Chapter 3. Drivers of Capital

This chapter introduces the centrality of resources as critical to success (not only for business firms, but to any organization). This is new in the literature, which tends to downplay the criticality of resources and places competitive strategies almost as a synonym of strategic management: This is a big mistake.

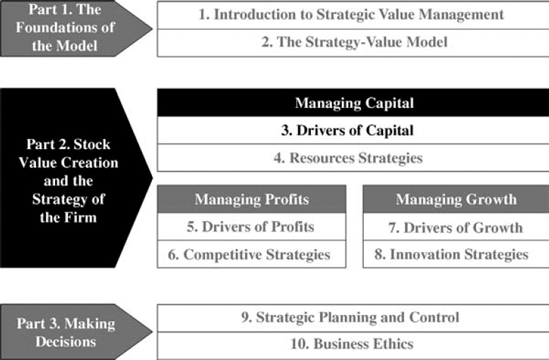

The economic value added (EVA) model shows the three dimensions of stock value creation: profits, growth, and capital. This chapter focuses on the analysis of capital, which is driven by investments in the resources of the firm.

Why are resources so critical? Because they can predict whether a company's competitive and innovation strategies will succeed, and also because resources require capital, and the cost of capital may turn any strategy into an unprofitable one. It is amazing that strategic management literature pays so little attention to such central aspects.

The first integrating example, Dell, at the end of the chapter, shows this paradigm: Even though Dell has good profits and sales growth, its stock value has been weak for years, because its resources are no longer unique. The pharmaceutical industry is a second integrating example, presented as a case where information technology (IT), not supported by knowledge management, does not become a really unique resource.

THE RESOURCES AS PILLARS OF STOCK VALUE CREATION

The resource view of ...

Get Strategic Value Management: Stock Value Creation and the Management of the Firm now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.