8 OPERATING EXPENSES AND ACCOUNTS PAYABLE

Recording Expenses Before They Are Paid

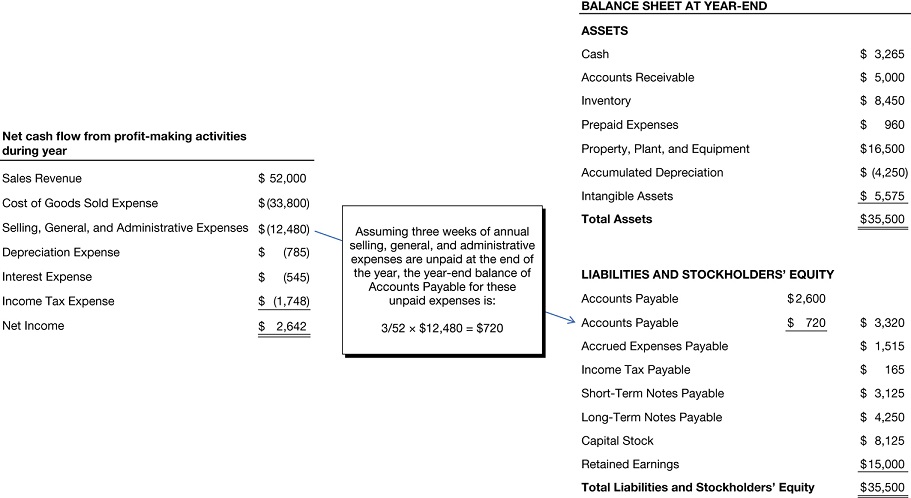

Please refer to Exhibit 8.1, which highlights the connection between selling, general, and administrative expenses in the income statement and the second of the two accounts payable components in the balance sheet. Recall from Chapter 7 the two sources of accounts payable: inventory purchases on credit and expenses not paid immediately. Chapter 7 explains the connection between inventory and accounts payable. This chapter explains how expenses also drive the accounts payable liability of a business.

EXHIBIT 8.1 SELLING, GENERAL, AND ADMINISTRATIVE EXPENSES AND ACCOUNTS PAYABLE Dollar Amounts in Thousands

Every business in the world has a wide variety of operating expenses. The term operating does not include cost of goods sold, interest, and income tax expenses. In our example, the company’s depreciation expense is reported separately. All other operating expenses are combined into one conglomerate account labeled “Selling, General, and Administrative Expenses.” (See the income statement in Exhibit 8.1.) This expense title is widely used by businesses, although you certainly see variations.

Day in and day out, many operating expenses are recorded when they are paid, at which time an expense account is increased and the cash account is decreased. But some operating expenses have to be recorded ...

Get How to Read a Financial Report, 9th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.