CHAPTER 11Raising Money

Your need for capital can have a big impact on your opportunity. While we touch on fundraising briefly in this chapter, a much more comprehensive book on this topic is Venture Deals: Be Smarter Than Your Lawyer and Venture Capitalist by Brad and his partner Jason Mendelson.

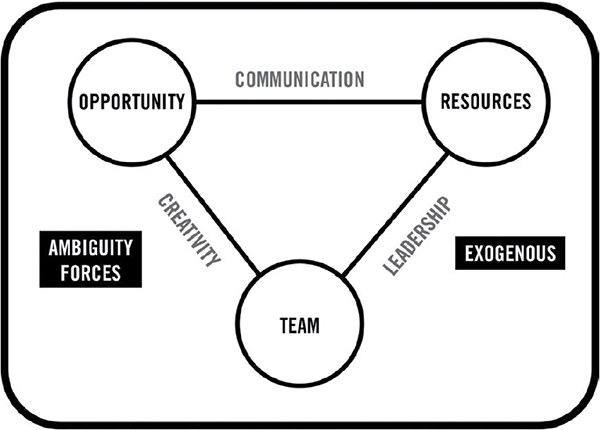

The Timmons Model of the Entrepreneurial Process1 lists resources as the third pillar of the startup process (see Figure 11.1). While resources cover more than just capital, capital for investment is often one of the most sought after.

Figure 11.1 The Entrepreneurial Process.

Source: The Timmons Model, J. A. Timmons and S. Spinelli (1999)

Recognize that many companies raise little to no outside capital. Brad’s first company, Feld Technologies, only raised $10, which was used to allocate the stock among the three founders (Brad, his partner Dave Jilk, and his father Stan Feld, who was an advisor to Brad and Dave). In many cases, you’ll be able to build a successful company without any meaningful outside capital. In others, you need capital to get going and fuel your growth.

Raising capital has a secondary benefit beyond money, namely, the signal it sends to the market. If you recall the discussion on signaling theory, having experienced angels or venture capitalists (VCs) invest in your company can generate a strong halo effect. Consider the halo effect that a famous entrepreneur, ...

Get Startup Opportunities, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.