Technical Analysis Trading Methods and Techniques (Collection)

Read it now on the O’Reilly learning platform with a 10-day free trial.

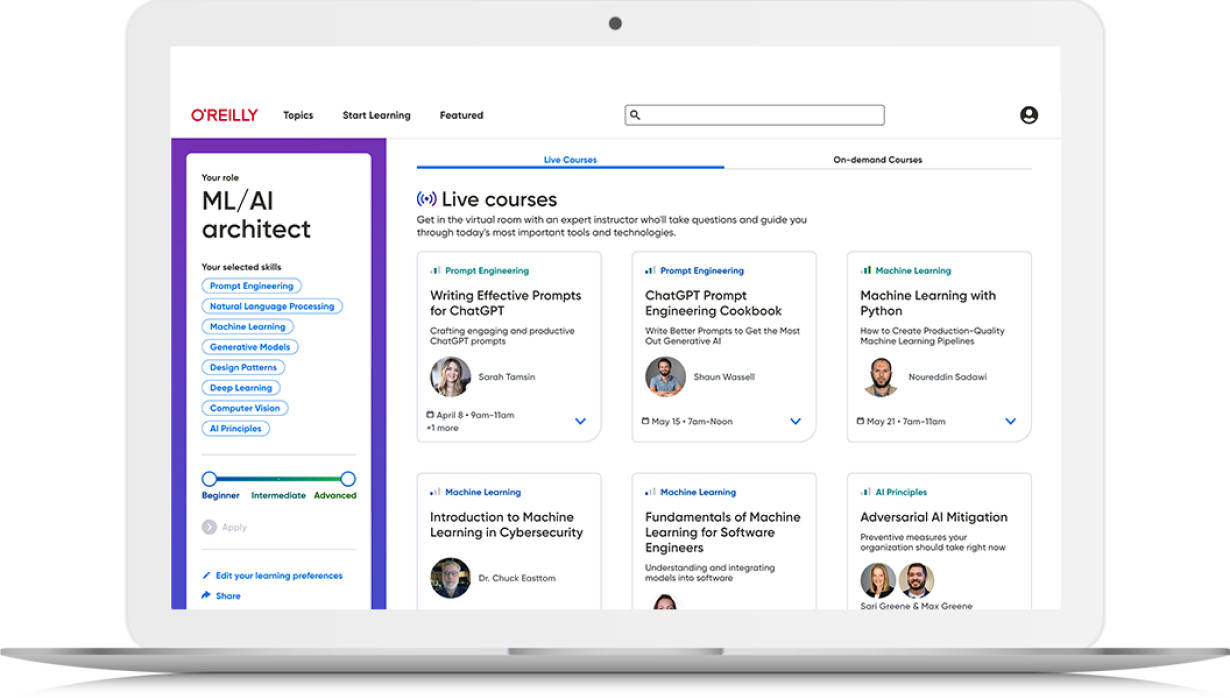

O’Reilly members get unlimited access to books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.

Book description

Three indispensable books reveal little-known technical and psychological techniques for outperforming the market — and beating the traders you’re up against!

Three remarkable books help you leverage powerful, little-known insights from technical analysis and behavioral economics to consistently outperform the market! In George Lindsay and the Art of Technical Analysis, Ed Carlson resurrects the nearly-forgotten technical analysis techniques created by the eccentric genius who called the beginning and end of history’s greatest bull market, within days! Carlson reveals why George Lindsay’s techniques are especially valuable right now, demonstrates their power visually, simply, and intuitively – and shows how to make the most of them without strong mathematical expertise. Next, Mastering Market Timing combines the powerful, long-proven technical analysis methods of Richard D. Wyckoff with the world-renowned analysis of Lowry Research -- sharing deep new price/volume insights you can use to uncover emerging trends faster, even if you’re entirely new to technical analysis. Finally, in Trade the Trader, Quint Tatro focuses on the real zero-sum nature of trading, helping you understand the traders you’re up against, anticipate their moves, outwit them – and beat them!

