitcoin began to rise, developers realized bitcoin was just a starting point. Because bitcoin was open source, developers rushed to build their own spin-off projects, essentially “minting their own money.”

Some of these alternatives to bitcoin (or altcoins) began to build their own passionate communities. And because the value of a blockchain is directly correlated with the number of people using it,6 some of these altcoins are today worth billions of dollars.

Note

Altcoins: Alternatives to bitcoin, also called cryptocurrencies. (Since crypto sounds mysterious and scary, we prefer altcoins or, more broadly, digital assets.) Top altcoins include Ethereum, Ripple, and Litecoin. (See CoinMarketCap.com.)

An ecosystem of digital exchanges quickly emerged, allowing users to buy and sell these new digital assets. While skeptics scoffed that these assets had any value, a new class of digital traders started trading them anyway. As the industry matured, the market capitalization (or total value) of these digital assets swelled and today stands at about $300 billion.

These units of value are variously called coins or tokens, but it doesn’t matter what you call them; what matters is how users perceive them. What the first explosion of digital assets taught us is that blockchain projects will have the best chance of user adoption if users perceive they are receiving something of value.

In other words, even if you don’t call them money, think about these digital assets as money.

The creation of any type of money involves many players besides the “buyer” and the “seller”: you’ll need banks, payment rails, accounting systems, and so on. Similarly, the creation of digital money (or digital value) on the blockchain platform typically involves an ecosystem of players. We’ll explore these in Chapter 2.

1 “IDC Sees the Dawn of the DX Economy and the Rise of the Digital-Native Enterprise,” Business Wire, November 1, 2016, https://www.businesswire.com/news/home/20161101005193/en/IDC-Sees-Dawn-DX-Economy-Rise-Digital-Native.

2 Satoshi Nakamoto, “Bitcoin: A Peer-to-Peer Electronic Cash System,” Bitcoin.org, October 31, 2008, https://bitcoin.org/bitcoin.pdf.

3 “Bitcoin History,” BitcoinWiki, June 27, 2019, https://en.bitcoinwiki.org/wiki/Bitcoin_history.

4 “DigiCash,” Wikipedia, August 6, 2019, https://en.wikipedia.org/wiki/DigiCash.

5 “E-Gold,” Wikipedia, December 17, 2018, https://en.wikipedia.org/wiki/E-gold.

6 Sir John Hargrave, Blockchain for Everyone (New York: Gallery Books, 2019), 321–328.

Get Blockchain Success Stories now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.