Chapter 4. Actions, Levers, and Decisions

Chapter 3 was all about learning to translate business problems into prescriptive questions that, in our case, must always be actionable. But what is actionable? Or even better, is everything actionable? We now turn to this question in our quest to find levers that take us closer to the prescriptive ideal.

One word of caution: to find levers, we need to know our business. This is not to say that you must have spent many years in one specific industry. That might help, as you must’ve developed strong intuitions about why things work and when they don’t. But it is also true that many times having a non-expert, even naive, view can help us think out of the box and expand our menu of options.

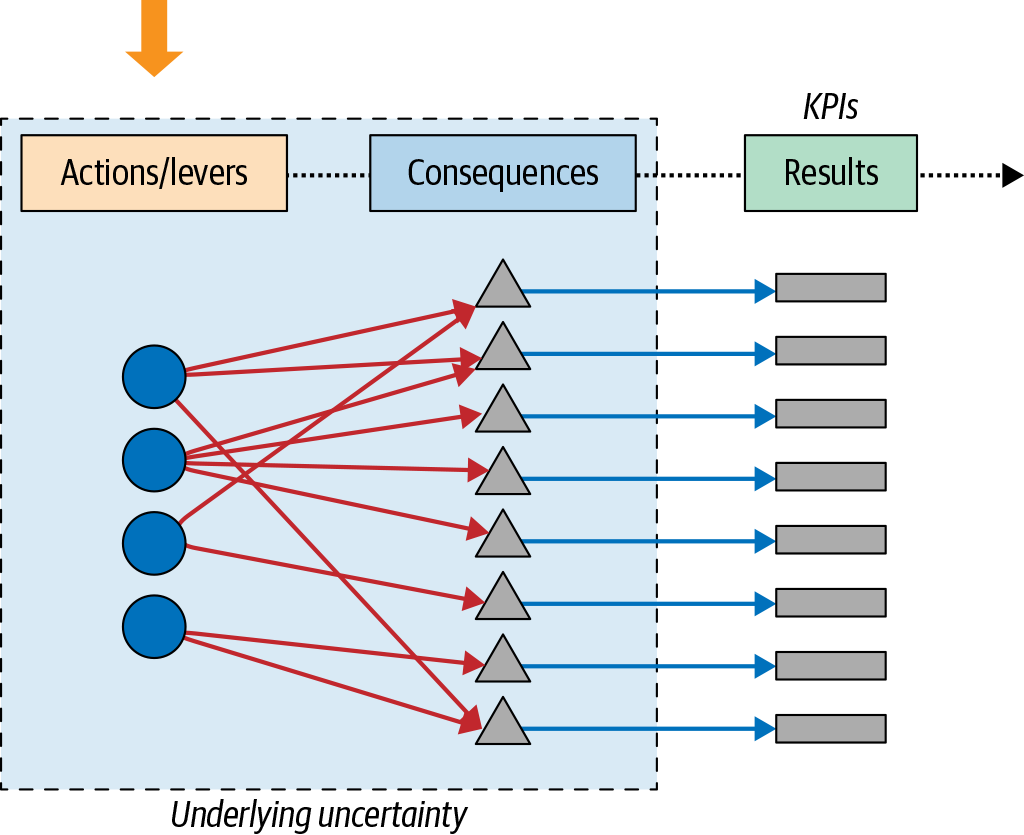

Going back to our decomposition, we will now move from the outer right side, where business outcomes live, to the outer left side, which contains the levers we pull (Figure 4-1). As we’ve already mentioned, this is the natural and healthy sequence to adopt: we start with the business, and then ask how we can achieve the best results by pulling the right set of levers.

Figure 4-1. Identifying the levers we want to pull

Understanding What Is Actionable

The hard truth about life and business-making is that most of our objectives can only be achieved indirectly, through actions we take. For instance, we can’t increase our sales, or productivity, or customer satisfaction, or reduce our costs just because we say so. Intervening factors (human or technological) restrict our ability to do all that we want to accomplish.

The impact that our decisions have on our business objectives is mediated by the rules of cause and effect, and it usually takes a lot of experimentation and domain knowledge to understand what works and what doesn’t for our businesses.

In general, we can divide levers into two types: those that depend mostly on the rules of the physical world to create consequences and those that arise from human behavior. As you would expect, each of them has their own sets of complexities and difficulties. Levers of the physical type depend on our understanding of the laws of nature and on technological advances. Human levers depend on our understanding of human behavior.

Physical Levers

As it turns out, the original use of the word “lever” is of a physical nature: you take a beam and a fulcrum, pull the beam down, and you are now able to move objects that were too heavy to lift by yourself. This use notwithstanding, physical levers have become a landmark of modern economies: the rapid growth during the Industrial Revolution, the invention of the microchip, and the current internet revolution, just to mention a few, were vastly facilitated by this class of levers.

Thanks to Henry Ford’s assembly line, for instance, the production of cars was greatly improved. It only took a complete redesign of the production process, but once you pulled that “lever” you were able to produce more cars in less time, with the consequent reduction in production costs.

Engineering advances generate physical levers that we may not be conscious of. For instance, changing the height or angle of an antenna in a cell site improves the quality of the calls we make or the speed at which we can transfer data in our day-to-day mobile communications. Similarly, better software configuration may improve your ability to work on the cloud or on premise. Physical levers require technical expertise that may be costly to acquire or hire, but since modern economies are built around the technological revolution, having at least some general knowledge of what can be achieved can take us very far if we want to be more productive or have more satisfied customers.