From world-renowned investing and trading expertsEd Carlson, Richard A. Dickson, Tracy L. Knudsen,andQuint Tatro

Table of contents

- Title Page

- Contents

-

George Lindsay and the Art of Technical Analysis: Trading Systems of a Market Master

- Contents

- Acknowledgments

- About the Author

- Introduction

- Part I. Biography and “The Other History”

- Part II. Three Peaks and a Domed House

- Part III. The Lindsay Timing Model

-

Part IV. The Counts

- Chapter 11. Long-Term Cycles and Intervals

-

Chapter 12. Basic Movements

- Standard Time Spans

- Basic Advances

- Basic Declines

- The Principle of Alternation

- Matching Basic Movements to Long-Term Intervals

- Special Rule: Declines Following Extended Basic Advances

- Secondary Lows

- Secondary Low Sequence

- Sideways Movements

- Moving Upward Out of a Sideways Movement

- Conclusion

- Endnote

- Chapter 13. Counts from the Middle Section

- Chapter 14. Case Study: The 1960s

- Glossary

- Index

- FT Press Financial Times

-

Mastering Market Timing: Using the Works of L.M. Lowry and R.D. Wyckoff to Identify Key Market Turning Points

- Contents at a Glance

- Table of Contents

- Acknowledgments

- About the Authors

- Foreword

- Introduction

-

Part I: A Wyckoff-Lowry Analysis of Major Market Tops and Bottoms Since 1968

- 1. Richard D. Wyckoff and Lyman M. Lowry: The Analysts and Their Methods

- 2. How Major Market Tops Form: Part I, The Preliminaries

-

3. How Major Market Tops Form: Part II, The End Game

- Idealized Major Market Topping Pattern (Part II)

- Using Lowry’s Measures of Supply and Demand to Supplement the Wyckoff Analysis

- Final Stages of the 1968–1969 Market Top

- The End of the 1972–1973 Market Top

- The Drawn-Out Conclusion to the 1976 Market Top

- The Less Drawn-Out 1980–1981 Market Top

- The Preamble to the Worst Bear Market Since 1929–1932—the Final Stages of the 2007 Market Top

- 4. How Major Market Bottoms Form: Part I, Panic and Capitulation

- 5. How Major Market Bottoms Form: Part II, Accumulation and Breakout

-

Part II: Combining a Wyckoff-Lowry Analysis with Other Tools for Timing Major Market Tops and Bottoms

-

6. Building a Cause: How R.D. Wyckoff Uses Point and Figure Charts to Establish Price Targets

- Point and Figure Charts

- Construction of a Point and Figure Chart

- Point and Figure Charts as Applied to Major Market Tops and Bottoms: The Horizontal Count

- The 1969 Market Top and Targets for the Bear Market

- The 1970 Market Bottom and Targets for the 1970–1973 Bull Market

- The 1972–73 Market Top and the Severe Bear Market into the 1975 Low

- The 1974–1975 Market Bottom

- The Drawn-Out Market Top in 1976

- The 1981 Market Top and Approaching End of the Secular Bear Market

- The 1982 Market Bottom and the Start of the Secular Bull Market 1982–2000

- The 2002–2003 Market Bottom

- The 2007 Market Top and Start of the Worst Bear Market Since the 1929–32 Wipeout

- Conclusion

- Endnote

- 7. Identifying Major Market Tops and Bottoms: Other Tools to Consider

- 8. The Curious Case of the 2000–2001 Market Top and Demise of the Secular Bull Market

- 9. A Wyckoff/Lowry Analysis of the 2000 Market Top

- 10. Where Are We Now?

