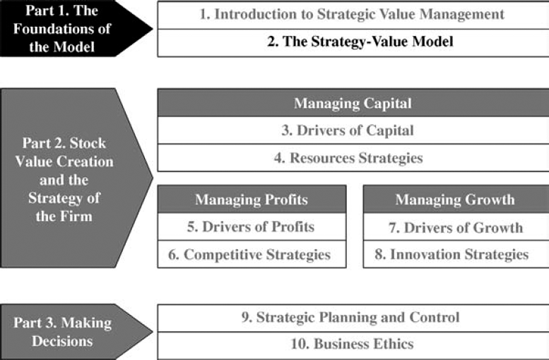

Chapter 2. The Strategy-Value Model

To present an integrated view of strategic management requires examination of the strategy-value model. This chapter introduces the financial part of the strategy-value model beginning with an explanation of the financial aspects of the economic value added (EVA) equation.

I was first exposed to the EVA during the 1990s, when McKinsey & Company popularized its use in strategic management. McKinsey based its business recommendations on the concepts introduced in two books: The Quest for Value (Stewart 1990) and Valuation (Copeland, Koller, and Murrin 2000). I had the opportunity to see McKinsey's recommendations in action in a group of companies where I worked. According to McKinsey, in order to create stock value, all managerial decisions had to be scanned and filtered by the EVA model. The EVA measures the profitability of a firm, minus the profitability of similar firms, incorporating a competitive or strategic dimension.

The first part of this chapter introduces the EVA equation and explains its components: profits, growth, and capital.

The EVA has amazing wisdom: the concepts of operating capital and market value added (MVA) measure the tangible and intangible resources, providing metrics and integrating modern theories such as the resource view of the firm and the intellectual capital model; the EVA measures competitiveness and market power, providing ...

Get Strategic Value Management: Stock Value Creation and the Management of the Firm now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.