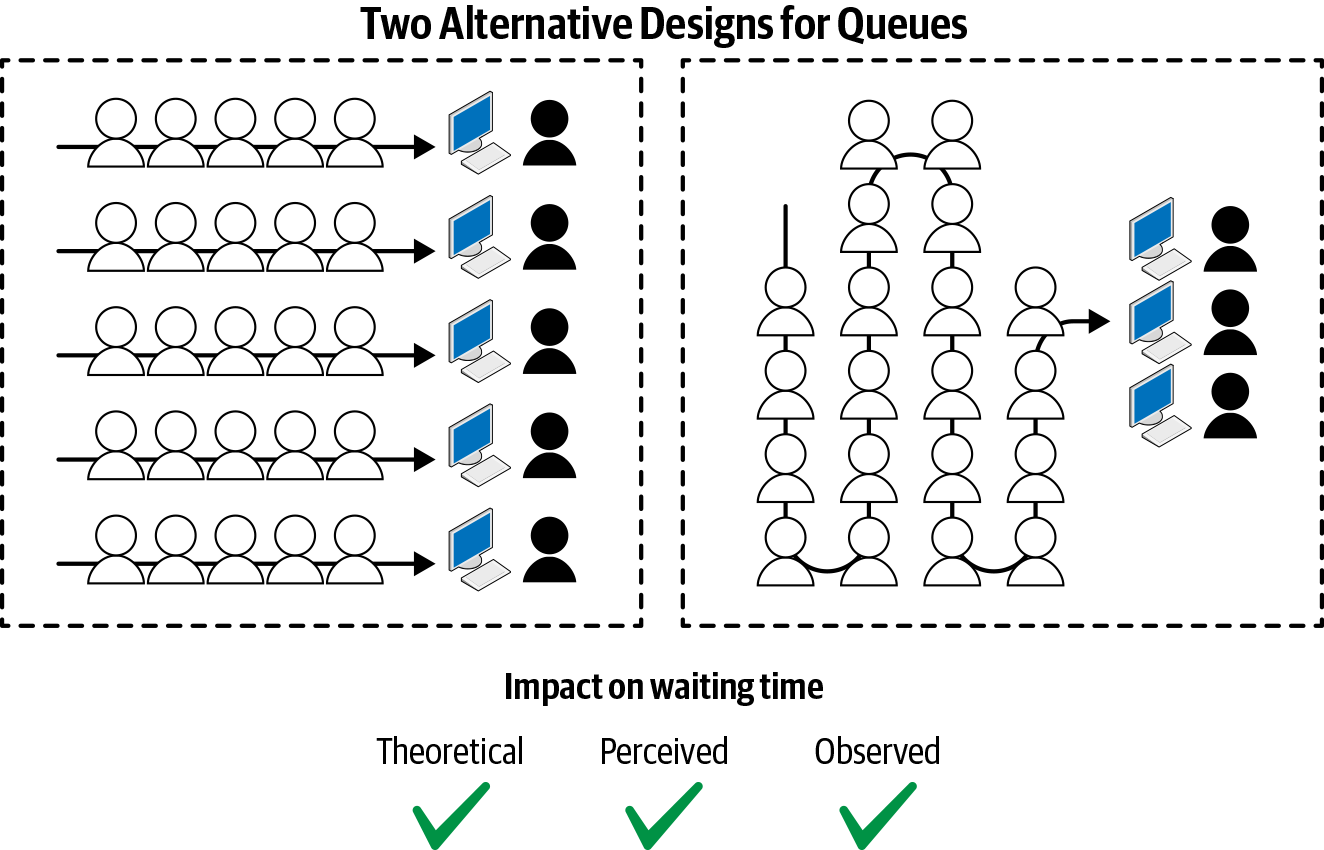

Let’s consider the design of queues as a final example. Figure 4-2 shows two possible designs: multiple-line, multiple-server on the left and single-line, multiple-server on the right.1

This is not the place to even try and delve into the technicalities, but let’s just mention that under certain conditions it can be proved that the average waiting time for the design on the left is longer than for the case of a single line. If these conditions are satisfied at your workplace and your objective is to improve general customer satisfaction (measured by the time they spend waiting in line), you can redesign your queues and you may meet your goals.

Figure 4-2. Queues as physical levers: the left side shows a multiple-line, multiple-server design; by moving to a single-line, multiple-server design (shown on the right), we may impact waiting time, so this change is a lever we can use when we want to have an effect on customer satisfaction

Physical and Psychological Levers in Waiting Lines

In Figure 4-2 I also claim that the perception of waiting times may also be positively affected by switching to the design on the right, but this would take us to the terrain of human levers where psychological laws operate. We will address this topic shortly, but you can check out “Why Waiting Is Torture” by Alex Stone for some evidence on the psychology of waiting in line.

Human Levers

Just as the design and use of physical levers requires considerable technical expertise, human levers require a thorough understanding of how humans behave. Humans, as opposed to materials, have a very specific set of difficulties of their own. Let’s discuss the most important briefly.

The most obvious one is that we can’t force others to behave the way we want: we have to incentivize them. You can’t force potential customers to buy your products, or your employees to work more or be more productive: you need to create the conditions that will lead them to act in ways that are favorable to your objectives out of their own self-interest.

Moreover, we are heterogenous and diverse beings: even identical twins that share all of their genetic material behave in different ways. We also have a sense of agency: we have intentions and these vary from individual to individual and throughout our lifetimes.

To add one more layer of complexity, we are social animals, and our behavior may vary drastically if we make choices surrounded by people or alone. We also learn from experience, a process common for toddlers, the elderly, and everyone in between. Finally, we make errors: we may regret some of our previous decisions, but these may not be easily predictable.

Why Do We Behave the Way We Do?

I will set out on an ambitious agenda and try to condense why humans behave the way we do into three categories that I believe cover a majority of the reasons behind our behavior. I was trained as an economist, so you may see a bias in this enterprise, but hopefully other social scientists won’t disagree that much.

I will claim that most of our behavior is driven by our preferences or values, our expectations, and the restrictions we face. These map neatly to the economists’ portrait of a rational being, but rationality has little to do with this characterization.2

Think about why you bought this book: my guess is that you wanted to learn about AI and how to use it to make better decisions, but since you weren’t sure of the quality of the material, you took a leap of faith and hoped for the best. Nonetheless, you could be doing anything else right now: you could be reading some other book, technical or not; watching a movie; sleeping; or spending time with your loved ones. You must have valued reading this book (or at least expected this to be the case). At the same time, you were able to afford the book and have the time to read it, two of the most basic restrictions we generally face.

