1Venture Capital, Behavior and Performance of Stakeholders

The venture capital industry is structured on the management of assets carried out by third parties. This chapter will focus on the logic guiding the actions of the various different stakeholders to make venture capital an effective mechanism for financing innovation. The social practices that take place are done within three-way relationships between the following players.

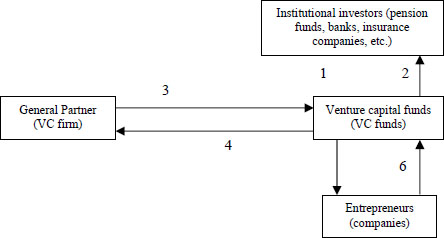

Figure 1.1. Simplified diagram of venture capital activity: (1) collection of funds; (2) distribution of returns obtained; (3) low level of contribution; (4) management fees and payments; (5) investments; (6) end of the investment relationships

(source: [RIN 11])

We have identified three main areas of investigation: interactions between financed firms and venture capital (selection, investments, strategies, exits), interactions between venture capital funds and institutional investors (collection of finances, distribution of returns), and finally the organization of venture capital firms and their relationships, including syndication. We adopt the point of view of the works of literature which considers the “General Partner” as a firm and the company as a start-up that receives funding. When we consider the financing chain for innovative start-ups, we may note two characteristics unique to France: first, the relative weakness of long-term funds, ...

Get Venture Capital and the Financing of Innovation now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.