CHAPTER 41Introduction on AI Approaches in Capital Markets

By Dr Aric Whitewood1

1Founding Partner, XAI Asset Management

Setting the Scene

This chapter introduces the key considerations, trends and use cases for artificial intelligence (AI) in Capital Markets. It’s meant for non-specialists, and, in particular, decision-makers needing to understand the benefits, pitfalls, and how to approach AI projects in the financial domain.

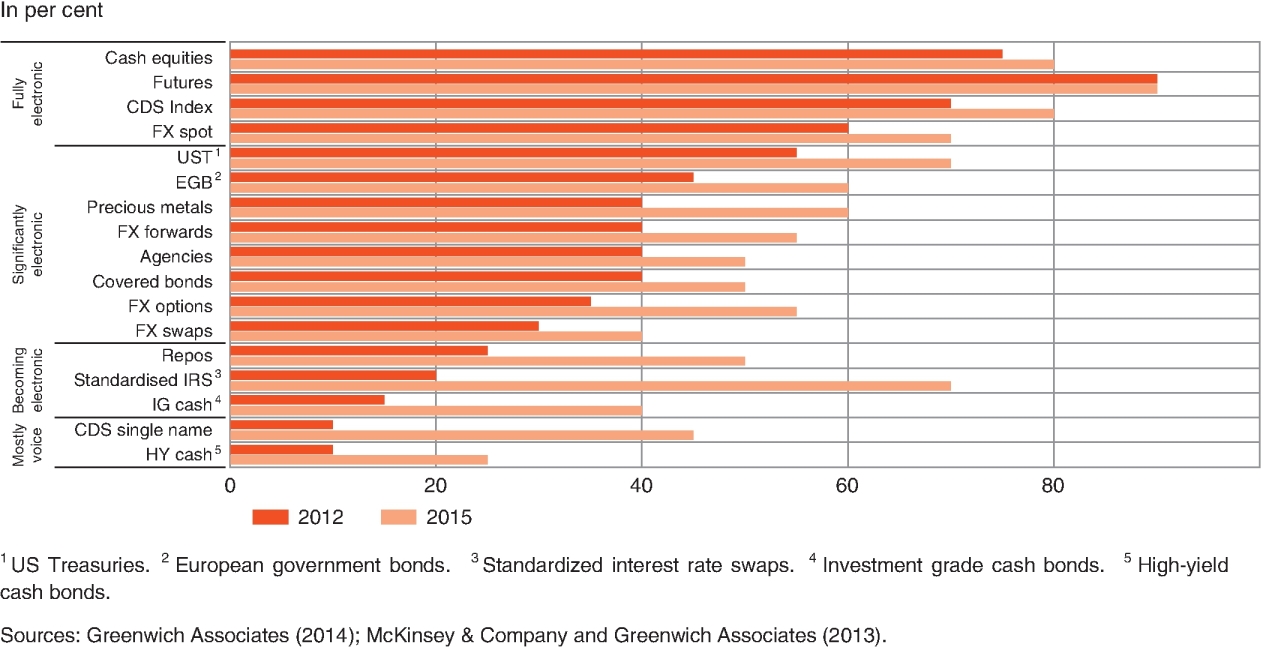

One can draw parallels between AI and other technological drivers like computerization of trade, which first took hold in the 1970s. Trading is now close to fully electronic, particularly in the case of cash equities, FX, futures and CDS indices, all assets that are highly liquid and standardized. Figure 41.1 shows different asset classes (listed on the left) and how trading becomes less electronic as we move down that list, from cash equities at one extreme (fully electronic trading), through to high-yield cash bonds at the other (mostly voice trading). The trend will continue; it’s possible that almost all assets will be significantly electronic in the next decade.

Figure 41.1 Chart of computerization of trade1

Cloud computing and new data processing techniques have enabled an ecosystem of FinTech startups to flourish and challenge incumbents in such areas as banking, insurance and investing. The availability of cheap data storage and processing ...

Get The AI Book now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.