Does this generalize to any other choices? I believe it does with most choices we make, if not all. In a sense, the claim is almost tautological: ask anyone why they just behaved as they did, and they could easily say “because I wanted to.”

Now, preferences come in at least two flavors: we have individual and social preferences, and this distinction allows us to account for the differences in choices when we are surrounded by others and when we are alone.

We will now discuss each of these in detail.

Levers from Restrictions

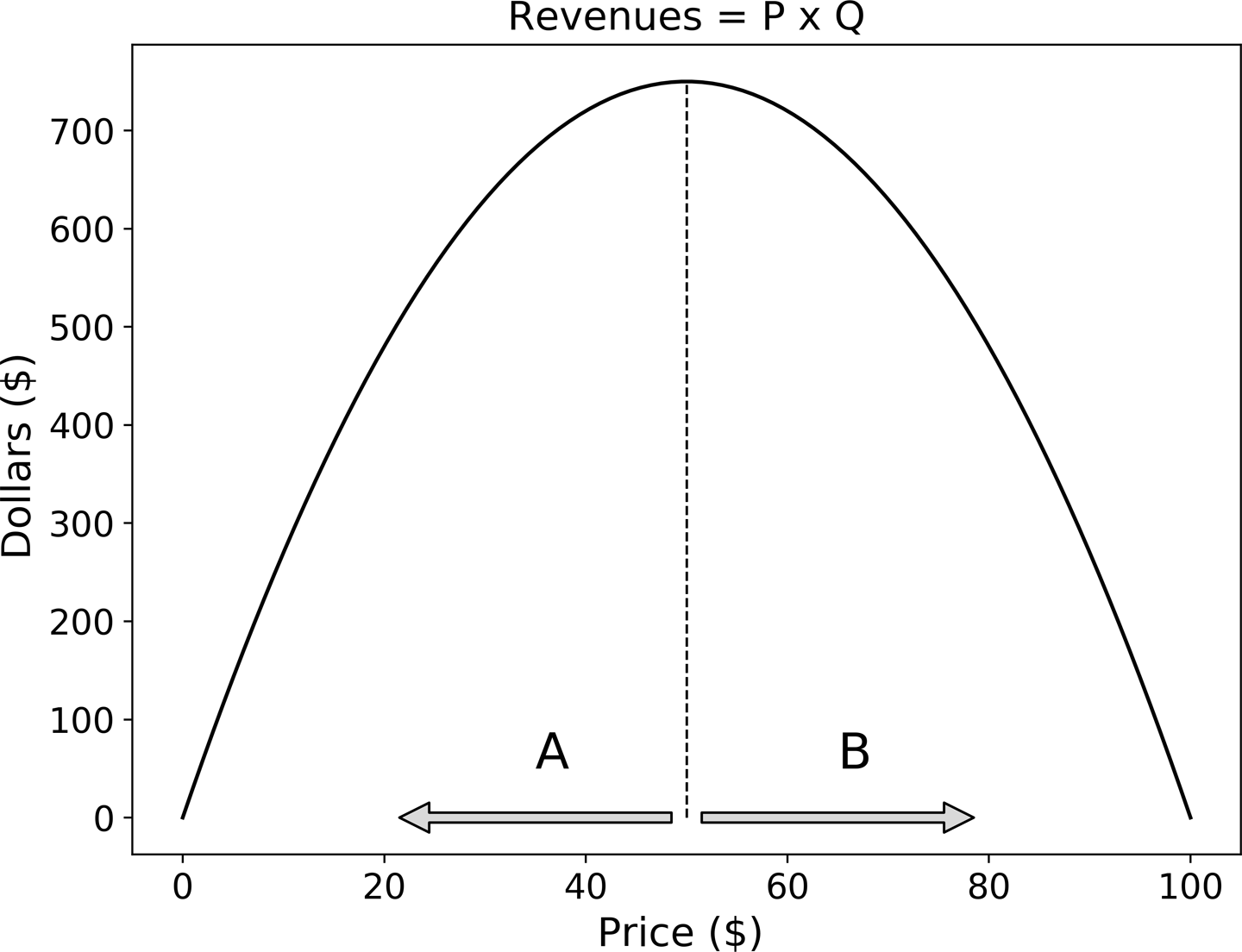

Let’s start with the pricing lever, arguably one of the most common actions we take to achieve the specific business objective of increasing our revenues. It is one of our favorite levers, since it directly affects our revenues—price (P) times sales (Q), or .

Interestingly, revenues depend on price in a way that makes the choice to pull the lever not obvious at all. The difficulty comes from what economists call the “Law of Demand”: when we increase our price, our sales generally fall. Since sales depend on the price we charge, revenues would better be expressed as to make clear that our choice of the pricing lever has two effects on our revenues: a positive direct effect coming from the first term, and a negative indirect effect from the latter term. The overall effect depends on the sensitivity of demand to changes in price.

Figure 4-5 shows a somewhat standard relationship between revenues and our pricing lever. It should now be clear that if we want to pull the pricing lever, we’d better know if we’re to the right or to the left of the vertical line: our company will be better off if we increase prices in range A, since a price increase generates higher revenues. The opposite will happen in range B. The math notwithstanding, the intuition should be clear: if our customers are not too price sensitive, an increase in price, say by one dollar, will decrease demand less than proportionally, thereby generating an overall positive impact on our revenues. This sort of calibration is standard when we are doing price and revenue optimization, one area where prescriptive analysis has been most successful and which will be revisited in Chapter 7.

Figure 4-5. How revenues change with our pricing choices

I hope this example convinces you that the choice of the pricing lever is far from obvious, but in my opinion it’s one of the most interesting and successful cases of prescriptive analysis. If we are considering giving away discounts, it’d better be the case that demand increases proportionally faster than the falling price.3 Otherwise, we should look for other levers.

