Chapter 4

![]()

VALUE-AT-RISK FOR FIXED INTEREST INSTRUMENTS

This chapter discusses market risk for fixed income products. The measures described in the first section are regarded as being for ‘first-order risk’. Since the advent of value-at-risk (VaR), risk managers and traders have been using both types of measure to quantify market exposure. In this chapter we consider calculation of VaR for a fixed interest product. We also note that credit derivatives are now a significant segment of the fixed income markets.

FIXED INCOME PRODUCTS

We consider the basic building blocks of a bond, which we break down as a series of cash flows. Before that, we discuss essential background on bond pricing and duration.

Bond valuation

A vanilla bond pays a fixed rate of interest(coupon)annually or semi-annually, or very rarely quarterly. The fair price of such a bond is given by the discounted present value of the total cash flow stream, using a market-determined discount rate.

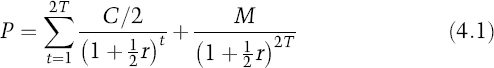

Yield to maturity (YTM) is the most frequently used measure of return from holding a bond. The YTM is equivalent to the internal rate of return on the bond, the rate that equates the value of the discounted cash flows on the bond to its current price. The YTM equation for a bond paying semi-annual coupons is:

| where | P = Fair price ... |

Get An Introduction to Value-At-Risk, Fourth Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.