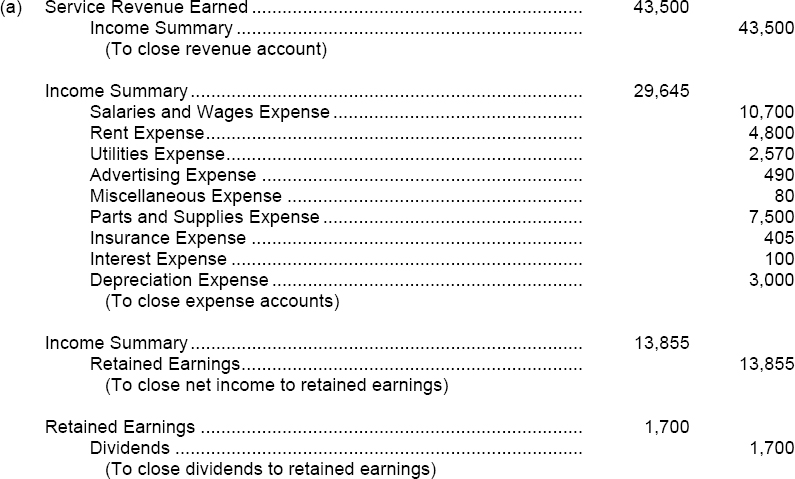

SOLUTION TO EXERCISE 4-5

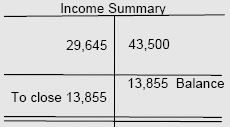

TIP: The Income Summary account is used only in the closing process. Before it is closed, the balance in this account must equal the net income or net loss figure for the period.

The amounts above would be reflected in the Income Summary account as follows:

TIP: Where do you look for the accounts (and their amounts) to be closed? If a worksheet is used, you can use the amounts listed in the Income Statement column pair and the balance of the Dividends account. If a worksheet is not used, you must refer to the temporary accounts (after adjustment) in the ledger to determine the balances to be closed.

(b) The major reason closing entries are needed is that they prepare the temporary (nominal) accounts for the recording of transactions of the next accounting period. Closing entries produce a zero balance in each of the temporary accounts so that they can be used to accumulate data pertaining to the next accounting period. Because of closing entries, the revenues of 2014 are not commingled with the revenues of the prior period (2013). A second reason closing entries are needed is that the Retained Earnings account will reflect a true balance only after closing entries have been completed. Closing entries formally recognize in the ledger the transfer of net ...

Get Problem Solving Survival Guide to accompany Financial Accounting, 8th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.