Audit Trails

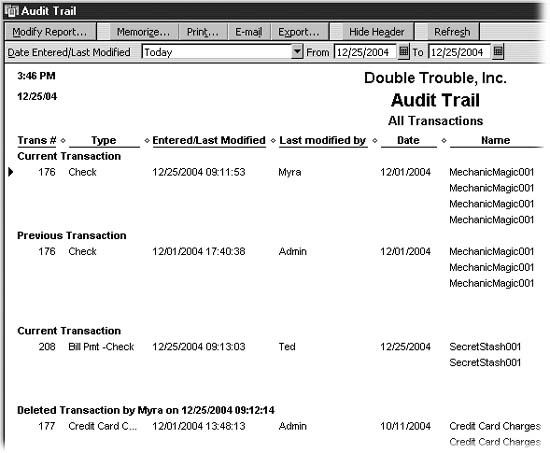

When you turn on the Audit trail preference in QuickBooks, the program tracks changes to transactions, who makes them, and when. The Audit trail report includes all this information, as you can see in Figure 23-5.

Note

QuickBooks works more slowly and your company file is a bit larger when you maintain an audit trail. Face it; these inconveniences are insignificant when you're protecting your company from fraud.

To turn on the audit trail feature, choose Edit→Preferences. In the Preferences window in the icon bar, click Accounting. Then click the Company Preferences tab, and turn on the "Use audit trail" checkbox.

Figure 23-5. To generate the Audit Trail report, choose Reports→Accountant & Taxes→Audit Trail. (You must be the QuickBooks Administrator or have permission to generate sensitive financial reports to do this.) The report shows transactions that have changed or been deleted only while the audit trail preference was turned on. To see the detail of a transaction, double-click it.

Get QuickBooks 2005: The Missing Manual now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.