CHAPTER 9Buy‐Side Representation

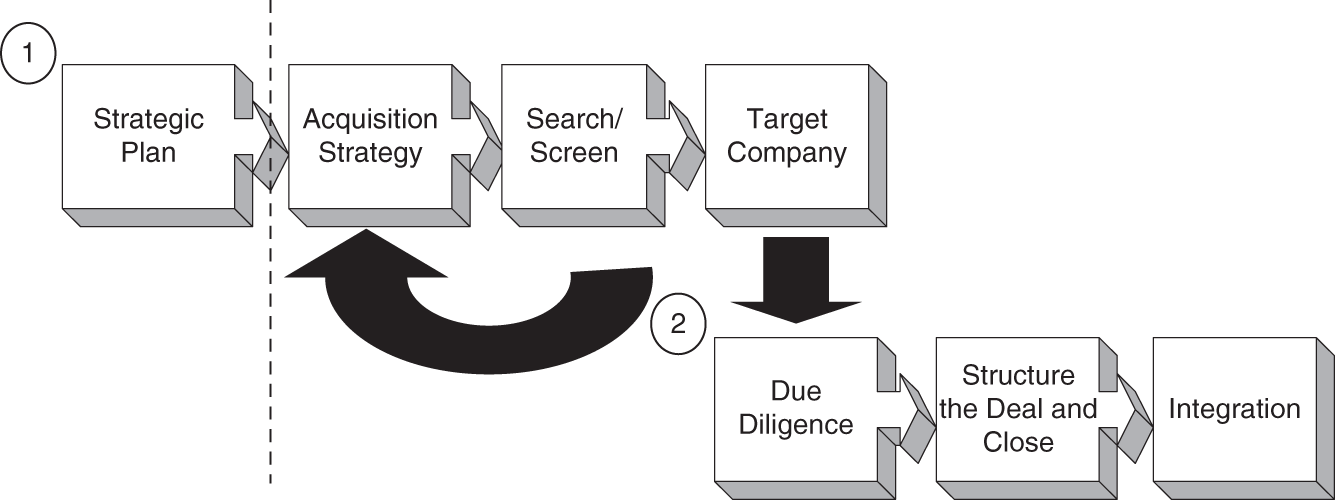

Chapter 8 provides an overview of corporate development and the buy‐side from the perspective of the strategic buyer. While conceptually similar, this chapter looks at the buy‐side through the lens of M&A advisors and emphasizes certain details relevant to them. We will use Figure 9.1 (first seen in Chapter 8 as Figure 8.2) as the baseline process for this chapter, keeping in mind that there are many variations. This chapter is meant to augment the content of Chapter 8.

BUYER CLIENTS

In general, there are two main types of buyers that may engage an M&A advisor to assist in the acquisition process: financial buyers and strategic (corporate) buyers.

FIGURE 9.1 Acquisition Process

Source: Copyright High Rock Partners, Inc., 2011–2022.

Some buyer‐clients are very sophisticated and all they need is to get access to the scarcest resource: the appropriate target company, with a willing seller. These sophisticated buyers (such as private equity funds or well‐staffed strategic buyers) have the in‐house resources to quarterback and execute on the deal process, including negotiating offers, managing due diligence work streams, arranging outside financing (if needed), and structuring and negotiating the definitive agreement documents with professional legal assistance. On the other hand, there are less‐sophisticated or shorter‐staffed buyer clients ...

Get Middle Market M & A, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.