7Myth – Crypto Is a Bubble

Yes, during the crypto winter of 2022, all markets took a beating, and crypto took a serious beating. In June, bitcoin was down approximately –55% year to date (YTD) and the widespread crypto markets were down roughly –70% YTD. There was a ridiculous amount of fear in the markets; much of it came from centralized finance companies like Celsius blowing up, along with actions the Federal Reserve was taking to unwind previous actions they'd taken during the pandemic to boost the economy.

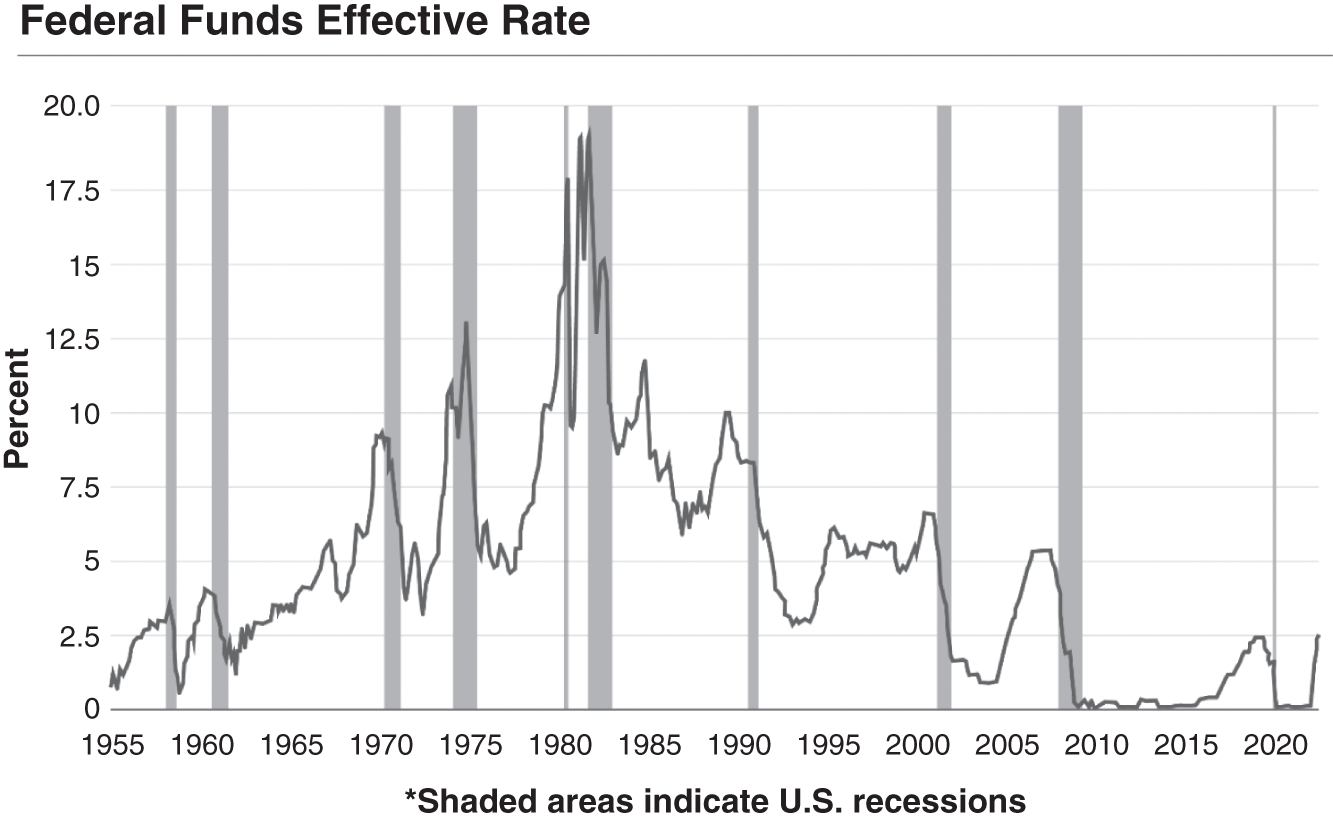

Many investors acted out of fear. We were coming out of a pandemic. Interest rates were rising notably, with the Fed hiking rates by three‐quarters of a percentage point in June, then again in July, again in September, and an additional three‐quarters of a point in November. In summer 2022 the Fed laid out its agenda of pain, which eliminated uncertainty. “In a further sign of the Fed's deepening concern about inflation,” the Associated Press reported, “it will also likely signal that it plans to raise rates much higher by year's end than it had forecast three months ago – and to keep them higher for a longer period. Economists expect Fed officials to forecast that their key rate could go as high as 4% by the end of this year. They're also likely to signal additional increases in 2023, perhaps to as high as roughly 4.5%.”1

Figure 7.1 Fed Funds Rate

Source: Board of ...

Get Crypto Decrypted now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.