CHAPTER 8 Bar Patterns: Estimating Risk and Setting Bar Size

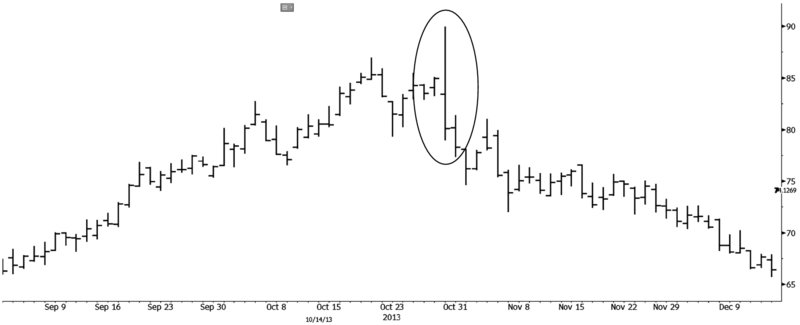

ANSWER 8.1 EGN with Bar Pattern

- Closing point reversal.

- Bar has a higher high and lower low than bar before, and closes below the prior close.

- It's similar to a bearish engulfing line.

- A bearish engulfing line must open at or above the prior close. This is not required for a closing point reversal.

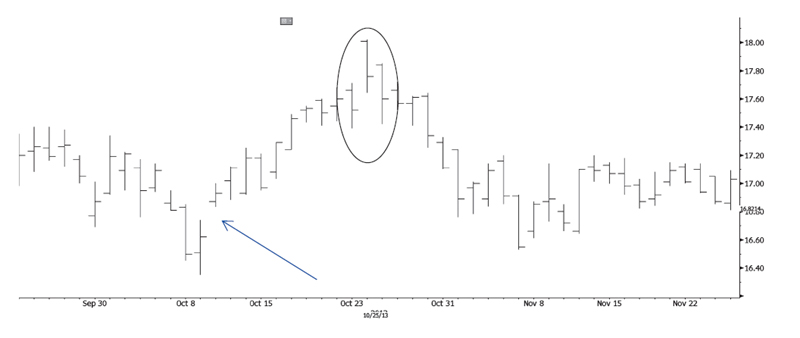

ANSWER 8.2 F with Bar Pattern

- Key reversal.

- Opens well above previous high, and closes toward the low of the bar.

- Dark cloud cover.

- The body (open to close range) does not overlap that of the prior bar.

- Arrow drawn to breakaway gap.

- Even though the bar extends beyond the prior high, and closes toward the bottom of the bar, it did not open above the previous bar, much less well beyond its high.

ANSWER 8.3 GILD Risk (NASDAQ)

- $8,000/$7.66 per share = 1,044 shares. One might want to round down to 1,000.

- Risk is proportional to the square root of time. Therefore, $7.66/$3.13 = 2.45. Target bar length = one day/2.452 = one day/6 = (6.5 hours * 60 minutes per hour)/6 = 65 minutes.

- Risk of ruin = EXP((70,000 * ((LN(1–.55))–LN(.55 * 1.50))/70,000)) = 0.50 percent.

- Risk in dollars = 70,000/((LN(.00001))/((LN(1–.55))–LN(1.5 * .55))) = 3,685. Risk in units = $3,685/$7.66 per share = 481 shares.

ANSWER 8.4 M with ...

Get Kase on Technical Analysis Workbook, + Video Course now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.