SOLUTION TO EXERCISE 5-5

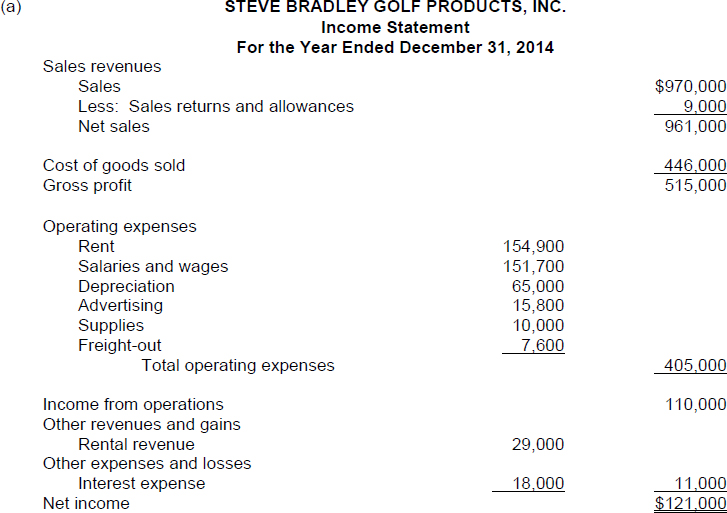

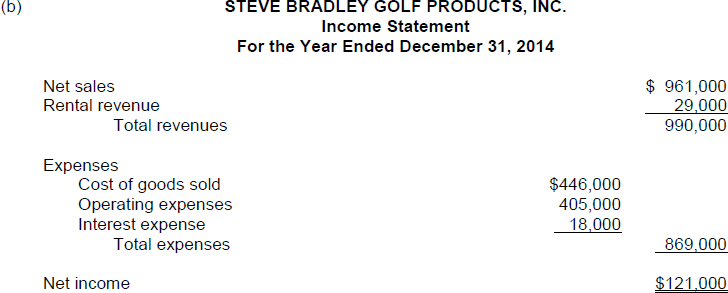

TIP: A merchandising business has various types of expenses. Common expense categories are as follows: (1) cost of goods sold, (2) selling, (3) administrative, (4) interest, and (5) income taxes. Collectively, selling expenses and administrative expenses are usually called operating expenses. Refer to the multiple-step income statement [part (a) above]. Notice where each of these types of expenses appear on a multiple-step income statement. (Income tax expense will be illustrated in a later chapter.)

TIP: Nonoperating activities consist of (1) revenues and expenses that result from secondary or auxiliary operations and (2) gains and losses that are unrelated to the company's operations. The results of nonoperating activities are shown in two sections on a multiple-step income statement: Other Revenues and Gains and Other Expenses and Losses. Items classified in the Other Revenues and Gains section of a multiple-step income statement include rent revenue, investment revenues (interest revenue and dividend revenue), unusual inflows (such as prizes received), and gains on the sale of assets not classified as inventory. Items classified in the Other Expenses and Losses section of a multiple-step income statement include financing expenses (interest expense), ...

Get Problem Solving Survival Guide to accompany Financial Accounting, 8th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.