6The Value Chain

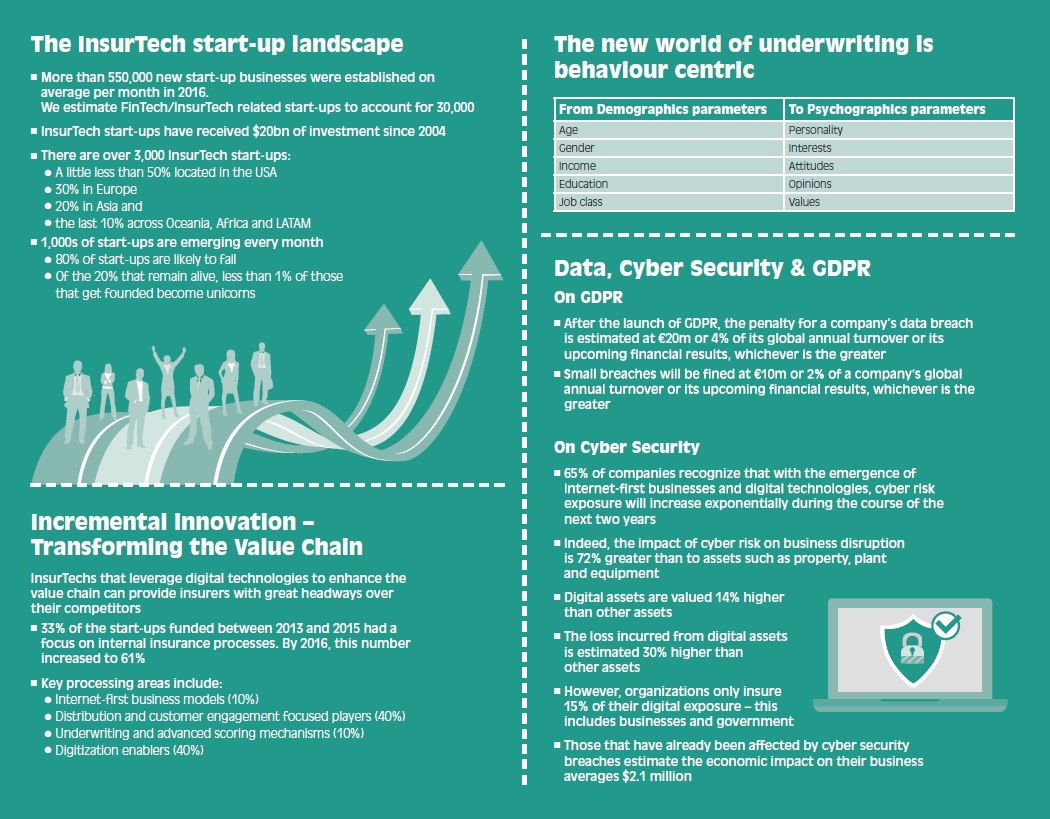

The authors in this part wanted to share their views as to why InsurTechs are becoming useful entities to re-engineer existing value chains, particularly at a time when insurance firms must invest significant time and effort to keep pace with current change.

You will find these articles cover the full set of insurance activities across the value chain, and other more targeted pieces that observe specific domains of expertise, such as microinsurance, products sold through smart devices or parametric insurance that drives frictionless experiences.

The authors start by reviewing an interpretation of the insurance value chain and offer improvement options and a method to identify those startups that will be the most suited to accelerate internal acceleration programs.

Advanced analytics is a key enabling driver of this change. One author asserts that insurers should go beyond basic demographic segmentation and infer individuals’ psychographics through the use of very specific data sets that are able to improve the accuracy of risk assessments across pre- and post-sales engagement processes.

Micro-policies, or the process of cutting traditional insurance products into smaller, digestible, non-overlapping coverage elements, are at the beginning of their journey, particularly in industrialized markets. Another writer recognizes that reinsurance has changed relatively ...

Get The INSURTECH Book now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.