Sales Forms and Accounts

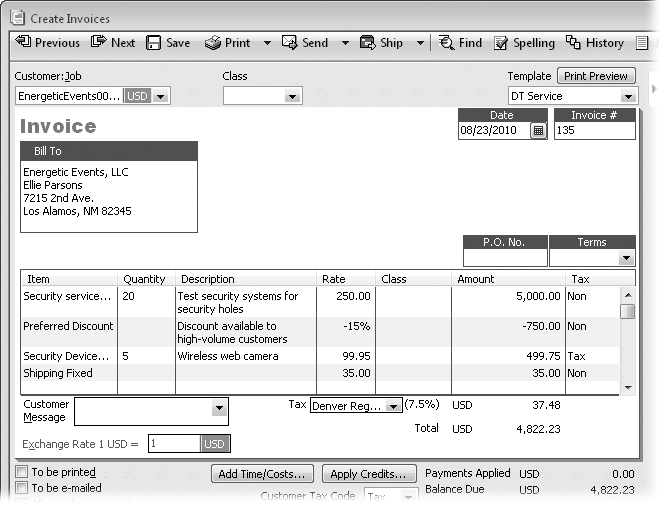

An invoice or other sales form is the first step in the flow of money through your company, so now is a good time to look at how QuickBooks posts income and expenses from your invoices to the accounts in your chart of accounts. Suppose your invoice has the entries shown in Figure 10-1. Table 10-2 shows how the amounts on the invoice post to accounts in your chart of accounts.

Table 10-2. Debits and credits have to balance

|

Account |

Debit |

Credit |

|---|---|---|

|

Accounts Receivable |

4822.23 | |

|

Services Revenue |

5000.00 | |

|

Product Revenue |

499.75 | |

|

Sales Discounts |

750.00 | |

|

Sales Tax Payable |

37.48 | |

|

Shipping |

35.00 | |

|

Cost of Goods Sold |

249.78 | |

|

Inventory |

249.78 | |

|

Total |

5822.01 |

5822.01 |

Figure 10-1. If you’re still getting used to double-entry accounting, balancing the debit and credit amounts for an invoice is a brainteaser. For example, the items for services and products in the invoice shown here turn up as credits in your income accounts, as in Table 10-2. The discount reduces your income so it’s a debit to the Sales Discounts income account. Although the debits and credits appear in different accounts, the total debit has to equal the total credit.

Here’s why the amounts post the way they do:

You sold $5,000 of services and $499.75 of products, which is income. The income values appear as credits to your Services Income and Product Revenue accounts to increase your income ...

Get QuickBooks 2011: The Missing Manual now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.