4 trends in fintech startups

An analysis of fintech competitions shows a focus on data, payments, lending, and small business.

Mexican paper money (source: Kevin Dooley on Flickr. Used under a Creative Commons license)

Mexican paper money (source: Kevin Dooley on Flickr. Used under a Creative Commons license)

Request an invitation to Next:Money, O’Reilly’s conference focused on the fundamental transformation taking place in the finance industry.

Fintech hackathons and competitions occur globally. In January 2012, Swift launched the Innotribe Startup Competition as an initiative to bring together disruptive startups and incumbents in financial services. It was one of the first of its kind and has been joined by similar events in subsequent years. Just this year, I counted 18 fintech hackathons and startup competitions — eight of which are happening later this year.

Fintech startups are aiming to disrupt financial institutions with their technology, products, and design. Meanwhile financial institutions focus on secure systems for money transfer, payments, and lending at a global scale. But the two are not necessarily at odds. It’s hard for incumbents to innovate existing businesses in house, and this is where startups thrive: testing new business models and pushing the limits of technology unencumbered by regulations or corporate baggage. Hackathons and startup competitions are where innovative ideas are tested.

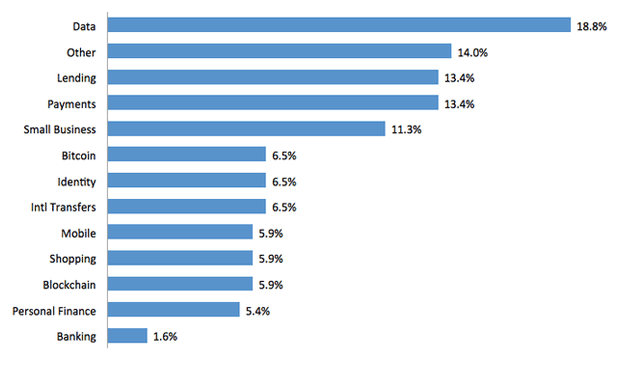

But where is the innovation focused? We analyzed 186 winners across 18 fintech competitions and hackathons, including Innotribe’s Startup Competition, the Future of Money and Tech Startup Competition, Money2020 Hackathon, Bankathon and BBVA Innovation, along with smaller events. This list of 25 fintech unicorns worth more than $1 billion were included in this analysis as well. Our analysis of the competition winners uncovered a number of trends, from big data to transactions to banking.

This graph shows the percentage of winners in each category. As you can see, the data startups came in at the top, pulling in almost 19% of the 186 wins.

Top trends included:

Data analysis for better decision making

Startups are increasingly offering data analysis as a service for deal and lending due diligence, to predict loan success, to identify which customers qualify for loan pre-approval or student loan refinance. As our devices collect more data about ourselves and our environment, there will be an increasing need for robust data analysis and intelligence.

Payments and international transfers

Payments and international transfers are at the heart of money. Startups in this area focus on increasing ways to pay, including credit cards and apps on mobile phones, ongoing subscriptions, contactless payments and bitcoin payments. Demand for immediate, free transactions has made this area ripe for innovation as well. One solution startups are exploring is the use of distributed ledgers to increase settlement speed of international transactions.

Lending

Startups in this category mainly explore peer to peer and crowdfunded lending. This category had the most overlap with big data. Specifically to understand which customers (whether they are individuals or small businesses globally) are the best lending customers, to use data for due diligence, to pre-approve loan offers to customers, and generally better understand lending ROI.

Small Business Financial Solutions

Startups in this category develop solutions to help small business with accounting, invoicing and payroll (including international payroll with currency exchanges). For larger businesses, startups offer services for employees at the paycheck level — short-term loans and automatic saving and investing services.

A few companies caught my eye in my review of the 186 winners. They show out-of-box thinking that is often typical of creative startups.

- Kill Bill — An open source platform from the 2014 Money2020 Hackathon caught my attention for how simply they solve a problem. Their dashboard manages your subscription payments. I think it’s genius because every time there’s a credit card hack, this would make it easy to update my recurring payments with a new credit card number.

- Trusting Social — Calling themselves “credit score 2.0” this Innotribe Startup Challenge and Future of Money and Tech finalist uses input from modern reputation systems to create a new comprehensive credit score that’s far better than antiquated FICO scores.

- Credibles — 2013 Future of Money and Tech finalist, Credibles is a creative mashup between local small food-based businesses and crowdfunding, using a subscription model. A partnership with Whole Foods supports their initiative to offer increased local food diversity.

- Geolocation stock discovery — From the New York FinTech Hackathon, this offers a novel way to discover stock investments, based on their geolocation.

The trends are clear: as individuals and companies use data to make better decisions, startups are seizing the opportunity to create new products and services. There remains, however, a lot of room for new startups, ideas, and products. Lending and debt is not going away. But more and more, your lender might not be a bank — your loan might be crowdfunded, or it could be funded through a combination of financial institutions and crowd backing. Innovation in payments and international transfers will continue as well, and many are looking at decentralized technology to improve speed and efficiency — after all, who wants to wait 1-3 business days for a global transaction when Bitcoin and Paypal offer near-immediate clearance?

There are immense opportunities for startups and incumbents alike looking to scale new technologies, products, and services in their organizations. The innovations from the startup competition and hackathons winners we’re seeing today are just a glimpse of what’s to come.