Long-Legged Doji and Spinning Top

Another candlestick with only one session that also gains significance from the context with which it appears is the doji session, which has exceptionally long upper and lower shadows. Both are required to create the long-legged doji or the near-doji formation called a spinning top.

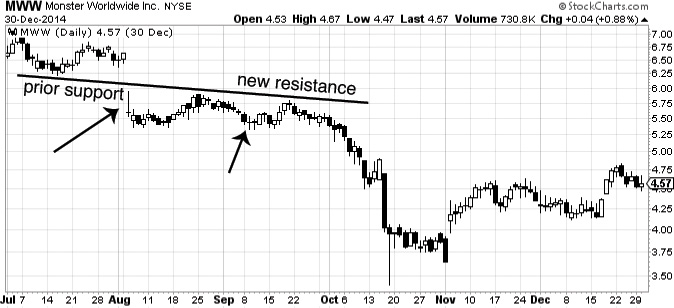

The long-legged doji signals continuation when a move is underway. A single example is not especially convincing, but when two or more are found, chart analysts should pay attention. For example, the chart in Figure 6.15 exhibits an advancing downtrend following a flip from support to resistance.

Figure 6.15 Long-legged doji (Chart ...

Get A Technical Approach To Trend Analysis: Practical Trade Timing for Enhanced Profits now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.