Pricing Levers as Restrictions

You may wonder why I chose to classify the pricing lever as a constraint. One important reason why customers generally follow the Law of Demand—the negative relationship between purchases and prices—is that by changing prices we affect their budget constraints.

Interestingly, this effect operates not only with our current customers but also with prospective ones that haven’t started buying since current prices may be too high.

But is this always true? The discussion of Case B in Figure 4-5 notwithstanding, most of the time we follow the Law of Demand, so most people just take it for granted.

Time restrictions

It is not a coincidence that two of the main restrictions we face are time and money. We have already discussed the budget constraint, but what about time constraints? Do companies leverage time restrictions as they do with budget constraints?

Consider digital banking. I don’t know about you, but most people I know can’t stand going to a branch, as it feels like a waste of our valuable time. One of the best cases for a better user experience is that we relax our customers’ time constraints, and give them back some time they can devote to other activities.

If you’re not convinced by the banking example, ask yourself the following question: is there something you would engage in if the time required was reduced? Imagine that by cutting in half the time in the gym, say from 60 to 30 minutes, you would get the same results. All of those infomercials that promise the perfect abs in just 10 minutes a day are pulling this lever. People value their time as much as their money, because as they say, “time is money.”

Levers That Affect Our Preferences

We will now consider some of the different determinants of why we like and value what we do. As we will see, all of them are actionable and are constantly used by companies around the world.

Genetics

How much of our behavior is determined by our genetic makeup and how much by our social upbringing? This Nature versus Nurture debate is one of the most important and controversial in the social and behavioral sciences, since it is very difficult to disentangle their relative importance empirically (Figure 4-6). For instance, if you enjoy a glass of red wine like your parents, is it because of your genes? Could it be that you were raised watching them enjoying red wine which itself created a positive, but social, effect on you?

Figure 4-6. Genes and environment both shape our preferences and choices

Let’s take the most accepted view that both genes and the environment matter, and that some behavior is most likely to arise when certain genes are exposed to certain environments. We can now ask ourselves if we could leverage this knowledge to attain our business objectives.

At the outset it seems clear that we cannot change our customers’ DNA, but in the foreseeable future it is possible that with further advances in behavioral genetics, we’ll eventually have a thorough understanding of how to leverage the exposure of specific customers to certain environments.4 Many stores already do some very basic and crude genetic leveraging by changing the aromas present in the store when we are buying. But imagine the case of genetic profiling: a person enters a store, we have knowledge of some genetic markers that matter for our product, and offer a complete sensory experience that makes them more likely to purchase.

I’ll leave this here, but keep in mind that this topic raises all sorts of ethical issues. I’ll have time to discuss some of these later in the book.

Individual and social learning

The truth about our choices is that many times we don’t know what we want or what we like, in contrast with the view of rational and consistent choices put forward by most decision theorists and economists. Some people are more prone to trying new things and exploring the variety and diversity of their tastes. At the other end of the spectrum, other people have had terrible experiences when trying new things and just stick to the same dietary routine they already know and feel comfortable with.

In any case, the fact that preferences are not fixed and consistent, and that most of us like to try new things to at least some degree, should help us find levers to achieve some of our business objectives. This is especially true when a company launches a new product: since customers are reluctant to pay for something they haven’t tried, the company typically gives out free samples. This reduces the real and perceived cost of trying the product and is done in the hope that the customer will be willing to pay the full price next time.

While this applies to both individual and social learning, in the case of the latter we have a second possible lever by way of influential people. In the current age of digital social networks, companies commonly use influencers to help others try their products without the need to give them away for free.

Social reasons: strategic effects

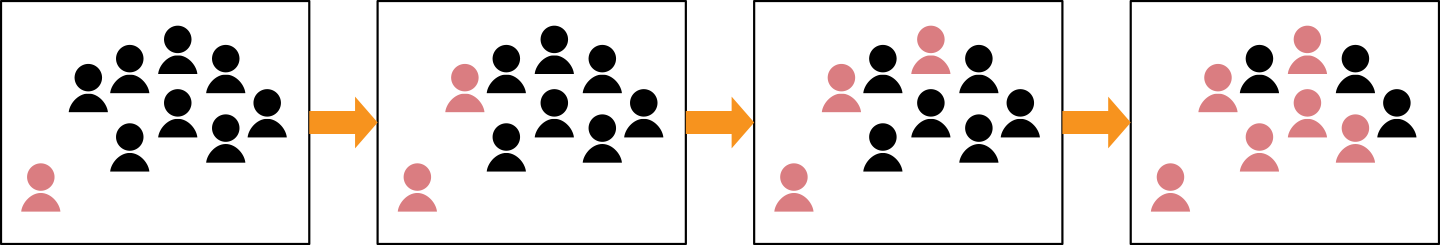

Imagine we see something like the behavior in Figure 4-7: here, a newcomer to the group brings a new idea or behavior. She first convinces one member of the group, who starts behaving similarly. And then another one, and then several others.

How can we leverage this type of social effect to achieve our business objectives? In the previous section we sketched one possible reason—social learning—and discussed two possible levers (price and influential people).

But it could also be that there are strategic effects that explain these dynamics. Think about two-sided platforms like Airbnb, Uber, WhatsApp, Facebook, Google, operating systems like iOS or Windows, etc.5 Going back to Figure 4-7, imagine that one person in our group of friends comes from Europe telling us that they are using the latest messaging app. At first, only her best friend downloads it to try it and, of course, to chat with her. But now two other people try it, because, yes, they want to know what their friends keep talking about! The more people that join, the higher our incentives to join: this is the first type of network effect that operates in two-sided networks.

The second type has to do with the other side of the network. Think about Uber: if more drivers join, it is easier for passengers to find rides, so now more customers join. But the larger demand also makes joining more profitable for the drivers: you can now see why two-sided platforms generate these huge positive feedback loops. It is common to refer to these as “strategic effects,” since our behavior depends on the choices of others, and vice versa.

