Execute the following steps to estimate the ARCH(1) model.

- Import the libraries:

import pandas as pdimport yfinance as yffrom arch import arch_model

- Specify the risky asset and the time horizon:

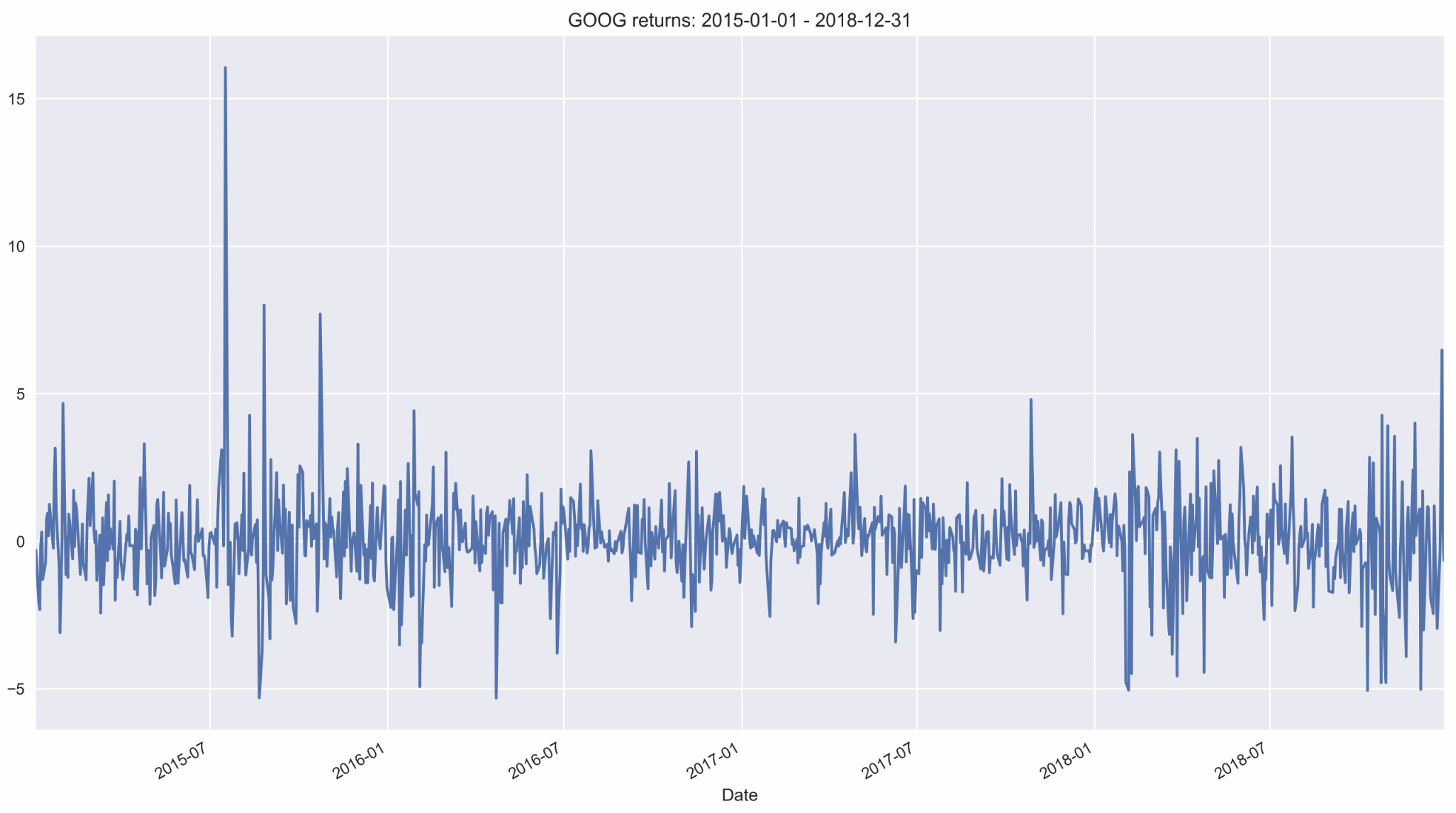

RISKY_ASSET = 'GOOG'START_DATE = '2015-01-01'END_DATE = '2018-12-31'

- Download data from Yahoo Finance:

df = yf.download(RISKY_ASSET, start=START_DATE, end=END_DATE, adjusted=True)

- Calculate daily returns:

returns = 100 * df['Adj Close'].pct_change().dropna()returns.name = 'asset_returns'returns.plot(title=f'{RISKY_ASSET} returns: {START_DATE} - {END_DATE}')

Running the code generates the following plot:

In the plot, we can ...