CHAPTER 13Selecting Direct Lending Managers

There is no passive option in direct lending; it is only accessible through active management. It is a dynamic market as managers continuously originate and refinance middle market corporate loans every three to five years, mirroring the private equity market but with greater velocity. The Cliffwater Direct Lending Index captures the collective (asset weighted) work product of the direct loan managers represented in the Index, but it is not investable. Manager selection, therefore, is part of investing in direct loans.

Not surprisingly, some managers have produced better outcomes than others, and by wide margins. The purpose of this chapter is to explore the factors that differentiate direct loan managers and offer suggestions on what characteristics best typify managers who will be successful. But before proceeding, a brief case study is presented to illustrate the importance over time from selecting the right manager.

SELECTION MATTERS

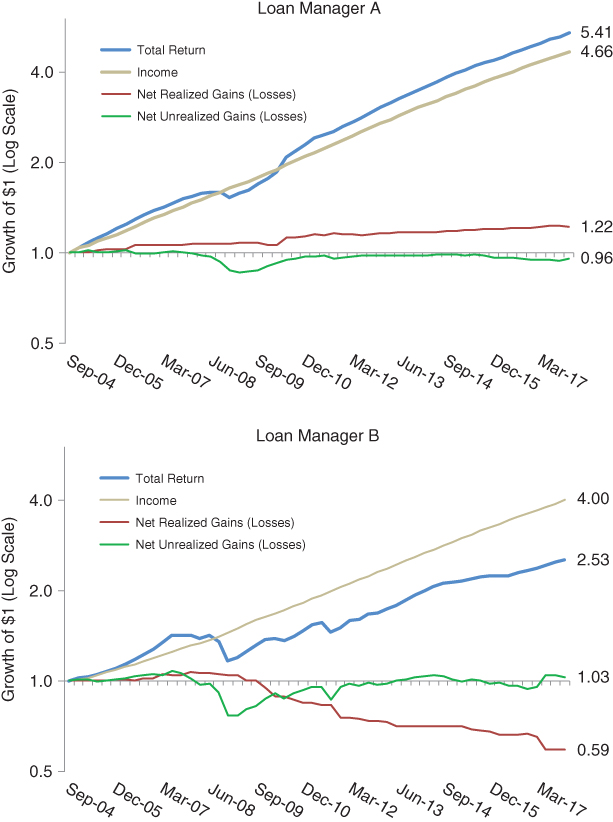

Exhibit 13.1 provides actual loan performance from two of the earliest and largest direct‐lending managers for the September 30, 2004, to December 31, 2017 period. Both manager track records are audited and included in the Cliffwater Direct Lending Index (CDLI).

EXHIBIT 13.1 Performance comparison of two direct lending managers.

Exhibit 13.1 shows clearly that not all managers are alike when ...

Get Private Debt now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.