Chapter 7. Modern Contrarian Patterns

Continuing in the spirit of contrarian trading, this chapter discusses the modern contrarian patterns, which are candlestick formations that I have noticed over the years and can be an addition to the already known patterns.

The purpose of this chapter is, as usual, to describe the patternsâ objective conditions and back-test them so that you form an opinion about their frequency and  predictability.

The Doppelgänger Pattern

In German, the word Doppelgänger means âdouble goerâ or âdouble walkerâ and is generally used to refer to people who look exactly the same but are biologically unrelated. The Doppelgänger candlestick pattern is a three-candlestick reversal configuration that I like to use to confirm intermediate reversals.

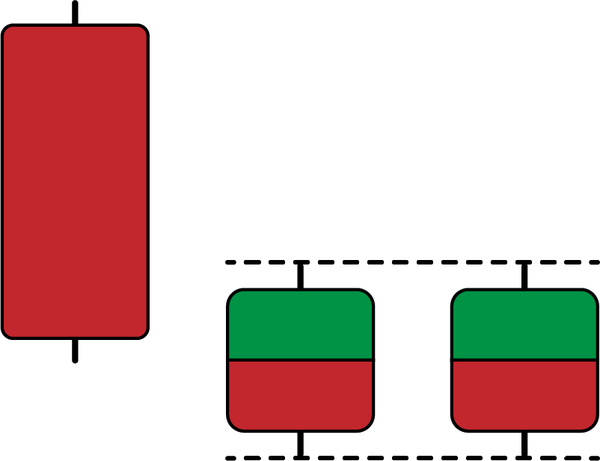

Figure 7-1 illustrates a bullish Doppelgänger. The pattern is composed of a bearish candle followed by two numerically similar candlesticks (same highs and lows, and either they must have the same close and open prices or the close price must equal the open price) with flexibility on their type (bullish or bearish).

Figure 7-1. A bullish Doppelgänger

In comparison, Figure 7-2 shows the theoretical bearish Doppelgänger pattern. The pattern is composed of a bullish candle followed by two numerically similar candlesticks with flexibility on their type (bullish or bearish). Note that these are theoretical ...

Get Mastering Financial Pattern Recognition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.