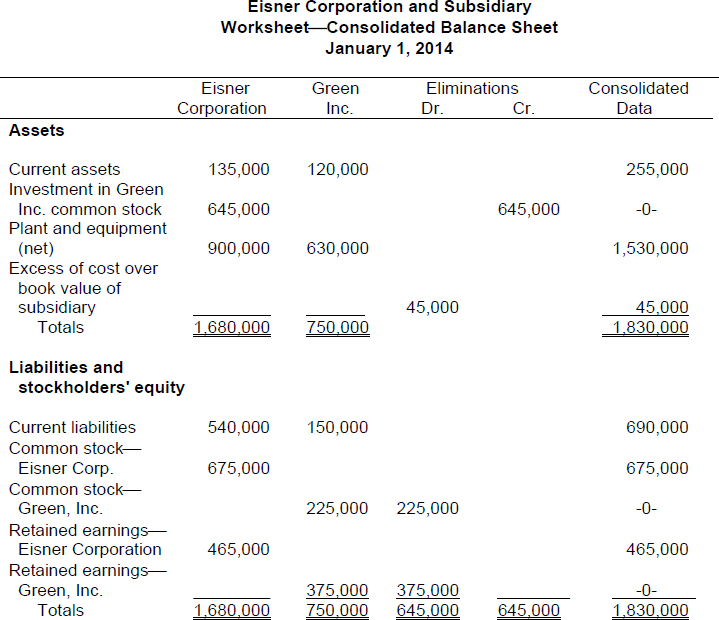

SOLUTION TO EXERCISE 12-6

TIP: When a company owns more than 50% of the common stock of another company, consolidated financial statements are usually prepared; that is, the investor and the investee report their assets, liabilities, revenues, and expenses as one company.

TIP: The cost of acquiring the common stock of another company may be above or below its book value. The management of the parent company may pay more than book value because it believes (1) the fair market values of identifiable assets such as land, buildings, and equipment are higher than their recorded book values or (2) the subsidiary's future earnings prospects warrant a payment for goodwill. The reason Eisner paid more than book value for Green's stock is unclear from the data given; thus, a payment for goodwill is assumed.

TIP: Consolidated balance sheets are prepared from the individual balance sheets of the affiliated companies. They are not prepared from ledger accounts kept by the consolidated entity because only the separate legal entities maintain accounting records.

All items in the individual balance sheets are included in the consolidated balance sheet except amounts that pertain to transactions between the affiliated companies. Transactions between the affiliated companies are identified as intercompany transactions. The process of excluding these transactions in preparing consolidated statements ...

Get Problem Solving Survival Guide to accompany Financial Accounting, 8th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.