CHAPTER 6Wholesale Financial Services Products

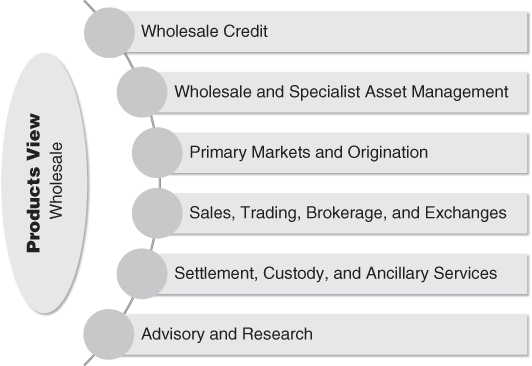

In the previous chapter we have discussed the products in the financial services sector that are mostly targeted at individuals, and at small to medium‐sized companies. Here we will discuss the products that remain, and that are targeted at wholesale players in the market. Those products fall into the following categories (see also Figure 6.1):

FIGURE 6.1 Classifying Financial Services by Product (Wholesale)

- wholesale credit

- wholesale and specialist asset management

- primary markets and origination

- sales, trading, brokerage, and exchanges

- settlement, custody, and ancillary services

- advisory and research.

6.1 Wholesale Credit

6.1.1 Large Corporate Credit

The large corporate credit segment serves large corporations, often multinationals that have a presence in multiple jurisdictions. Large corporates are offered the same products as mid‐market companies, but in a bigger size. Large corporates in particular tend to engage in more derivative activities, therefore derivatives lines become more important.

Also, the loan documentation becomes more complex: a large corporation consists of a group of companies, and ultimately it is loan companies entering into agreements, not the corporations who themselves do not have a legal identity. It is therefore important to consider which group company is the actual borrower, which group companies ...

Get A Guide to Financial Regulation for Fintech Entrepreneurs now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.