CHAPTER 4

WHAT IS A PROPER SPENDING RATE?

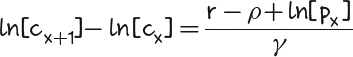

EQUATION #4: IRVING FISHER (1867–1947)

At this point in the narrative, I hope that conversations about retirement income planning will be based on the following three principles. First, as Benjamin Gompertz pointed out, the amount of time you will spend in retirement is random. Planning for averages is plain sloppy, because you face longevity risk either way. Second, Leonardo Fibonacci taught us the strict mathematical relationship between the amount of money you plan to spend each year of retirement and the amount of time the money will actually last. Third and finally, a government or corporate pension annuity, or private annuity that you can purchase from an insurance company, which pays income for the rest of your life, is quite valuable. The younger you are when you retire, and the lower the prevailing interest rate in the economy, the more valuable the pension annuity. You should know this from the astronomer Edmond Halley.

Who you have not heard from yet is a bona fide economist. In this chapter you will learn about the greatest economic scholar of the first half of the 20th century, Professor Irving Fisher. Some have called him the American John Maynard Keynes (who was British). Irving Fisher's contributions to retirement economics go far beyond the one equation I have chosen to display atop this chapter—the one which I will soon ...

Get The 7 Most Important Equations for Your Retirement: The Fascinating People and Ideas Behind Planning Your Retirement Income now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.