CHAPTER 3The Risk Arbitrage Industry

When I first became involved in risk arbitrage, in the 1970s, there were very few competitors. The business was characterized as being performed under a cloak of silence by a limited number of firms. Generally, the participants in the business operated as an arbitrage department within the auspices of a brokerage firm. When I first started, only 10 to 15 firms were involved in risk arbitrage.

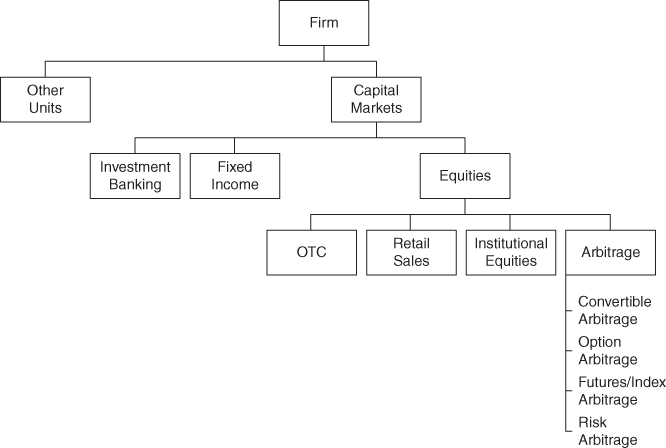

Over time, however, the business developed and additional people began to participate in various ways. This additional participation came from two directions. Historically, brokerage firms began to establish arbitrage departments by hiring experienced arbitrage personnel who worked at other brokerage firms. The newly formed departments were generally centered in the capital markets areas of the firms. Exhibit 3.1 shows the structure and the typical line of reporting within a brokerage firm. However, since the Volker Rule was adopted after the Credit Crisis of 2008, very few firms have been allowed to commit capital to proprietary accounts.

EXHIBIT 3.1 Typical Arbitrage Structure within a Brokerage Firm

The second form of participation developed during the 1970s and the trend has accelerated since the Volker Rule was adopted. Using a limited partnership format, some arbitrageurs formed their own firms and raised money from outside investors. These ...

Get Risk Arbitrage, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.