Can we use this as a lever to attain our business objectives? Most certainly: one of the most popular levers for two-sided markets is to subsidize the side of the market that is most price sensitive by way of discounts or lower fees. This will generate the two positive feedback loops we just described, and by choosing the most price sensitive side we reduce the cost of the lever. For instance, Uber subsidizes the value of each trip by dropping prices for the customers, and Google gives away the use of their search engine, but auctions ad space to the other side.

Social reasons: conformity and peer effects

Many times we change our behavior in response to changes in our social network just because we want to belong. This desire to conform as an explanation for human behavior has its own set of difficulties, most easily illustrated with the case of influencers.

Why would we buy a swimsuit worn by Selena Gomez or Cristiano Ronaldo on Instagram? It could be that we learned that it actually looks good on us only after seeing it on them, instead of appealing to a need or desire to belong.

Note that conformity may arise from strategic effects: peer and group pressure create a burden on me, so I may find it in my best interest to do what everyone else is doing. The same reasoning applies to my friends and peers, giving rise to what is sometimes referred to as herding behavior.

To sum up, this discussion isn’t purely academic: it affects and enlarges our set of levers, especially with certain demographic groups such as teenagers. It may not be that effective with other demographic groups, or at least I haven’t seen credible empirical evidence showing that we should care about it in regards to other groups.

As a final note, let’s discuss the case of corporate culture, a common use case where conformity might play an important role. A positive culture will make employees happier and more productive, and a negative culture can produce really bad outcomes such as robbery, corruption, and the like. Precisely because we think it matters, it is generally the CEO’s and chief human resources officer’s task to find ways to create and grow a favorable corporate culture. The desire to conform is but one of the reasons why new cultures arise, so one lever is to find some people who could serve as corporate influencers. Who better than the CEO and their whole executive committee?

Framing effects

Let’s now move to the terrain of behavioral economics, the systematic study of “irrational” or “inconsistent” behavior. We’ll see that there is a lot of consistency in our inconsistent behavior that can be used to achieve our objectives.

Suppose that given a choice between your product and your competitors’, your average customer chooses yours in some circumstances and your competitors’ in others. This inconsistency of choice is troubling, since it suggests that nothing intrinsic about your product (or your competitor’s) explains the choice, but rather, that something external like the decision context may be the cause of the final outcome.

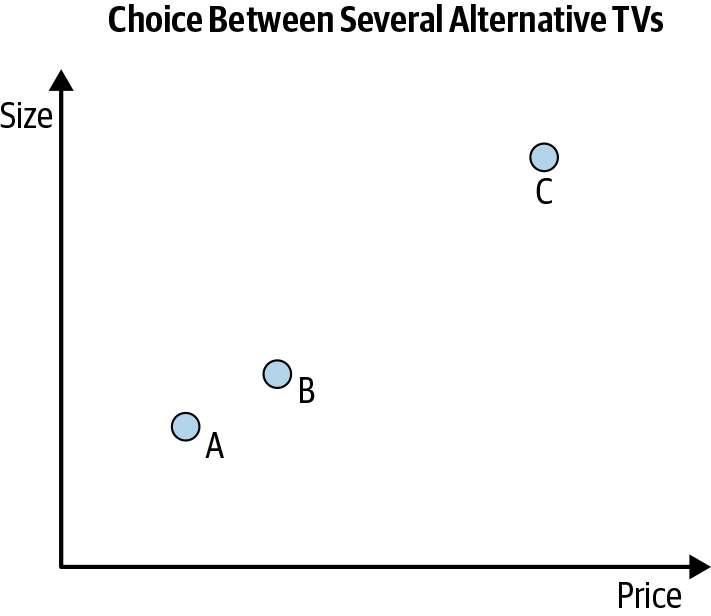

Consider Figure 4-8 where three alternative TVs are presented with respect to two different attributes, size and price. The problem here is that these attributes compete against each other: I prefer a larger TV, but unfortunately it comes at a cost, so I have to trade-off one for the other. Brand A has the smallest screen and it’s thus also the cheapest model. Brand B isn’t too different from A (especially when compared with C), and finally C is the best in terms of size, but you’d have to pay some extra dollars to get it. Which one would you choose?

Figure 4-8. Framing effects: each circle denotes a specific type of TV, varying in terms of their price and screen size

If you’re like most people, then you would’ve chosen B. It appears to be the reasonable choice in terms of the two attributes, especially since C is considerably more expensive. Marketers have been studying these effects for a long time, so they usually pull the framing lever to direct our choices to whatever they want to sell. Let me repeat what I just said to make the point clear: they want to sell alternative B from the outset, and to do so they decide to pull a “framing lever.” They carefully select the two alternatives they want to display so that we “naturally” choose B.

