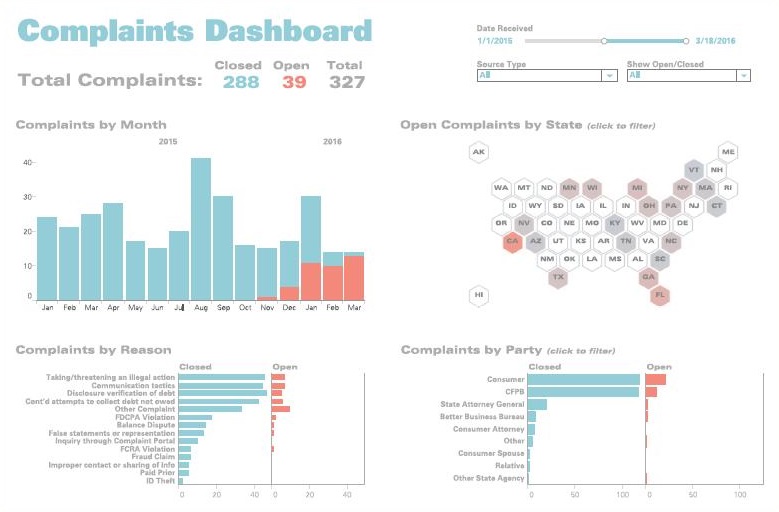

Chapter 20 Complaints Dashboard

Complaints dashboard.

Dashboard Designer: Jeffrey Shaffer

Organization: Unifund

Scenario

Big Picture

You work for a bank or credit card company. You receive complaints on a regular basis. These complaints must be handled appropriately and swiftly. Complaints can come directly from consumers, or they can be channeled through regulators, such as federal or state agencies. Once the complaints are handled appropriately, they are then marked as closed.

Specifics

- You need to see the number of consumer complaints for a specific time period.

- You need to see how many complaints are open and closed.

- You need to see the volume of complaints by reason.

- You need to see the volume of complaints by the party making the complaint.

- You need to see the number of complaints by state, and you need to be able to filter the dashboard by state.

- You need to be able to change the date range to see the complaints for different periods of time.

Related Scenarios

- You need to monitor consumer complaints for financial products. Examples include:

- •Banks and credit unions

- •Credit card issuers

- •Collection agencies

- •Attorneys

- •Account receivable management companies

- •Student loan issuers or servicers

- •Auto loan companies

- •Credit counseling companies

- •Payday loan companies

- Online financial service companies

- You need to monitor customer complaints for any product or service. ...

Get The Big Book of Dashboards now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.