InsurTech Definition as Its Own Manifesto

By Valentino Ricciardi

Insurance and InsurTech Knowledge Consultant, McKinsey & Co.

InsurTech is the new cool word within the vocabulary of the financial services, replacing the term FinTech, which established itself in the last years of 2000 when companies like Square, Transferwise, and Stripe accelerated the payments revolution launched by PayPal in the US and Alipay in China. However, I believe that InsurTech does not have yet a clear, agreed, and established definition.

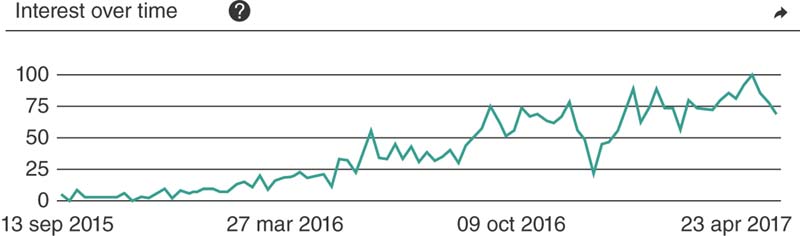

An InsurTech definition should cover different concepts well beyond the idea of combining insurance and technology to include the native customer-centric approach, as well as the potential that technology has to enable incumbents’ value chain or to disrupt incumbents’ consolidated business models. This definition should be open and inclusive so as to host new and innovative technologies that are relevant both now and in the future. So all technologies at the forefront of insurance innovation, such as artificial intelligence, chatbots that enable H2C (Human to Customers) in distribution, as well as advanced analytics that are looking for the right use cases in the data-driven business of insurance, need to fit and find their own space in the definition and concept of InsurTech, which has increased significantly, as shown in Figure 1.

Figure 1: InsurTech interest ...

Get The INSURTECH Book now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.