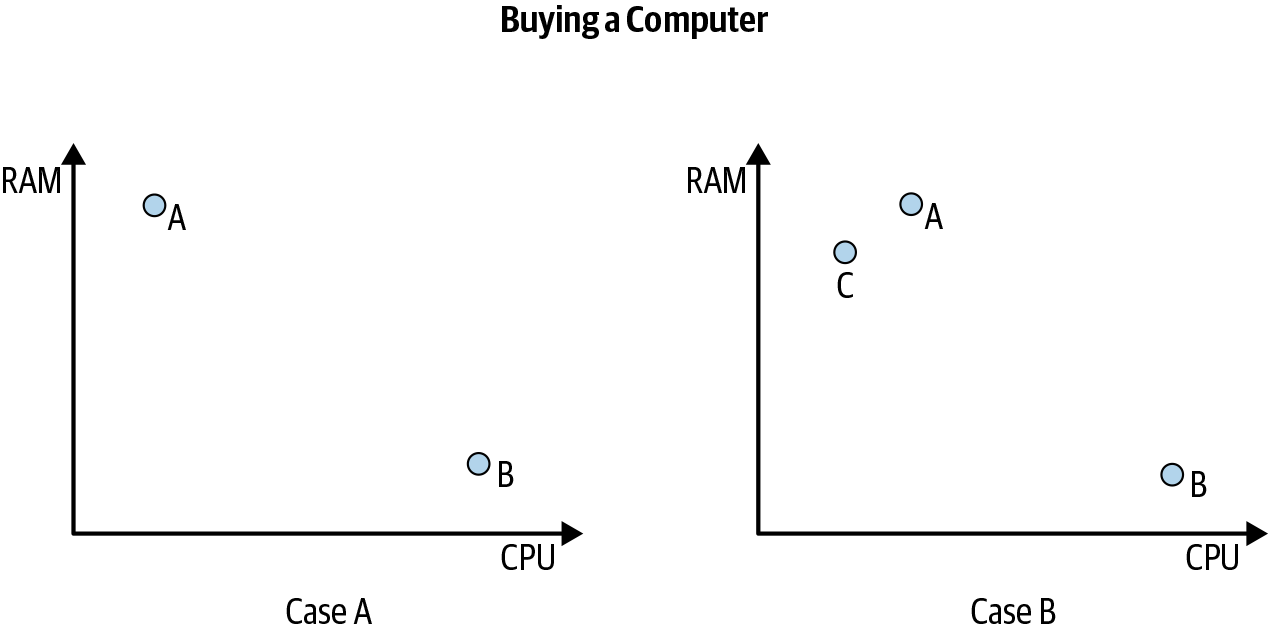

Consider Figure 4-9 now, and imagine your objective is to buy a new laptop where we only care about two attributes: the amount of memory (RAM) and the speed of the processor (CPU). Case A shows two alternatives that clearly trade-off both attributes: you either have a lot of memory but low CPU (A) or vice versa (B). This type of choice makes us pretty uncomfortable since there is no clear winner with respect to all attributes we care about, and life is so much easier when we don’t have to make sacrifices.

Figure 4-9. Buying a computer: another case of framing effects

Wouldn’t it be nice if we could find a reason to choose one or the other? This takes us to Case B, where our retailer now presents a third alternative that is clearly dominated by laptop A (C has less memory and computing power). Why would he do that? Alternative C acts as a reference point that helps us find undisputed arguments to now choose A.

Note that the lever here is the way we present or frame the choice situation. Compared to other levers that negatively impact our revenues (like discounts), this sounds like an almost free way to increase our sales.

Loss aversion

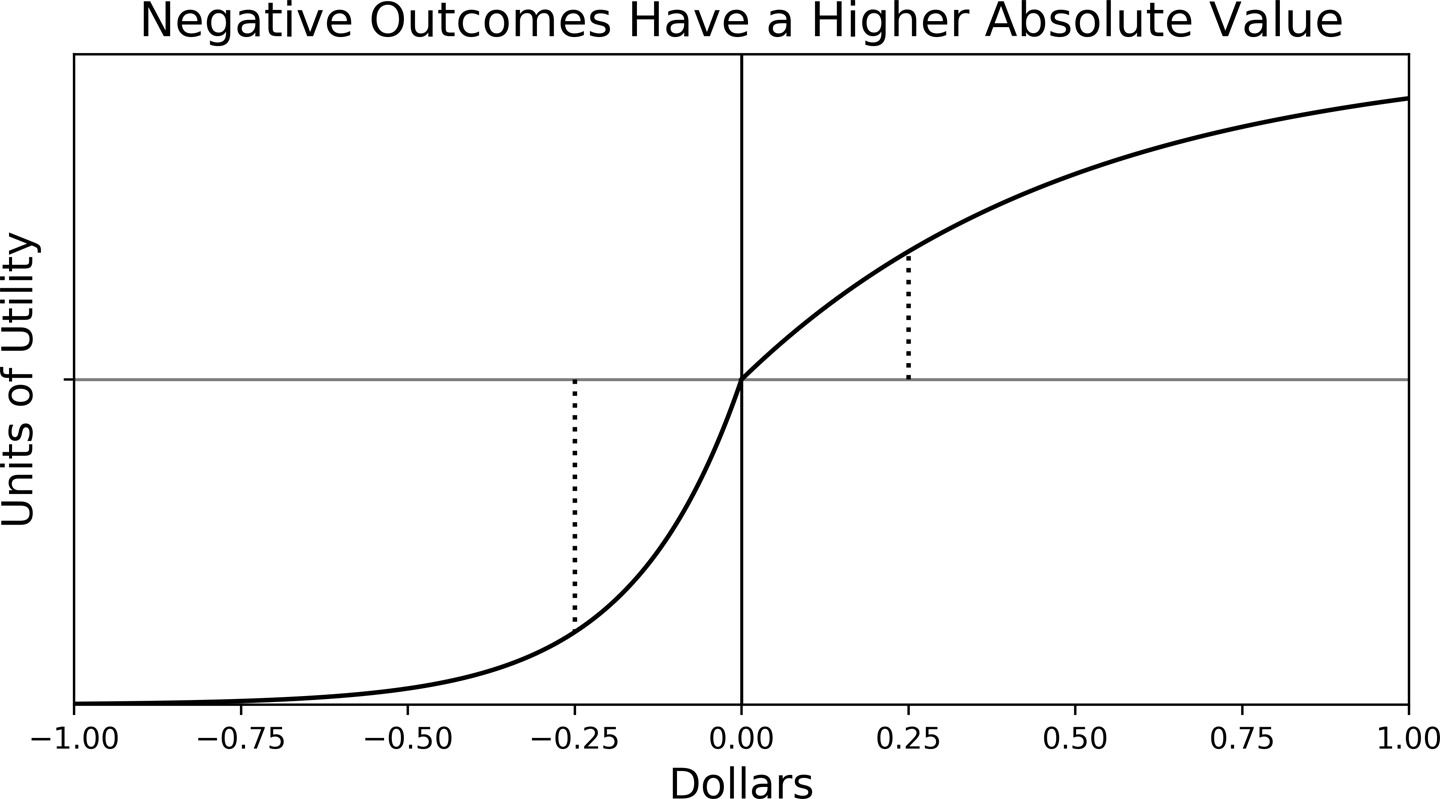

Our final example of levers that may affect your customers’ preferences is known as loss aversion. As the name suggests, the idea is that the worth of something changes if we own it or not, or more interestingly, if the choice situation is framed as a loss. Figure 4-10 shows how much we value money by way of a utility function. These functions translate units of the things we own and care about into units of utility or satisfaction, and are commonly used to analyze decisions (see Chapter 6).

