ISSUES FOR DISCUSSION

REAL DATA

ID8-1

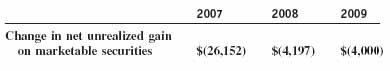

Equity adjustments for marketable securities

H&R Block reported the following account on its statement of shareholders' equity (dollars in thousands):

REQUIRED:

a. Did the market value of H&R Block's marketable securities increase or decrease in 2007, 2008, and 2009?

b. How could H&R Block manage its earnings by choosing when to sell certain of its marketable securities?

c. Explain how the FASB requirement on comprehensive income will influence the reporting practices of H&R Block.

REAL DATA

ID8-2

Short-term equity investments classified as available-for-sale

The following was taken from the 2009 annual report of H&R Block:

Marketable securities—available for sale: Proceeds from the sales of available-for-sale securities were $8.3 million, $13.9 million, and $3.5 million during fiscal years 2009, 2008, and 2007, respectively. Gross realized gains on those sales during 2009, 2008, and 2007 were $0.7 million, $0.4 million, and $0.3 million, respectively; gross realized losses were $1.3 million, $0.1 million, and $0.1 million, respectively.

REQUIRED:

a. Describe the difference between trading securities and available-for-sale securities.

b. How is the company's total comprehensive income affected by the dollar values reported in the footnote?

c. Compute the cost of the securities sold during 2007, 2008, and 2009.

REAL DATA

ID8-3

Equity method

Get Financial Accounting: In an Economic Context now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.