- 11. Putting It All Together

-

6. Building a Cause: How R.D. Wyckoff Uses Point and Figure Charts to Establish Price Targets

- Index

-

Trade the Trader: Know Your Competition and Find Your Edge for Profitable Trading

- Contents

- Acknowledgments

- About the Author

- Chapter 1. I’m Trading Against You

- Chapter 2. My Story

- Chapter 3. It’s All Opportunity

- Chapter 4. The Other Traders

- Chapter 5. Finding Your Edge

- Chapter 6. Timing the Entry

- Chapter 7. Trend Lines

- Chapter 8. The Basics Are Not Enough

- Chapter 9. Pick Your Time Frame

- Chapter 10. Developing Your Plan

- Chapter 11. Determining Entry Points

- Chapter 12. Setting Stops

- Chapter 13. How to Trade the Trader

- Chapter 14. Using and Controlling Risk to Your Advantage

- Chapter 15. Taking Gains

- Chapter 16. Reviewing the Entire Plan

- Chapter 17. It’s a Head Game

- Chapter 18. Dealing with the Emotions

- Chapter 19. Following the Trend

- Chapter 20. The Blowup

- Index

- Financial Times Press

-

Technical Analysis: The Complete Resource for Financial Market Technicians, Second Edition

- Contents

- Acknowledgments

- About the Authors

- Part I: Introduction

-

Part II: Markets and Market Indicators

- Chapter 5. An Overview of Markets

- Chapter 6. Dow Theory

-

Chapter 7. Sentiment

- Chapter Objectives

- What Is Sentiment?

- Market Players and Sentiment

- How Does Human Bias Affect Decision Making?

- Crowd Behavior and the Concept of Contrary Opinion

- How Is Sentiment of Uninformed Players Measured?

- How Is the Sentiment of Informed Players Measured?

- Sentiment in Other Markets

- Hulbert Gold Sentiment Index

- Conclusion

- Review Questions

- Chapter 8. Measuring Market Strength

- Chapter 9. Temporal Patterns and Cycles

- Chapter 10. Flow of Funds

- Part III: Trend Analysis

-

Part IV: Chart Pattern Analysis

-

Chapter 15. Bar Chart Patterns

- Chapter Objectives

- What Is a Pattern?

- Do Patterns Exist?

- Computers and Pattern Recognition

- Market Structure and Pattern Recognition

- Bar Charts and Patterns

- How Profitable Are Patterns?

- Classic Bar Chart Patterns

- Patterns with Rounded Edges—Rounding and Head-and-Shoulders

- Long-Term Bar Chart Patterns with the Best Performance and the Lowest Risk of Failure

- Conclusion

- Review Questions

- Chapter 16. Point-and-Figure Chart Patterns

- Chapter 17. Short-Term Patterns

-

Chapter 15. Bar Chart Patterns

- Part V: Trend Confirmation

- Part VI: Other Technical Methods and Rules

- Part VII: Selection

- Part VIII: System Testing and Management

- Part IX: Appendices

- Bibliography

- Index

- Footnotes

Product information

- Title: Technical Analysis Trading Methods and Techniques (Collection)

- Author(s): Ed Carlson, Richard A. Dickson, Tracy L. Knudsen, Quint Tatro

- Release date: December 2011

- Publisher(s): Pearson

- ISBN: 9780132938549

You might also like

book

Technical Analysis for the Trading Professional, Second Edition: Strategies and Techniques for Today’s Turbulent Global Financial Markets, 2nd Edition

by Constance Brown

THE TECHNICAL ANALYSIS CLASSIC—REVISED AND UPDATED TO HELP YOU SUCCEED, EVEN DURING TIMES OF EXTREME VOLATILITY …

book

Mechanical Trading Systems: Pairing Trader Psychology with Technical Analysis

by Richard L. Weissman

A wide variety of flexible trading systems that combine sophisticated technical analysis with trading psychology theory …

book

Technical Analysis: The Complete Resource for Financial Market Technicians, Second Edition

by Charles D. Kirkpatrick, Julie R. Dahlquist

Already the field's most comprehensive, reliable, and objective guidebook, Technical Analysis: The Complete Resource for Financial …

book

Technical Analysis: The Complete Resource for Financial Market Technicians

by - CMT Charles D. Kirkpatrick II, Ph.D. Julie R. Dahlquist

Now, there's a comprehensive, objective, and reliable tutorial and reference for the entire field of technical …