The horizontal axis shows our net holdings of money (if negative, we lose) and the solid line shows how much we value each of these states. The important thing to notice is that the function is asymmetric with respect to gains or losses: gaining an extra 25 cents is valued less (in absolute value) than losing a comparable amount. Loss aversion really captures this idea: our brain may be hardwired to make us more sensitive to loses than to gains.

Is this something we can use to attain our objective? It may not come as a surprise by now, but yes, the way you communicate with your customers can make a difference. What the theory of loss aversion suggests—again, backed by tons of experimental evidence—is that framing choices as losses can make a difference.

Figure 4-10. Loss aversion: winning 25 cents is judged as a lesser option compared to losing the same amount

Suppose you want to sell the latest version of your product. If you give some credit to this theory, you may try A/B testing something like these two alternative messages:

- Alternative A

-

“Buy our amazing new product!”

- Alternative B

-

“Don’t miss the opportunity to buy our new product! It’s a once-in-a-lifetime opportunity!”

Since alternative B frames the communication as a loss, we should expect to have a higher conversion rate on it relative to A. This may sound crazy, but since testing is relatively cheap, why not try it? Recall that our aim is to sell more without having to give out our products at a discount.

Levers That Change Your Expectations

We’ve now covered preferences and restrictions. Preferences guide our choices and restrictions force us to choose between competing alternatives. What role do expectations have, then?

Most of our decisions are made without us knowing the outcome of our choices. Should you date or marry that person? Should you buy coffee or tea? Should you accept that job? If you think about it, all of these choices are made under conditions of uncertainty.

Our brain is a powerful pattern-recognition machine that allows us to make relatively good predictions many times. But how do we do it? Do we have the laws of probability hardwired into our DNA?

The work of psychologist and Nobel Prize in Economics-winner Daniel Kahneman and his coauthor, the late Amos Tversky (and their many students and coauthors), has taught us that our brain simplifies many of the computations needed to survive in a world where uncertainty is queen. Two of the most important shortcuts that we take are the availability and representativeness heuristics. We will see that these can be leveraged to attain our business objectives.

The availability and representativeness heuristics

Recall that heuristics are shortcuts or approximations used to solve computationally hard problems like making decisions under uncertainty. Sometimes quick and dirty—though vaguely approximate—is better than no decision at all. That’s probably how our brain evolved into a powerful pattern-recognition machine.

Quantifying beliefs requires gathering evidence, which is generally costly (as you’ve probably witnessed). With the availability heuristic we simplify this process by taking whatever evidence is most readily available and using it to approximate likely scenarios. With representativeness we use whatever evidence we have, even if scant, and extrapolate it. Note that these are shortcuts: if we had more time and resources, we could have collected more and better evidence to form our beliefs.

Let’s use this knowledge to understand how we can improve our advertising efficiency. The difficulty with advertising is that it doesn’t necessarily have an immediate impact, but it may affect our brand awareness. When a potential customer actually wants to make a purchase, the availability heuristic may bias his recall toward our brand if our campaigns were successful.

What about representativeness? If your first product was really good, your customers may extrapolate this belief, making them more willing to purchase a second one. Or, thinking about issues of corporate governance: if you have created a reputation for disrespecting the most basic ethical standards, customers may extrapolate that to the quality of your product. Choice heuristics abound, so we should use them in our favor (and be extra careful not to have them work against us).

Revisiting Our Use Cases

The last pages presented a lot of material. My goal was to point out different sources of inspiration to find levers to achieve our business objectives. This will be more apparent now when we revisit the use cases from Chapter 3.

Customer Churn

Just as a reminder, we first framed the business question as a prescriptive one, and we now want to start looking for levers to achieve such an objective. In Chapter 3 we concluded that our aim is not to minimize churn, but rather to maximize profits from our retention campaign. In this case it may be optimal to let some customers go if it’s just too costly to keep them loyal to our brand.

What actions can we take to achieve this business objective? Think about it: why on earth would someone want to be our customer instead of our competitors’? Let’s go back to basics.

Customers generally want three things from our companies: good-enough quality products, affordable prices, and good customer service if they need support. Moreover, they’ll likely be willing to trade-off one or more of these, at least to some degree. To leverage this knowledge we must move to the terrain of preferences, restrictions, and expectations.

With a price discount we may be willing to sacrifice short-term profitability if the long-term impact is positive and incremental. But this is not the only lever that we have. We can also create the perception that switching is costly by creating a loyalty program or highlighting some of the least favorable attributes of our competitors’ products. The fact that they know our product (rather than our competitors’) should help us design levers that take advantage of loss aversion or availability heuristics (recall the adage “better the devil you know than the devil you don’t”).

On a final note, what about some of the consistently inconsistent behavior we mentioned previously? Most economists believe these will work as levers only temporarily, and eventually your customers (or some competitor) will realize that they’re being framed. You may exploit these short-term rents, but be careful if you’re considering making them an integral part of your business model.

Cross-Selling

In cross-selling we are looking for the next-best offer for each of our customers so that we maximize their customer lifetime value. In this sense, our main lever is to offer, or not, each of our products to each of our customers. Note that we may want to include the “no-offer” option as a lever, since we may lose customers by making undesired offers, thereby reducing their lifetime values.

This said, you can use some of the techniques we have described as second-order levers, that is, as levers used to accomplish the actual cross-sale. For instance, the way we communicate and frame our offers can always be used in our favor.

Capital Expenditure (CAPEX) Optimization

While the immediate levers have already been spelled out for use (spend or not spend), the intervening factors that map spend to consequences are far from well understood.

For instance, CAPEX is one of those cases where physical levers can play a significant role (think of investing in cost-saving technologies). But we may also think of human levers that affect our revenues (invest in new technologies that make our products more desirable, even if the cost is higher, until we’re able to achieve some scale economies).

This class of problems is so broad that the search for levers must be done on a case-by-case basis.

Store Locations

Similar to the problem of CAPEX optimization, our immediate lever is to open stores or not (or even close some) at different locations, and again, it’s everything but clear why these actions impact our business objectives. At this level it’s almost magical that we just decide to open a store and our bank accounts start collecting more profits.

The most important intervening lever is our ability to capture some share of demand (price or quantity) or reduce our costs (that also vary spatially). We will have more time in later chapters to discuss these issues in depth.

Who Should I Hire?

Recall that our objective here is to maximize the incremental returns from hiring. For this we must have a good understanding of the employees’ impact on our business, which, as we’ll see in detail later in Chapter 7, is not obvious at all. But assuming we have this piece of information, our decision is then to hire or not, and at what cost. Again, we have a binary lever (hire or not) and one that we can fine-tune more granularly (the salary, benefits, emotional salary, work environment, and all other levers used by recruiters).

Delinquency Rates

The business problem is to maximize the ROI from lending resources to one customer. As such, the three natural levers for this use case are the size of the loan (zero inclusive), the time horizon or maturity, and the interest rate if regulation permits. At this point we can forget about the complexity of optimizing all three: we must first start understanding the menu of levers we have at our disposal.

But we can be way more creative and test behavioral levers. What if we print children’s photos on credit cards? Will that make our customers more likely to pay their debts on time? Or talking about communication strategies, can we nudge better payment behavior just by sending an SMS with a happy emoticon? Again, testing is relatively cheap: we just need a working hypothesis, the ability to think out of the box, and stakeholders’ buy-in to find less costly levers.

Stock Optimization

At the most basic level, we want to leverage how many units of each item we should have in stock. Levers then are just a number, which could be positive (we need to have more stock), zero (current amount is just right), or even negative (move some of these items to other stores since we will never be able to sell them at this location). This is not to say that there aren’t other physical levers that can be pulled. For example, think about reducing our first order storage and transportation costs (think Amazon).

Store Staffing

The choice of levers in this problem is again restricted by physical and operational constraints. For instance, is it operationally feasible to make specific staffing decisions for any given hour of any given day? What about every half hour? Recall that we should have the right number of salespeople in each store in order to maximize our profits or customer satisfaction. But this depends on how many customers we have at any given moment, so depending on the granularity, we may always be under- or overstaffed.

If we are willing to think out of the box, we might even consider relaxing these operational constraints by “Uberizing” our staff: hire people only when demand is high enough.

Key Takeaways

-

Once we define a business objective, we must consider whether it’s actionable: most times our problems are actionable, but we may have to think out of the box.

-

The problem of choosing levers is one of causality: we want to make decisions that impact our business objectives, so there must be a causal relation from levers to consequences.

-

The two main types of levers are physical or human: physical levers are usually exploited by taking advantage of technological advances. Human levers involve a deep understanding of why our customers, employees, or any other human being involved with our production process behave the way they do.

-

To understand the relation between actions and consequences, we must construct hypotheses: most times we don’t need to rediscover the wheel, as there’s plenty of knowledge out there about how things work or how humans behave. I provided a very quick and incomplete overview of some findings that I’ve found useful to think about these problems.

-

Hypotheses often fail, but we should embrace the learning process: many times we start with a theory about causes and consequences only to see it fail during testing. That’s fine. It’s part of the process. Embrace it and guarantee your team learns from these failures.

Further Reading

Physical levers are problem-specific, so my suggestion here is to ask your more technical colleagues for some reading suggestions that can help you gain at last some general knowledge of what can be achieved or not.

The human levers discussed here have been thoroughly studied by social scientists, including economists, psychologists, and sociologists. I’d recommend starting with an introductory textbook on microeconomics since most of our business decisions have some economic foundation. I personally enjoy how David Kreps, professor at Stanford Graduate School of Business, explains these very technical topics to the more general public.

Books on behavioral economics will give you some extra background on less-than-rational choices. One of my favorites is Dan Ariely’s Predictably Irrational (Harper Perennial), but a safe choice will also be Daniel Kahneman’s Thinking, Fast and Slow (Farrar, Straus and Giroux). I certainly recommend Ariely’s book as he provides many examples of levers we might pull to improve our business that we would never have expected to work. If you want to learn to think out of the box, this is the type of literature I’d recommend.

Gary Becker and Kevin Murphy’s Social Economics (Belknap Press) is still a good reference on choice under the social umbrella, but another classic, full of intuition, is Thomas Schelling’s Micromotives and Macrobehavior (W. W. Norton & Company). A highly technical and encyclopedic treatment of the economics of social networks can be found in Matthew Jacksons’s Social and Economic Networks (Princeton University Press).

Finally, strategic behavior and game theory are topics of their own. You can start with an introductory textbook that is less technical but provides a lot of intuition. Avinash Dixit and Barry Nalebuff’s The Art of Strategy (W. W. Norton & Company) or an introductory textbook by Ken Binmore, such as Fun and Games (D. C. Heath & Co.) or Playing for Real (Oxford University Press), might do the job.

1 In this setting server is the person or machine responsible for serving each customer (like a cashier) and not a computer server.

2 Rationality has to do with the consistency of choices, which I will not use or claim at all.

3 Unless you want to capture market share that would supposedly increase long-term revenues, but this is a different business objective. In this case you may consider operating at a loss in the short term, but you must then optimize the net present value for your longer-term profits.

4 See Carolyn Abraham’s article, “Why your DNA is a gold mine for marketers” in The Globe and Mail for an example.

Get Analytical Skills for AI and Data Science now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.